PHOTO: NZ House prices. FILE

6 December 2021 – Two out of five Kiwis want the Government to bring house prices down to pre-Covid levels, according to the results of a new poll by property listings site OneRoof.co.nz and data insights firm Kantar.

The OneRoof-Kantar Housing Survey, published in full in the OneRoof Property Report and on OneRoof.co.nz, shows rising house prices are a concern for the majority of New Zealanders.

More than 80% of those polled think current house prices are too high, with 68% believing that housing affordability will worsen in the next two to three years.

The view that house prices are too high was particularly prevalent among those living in Auckland and Wellington, especially in the 18-39 age group. Respondents aged above 60 are significantly more likely to think house prices are “about right”.

When it comes to current homeowners, however, confidence in being able to purchase another house is divided, with over half of respondents sitting on the fence. Those who say they are very confident at being able to purchase another house skew towards those living outside of the North Island, in places like Canterbury.

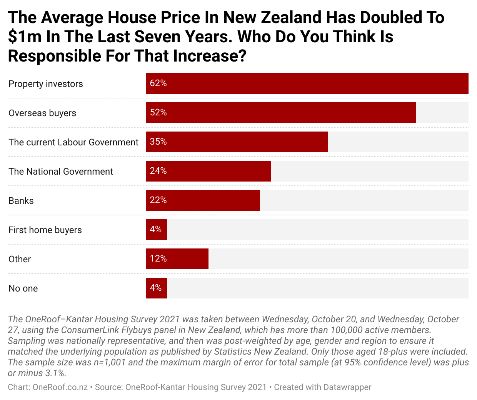

The survey found that most New Zealanders place the responsibility for increased house prices on property investors (62%), overseas buyers (52%), the Labour government (35%), the previous National government (24%), and banks (22%).

Regarding government action, 42% of respondents agree that they should forcibly bring house prices down to pre-Covid levels, compared to 31% who disagree. Strong agreement is higher among New Zealanders age 18-39, non-homeowners and those with an annual household income of $50,000-100,000.

OneRoof editor Owen Vaughan says it should come as no surprise that housing affordability has become a critical issue for New Zealanders. “The jump in house prices in the last 18 months has fuelled concerns among many that the market is out of control. The average property value for all of New Zealand has risen $225,000 in the last 12 months alone to just over $1m.

“The survey results show there is a lot of uncertainty about the current state of the housing market and, concerningly, suggest that Kiwis are polarised around house price levels.”

Independent economist and OneRoof columnist Tony Alexander says of the report, “It is surprising that 52% of people still say overseas buyers are responsible for house prices doubling in the past seven years, given there has been a ban on almost all foreign buying since late-2018 and only 40% of the price doubling since 2014 occurred before the ban. A larger 62% of people blame investors for house prices doubling and that seems accurate from my own analysis.”

Alexander says that with so many people reliant on house prices staying up to maintain wealth and ensure a comfortable aging, falling house prices are unlikely to be positively greeted by most people. “Yet in the OneRoof – Kantar survey, 42% feel the government should force house prices back down to pre-Covid levels. That would involve reversing the 39% rise in prices since March 2020.”

When it comes to what’s next for the market, Vaughan says, “Further rises in interest rates and the expected implementation of new lending controls are likely to take the heat out of the market over the coming 12 months, but for many Kiwis, this may add to the confusion of what direction the market is heading.”

NZME’s Chief of OneRoof Paul Maher says that OneRoof.co.nz supports Kiwis by offering the latest insights to help with their real estate journey, regardless of the market, and is a trusted, independent resource. “With thousands of listings across New Zealand, the latest sales data and in-depth market insights and trends, OneRoof not only makes your property search simple, but provides you with the resources and knowledge to make informed decisions in the context of the market.”

The OneRoof Property Report is included in copies of the New Zealand Herald out today or can be found at OneRoof.co.nz/propertyreport.

Note about the poll: The OneRoof–Kantar Housing Survey 2021 was taken between Wednesday, October 20, and Wednesday, October 27, using the ConsumerLink Flybuys panel in New Zealand, which has more than 100,000 active members. Sampling was nationally representative, and then was post-weighted by age, gender and region to ensure it matched the underlying population as published by Statistics New Zealand. Only those aged 18-plus were included. The sample size was n=1,001 and the maximum margin of error for total sample (at 95% confidence level) was plus or minus 3.1%.

MOST POPULAR

New National Party leader is quite the property investor

New National Party leader is quite the property investor Luxon unaware his $7m Remuera home increased in value by $2.3m over one year

Luxon unaware his $7m Remuera home increased in value by $2.3m over one year How KFC car park deal brought down rising real estate star | AUSTRALIA

How KFC car park deal brought down rising real estate star | AUSTRALIA Prime Minister Jacinda Ardern is now a property millionaire

Prime Minister Jacinda Ardern is now a property millionaire ALERT: Major bank predicts when house prices will fall

ALERT: Major bank predicts when house prices will fall Real estate agent’s hilarious ‘threesome’ newspaper ad goes viral

Real estate agent’s hilarious ‘threesome’ newspaper ad goes viral Abandoned land for sale

Abandoned land for sale What it’s like to be a Billionaire in New Zealand | WATCH

What it’s like to be a Billionaire in New Zealand | WATCH Woman horrified to find her home up for sale: WATCH

Woman horrified to find her home up for sale: WATCH New Zealand’s first Ikea store

New Zealand’s first Ikea store