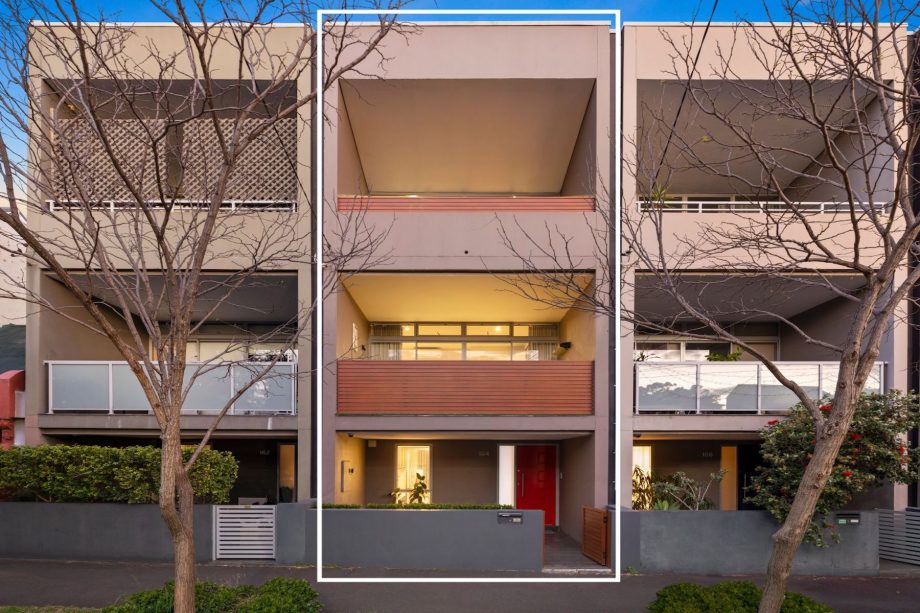

PHOTO: First home buyers

At this point, we’re starting to sound like a bit of a broken record when it comes to whinging about Australia’s (and specifically Sydney’s) problem with housing affordability. But this property sale in the Harbour City’s bohemian Inner West really demonstrates just how bad the problem really is.

164 Belmont St, a modern four-bedroom terrace-sized home in Alexandria, went under the hammer at an online auction and sold for an unprecedented $2.68 million to a young couple from Paddington who happened to be first home buyers, Domain reports.

@propertynoise Always working… #rugbybricks #rugby #viral #nzrugby

It’s a big sale, considering the property last traded in 2017 for $2.275 million and that the median Alexandria house price sits at $1.85. But it’s not necessarily the price tag that’s interesting – it’s the fact that it was first home buyers who ended up securing the place.

Okay, it’s possible that the young couple had ‘The Bank of Mum and Dad’ backing them (if you’re from Paddington these days, you’re probably not too hard up for cash) and Alexandria is hardly Sydney’s most affordable suburb, that’s almost irrelevant. The sale just goes to show how far first home buyers occasionally have to go in order to get into the property market.

164 Belmont Street from the street. Admittedly, it’s the nicest house in the nicest complex on the street. Image Credit: Domain

According to Finder’s 2021 First Home Buyers Report, which came out in May, the average first home buyer in Australia takes out a loan of $431,525. A buyer with a typical loan-to-value ratio (LVR) of 80% would pay an average deposit of $107,881. Since 2019, this figure has climbed 15% nationwide, comfortably exceeding inflation over the same period.

READ MORE VIA DMARGE

MOST POPULAR