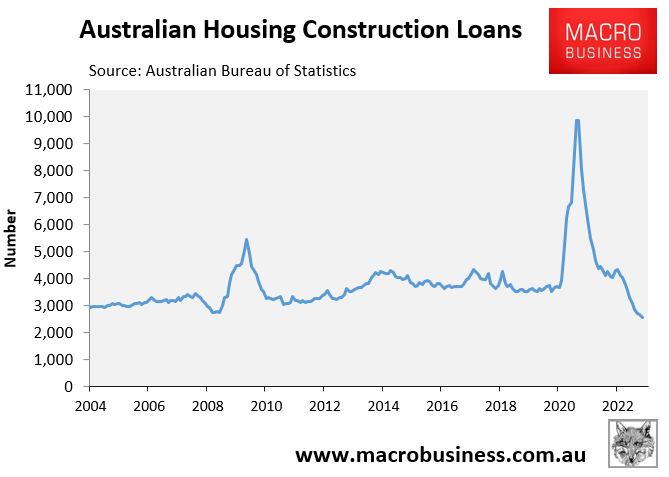

PHOTO: The number of loans issued for the purchase or construction of a new home plunged to a record low in April, down 74% from the January 2021 peak the number of loans issued for the purchase or construction of a new home plunged to a record low in April, down 74% from the January 2021 peak

Australia is staring down the barrel of an unprecedented housing shortage and homelessness crisis.

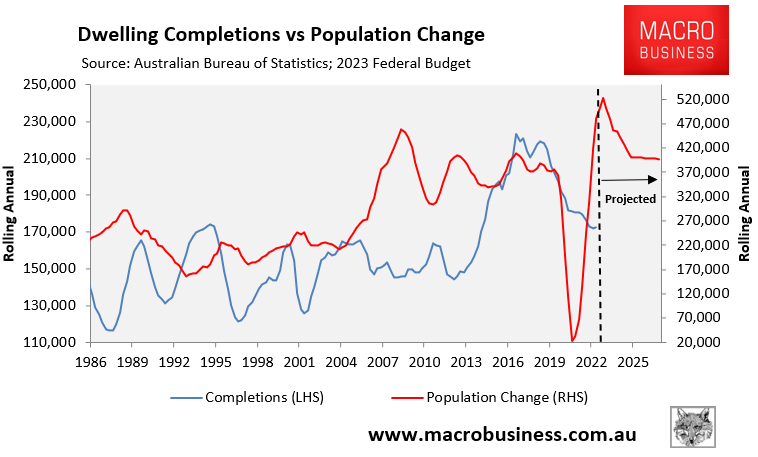

The latest federal budget projected that Australia’s population would increase by a record 2.18 million people over the five years to 2026-27, driven by record net overseas migration of 1.5 million people.

https://propertynoise.co.nz/au/troubled-the-block-star-suzi-taylor-thanks-fans-for-their-support/

This population increase is projected to arrive at the same time as the actual number of new homes completed across Australia is falling, as illustrated clearly in the next chart:

The forward looking indicators for housing construction are dire.

According to the Australian Bureau of Statistics (ABS), the number of loans issued for the purchase or construction of a new home plunged to a record low in April, down 74% from the January 2021 peak:

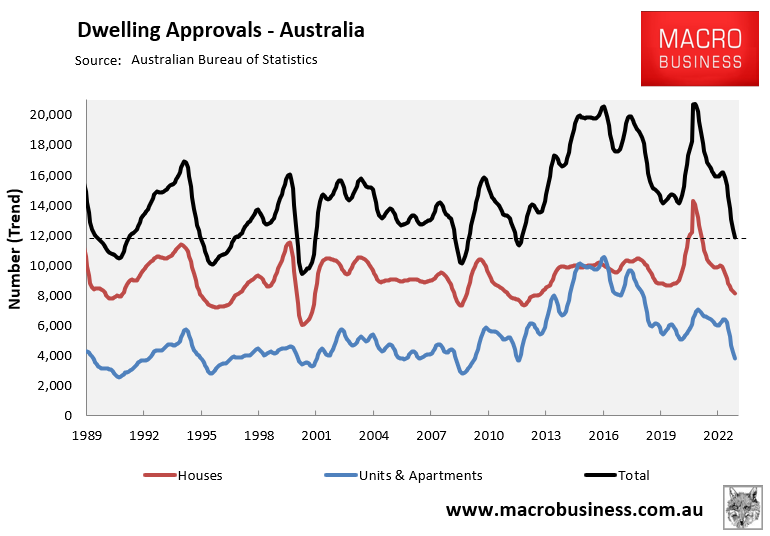

Australian dwelling approvals have also crashed to a 13-year low, according to the ABS:

