PHOTO: Almost a third of Australians are facing rent or home loan stress, according to Finder’s Consumer Sentiment Tracker. Photo: iStock

Almost a third of Australians say they face mortgage or rental stress amid the ongoing coronavirus pandemic, with household savings also taking a hit in recent months.

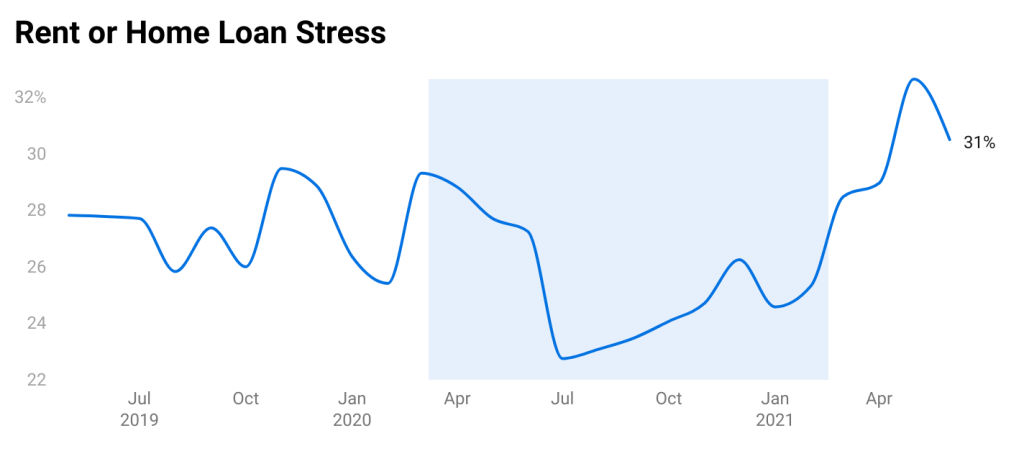

Against a backdrop of rapidly rising property prices and record-high rents across much of the country, 31 per cent of people are struggling to make their rent or home loan payments, new figures show.

While this is down slightly from 33 per cent of renters and home owners in June, it’s well up on the 23 per cent of respondents who reported rent or home loan stress in July last year. The Finder Consumer

Sentiment Tracker shows stress levels had been rising steadily since.

Graham Cooke, head of consumer research at Finder, said financial stress had been going in the opposite direction to what might be expected, with stress levels down last year, despite the coronavirus pandemic.

“This shows that the government payments were effective in relieving some of the financial pressure resulting from the first lockdowns,” Mr Cooke said. He noted the stress metric had risen as lockdowns continued and as government support payments were lifted.

People overextending themselves to keep up with rising property prices could also be a factor for increased mortgage stress, particularly among recent first-home buyers, as could recent increases in rates for fixed mortgages.

Mr Cooke noted average monthly cash savings had also taken a hit, dropping to $703 in June – its lowest level since March 2020 – and down from a peak of $953 in February.

READ MORE VIA DOMAIN