PHOTO: A listing to buy a Sydney house has raised eyebrows over its unusual marketing strategy. FILE

A listing to buy a Sydney house has raised eyebrows over its unusual marketing strategy that some have said is insulting as the city grapples with the worst rental crisis ever.

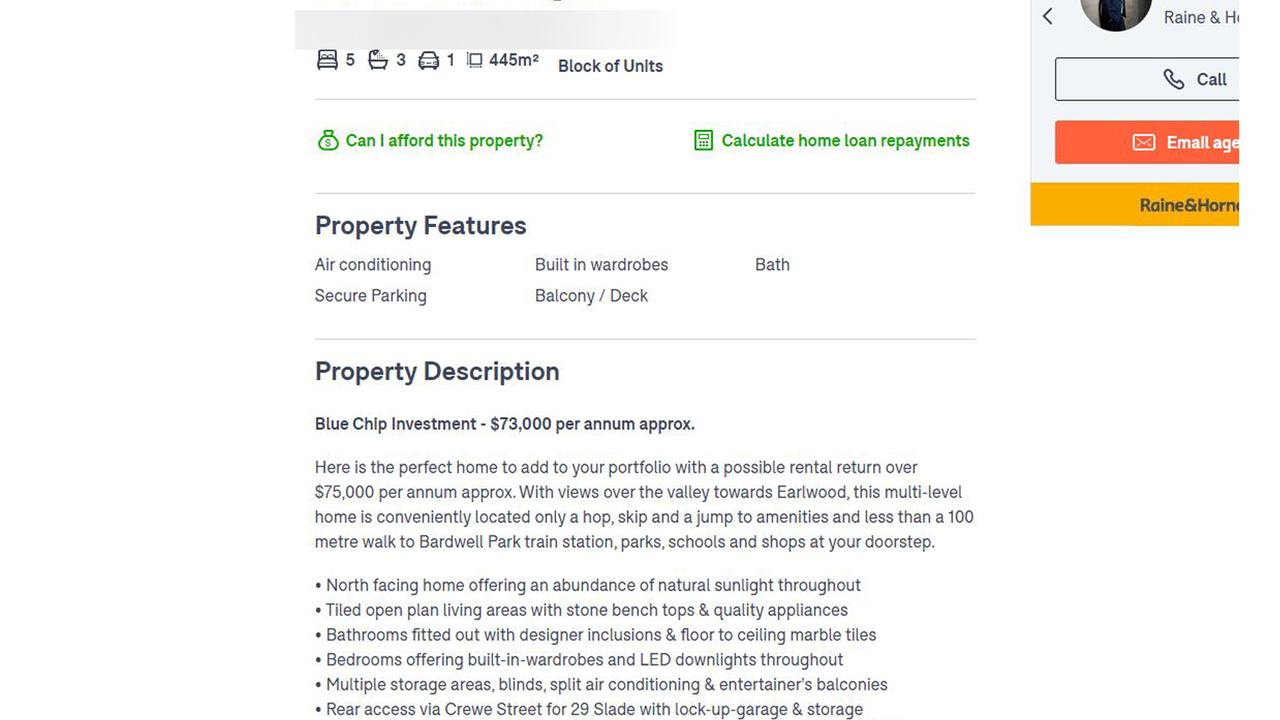

The advertisement for the five-bedroom, three-bathroom home, situated in Bardwell Park in the city’s south, doesn’t waste any time getting straight to the point.

The first sentence is all about the rental income an investor would enjoy if they purchased the property.

“Here is the perfect home to add to your portfolio with a possible rental return over $75,000 per annum approx.,” the sale listing begins.

The property is described as a “blue chip investment”.

A tenant advocate said the move was “disappointing” given the lack of affordable houses across the country while a real estate expert said the marketing was strange because it alienated owner-occupiers.

Meanwhile, the real estate agents handling the sale, Raine & Horne, insisted they were just trying to sell the property in the best possible way.

The listing for the five-bedroom home.

Leo Patterson Ross, CEO of the NSW Tenants Union, criticised the way the house had been advertised.

“Putting such emphasis on the financial side, that that’s all it is, that really that’s what they’re focusing on, is quite disappointing when we’re in the middle of a rental crisis,” Mr Ross told news.com.au.

“We really have a big problem where particularly renters’ homes are treated as an investment first and a home second.”

The national rental vacancy rate is at an all-time low at just 0.9 per cent, forcing staggeringly high prices and fierce competition for every available property.

It’s fairly standard for house listings to indicate that there are currently renters residing there, but there was something about this advertisement that stood out to Mr Ross.

“It’s usual for advertisements to say it’s currently tenanted. Around a third of properties are rented,” he explained.

“What they don’t do is put it (the rental yield) upfront at the top of the ad and make it the centrepiece of the sales pitch.”

Mr Ross said there was an unusual emphasis placed on the home as a source of income for an investor.

The home is based in Bardwell Park.

When news.com.au contacted the Raine and Horne selling agent, they defended their sales tactic.

“We are trying to sell a property,” the staff member said, adding that the house was ideal for renters because it was a dual occupancy, before hanging up the phone.

In additional comments, a Raine and Horne spokesperson from the Bardwell Park office said:

“We’ve referred this home to active homebuyers and their feedback is ‘this would actually suit an investor’.

“The properties are leased so a homebuyer would have to wait until the leases expire to occupy,” they added.

The property was open last Saturday and another viewing will be happening again this Saturday for prospective buyers.

Although there was no price guide on the house, data from real estate research firm PropTrack found that a 5+ bedroom house in Sydney has a 12-month median price of $1.915 million.

For the Bardwell Park/Earlwood area, the median house sells for $2.41 million.

The suburb has seen only 16 sales for houses with five bedrooms or more in the past 12 months.

The real estate agent said the property was currently tenanted.

It is a dual occupancy property, according to the realtor.

Doug Driscoll, chief executive of real estate firm Starr Partners, said the ad was strange because it was “ostracising” owner-occupiers from purchasing the property.

“They’re attracting a certain market that is speaking a certain language,” Mr Driscoll told news.com.au.

“For people struggling to find accommodation, I can clearly understand why they might take some sense of umbrage towards it.”

He said he disliked the sales strategy and the way in which they were trying to sell the home.

“What I don’t like about it … is how geared towards investors (it is). The kilter is out of balance. They’re ostracising owner-occupiers,” he added.

READ MORE VIA NEWS.COM.AU