PHOTO: Westpac

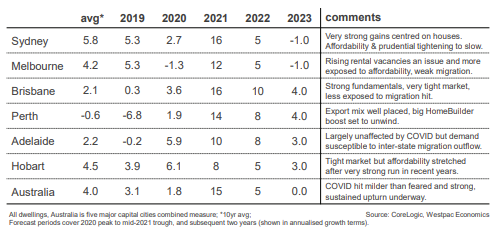

With the worst of the pandemic seemingly behind us, bankers are now predicting 15 per cent price growth for Australia’s housing market this year, before macro-prudential measures dramatically slow growth early next year.

Citing high clearance rates, a surge in housing construction and consistent price growth, Westpac is no longer referring to market activity as a post-COVID rebound. Instead, in its latest housing pulse report, the bank has upped its price growth predictions for this year from 10 per cent to 15 per cent.

“Australia’s housing markets are fizzing. The broad–based lift that was gathering three months ago is now a fully fledged boom,” said Westpac senior economist Matthew Hassan.

But it’s next year’s forecast that has caught pundits off guard, with Westpac revising down its earlier strong growth prediction to a slim 5 per cent in 2022, before the market completely stalls in 2023 with 0 per cent growth.

According to the big four bank, affordability and macro-prudential measures will play a key role in slowing the market from here, with supply and demand factors also expected to come to play as a result of border closures.

Westpac’s growth predictions are as follows:

READ MORE VIA REB