Treasury secretary Steven Kennedy warned Senate Estimates this month that the downturn in dwelling approvals will continue until 2025, with investment in new dwellings forecast to contract by 2.5% this year and a further 3.5% in 2023‑24 and 1.5% in 2024‑25.

https://propertynoise.co.nz/au/humble-receptionist-to-property-boss/

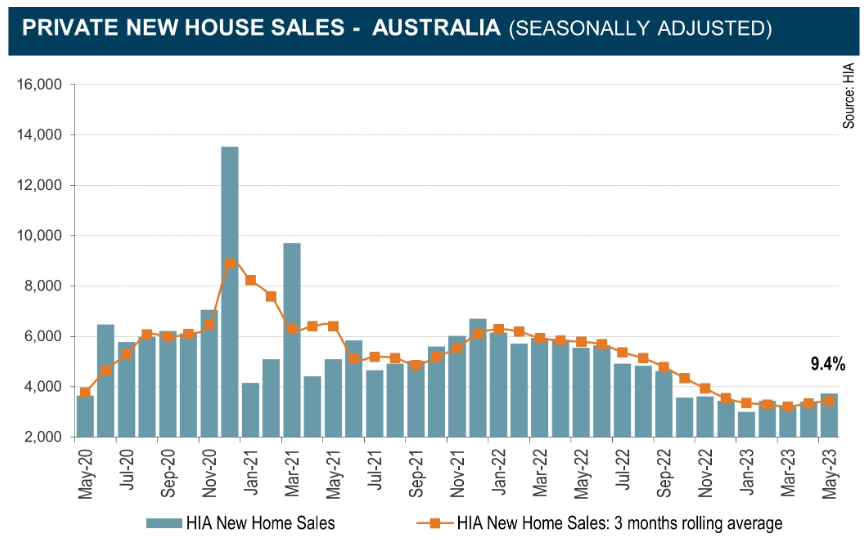

Finally, the Housing Industry Association’s (HIA) new home sales series was running 25% below pre-pandemic levels in May; albeit has rebounded 4.4% over the quarter:

HIA Senior Economist Tom Devitt warned that “the RBA’s rate increases will continue to hold down new sales and cause further cancellations as finance becomes unobtainable for an increasing number of buyers”.

In turn, new home sales would continue to “contract for at least the next 12 months to its lowest level in more than a decade”.

The last 18 months has already seen thousands of home building companies collapse, encompassing small players to industry titans like Porter Davis Homes, which left 1700 homes under construction across Victoria and Queensland in limbo.

These collapses have reduced the industry’s capacity to ramp-up production to meet the growing demand via mass immigration.

https://propertynoise.co.nz/au/new-twist-in-fraudsters-home-sell-off/

Late last week, Lendlease Australia CEO Dale Connor warned that more building and construction companies will collapse, saying “there are days where I feel like we’re doomed”.

“Unfortunately, I think there’s going to be more organisations that perhaps are going to go broke before it gets better”, Connor said.

As explained yesterday, Australia needs to add 329 homes every day to Australia’s housing stock (net of demolitions) just to accommodate the 1.5 million net overseas migrants projected to arrive in Australia by 2026-27.

Given the headwinds facing the industry from builder collapses, high materials costs and high interest rates, meeting such a supply target will obviously be an impossible task.

In turn, Australia’s housing crisis will worsen, driving rents higher and pushing more people into homelessness.

Running such an extreme immigration policy into a housing crisis is pure policy madness.

READ MORE VIA MACRO BUSINESS