PHOTO: Australian recession

Yesterday’s cash rate hike was a big blow to many Aussies, with fears further rises could steer Australia towards a new recession.

On Tuesday, the Reserve Bank of Australia (RBA) sent a dagger through the hearts of Australian mortgage holders, hiking the official cash rate (OCR) another 0.5 per cent – the third consecutive monthly increase.

The decision sent the OCR to 1.35 per cent, up sharply from April’s all-time low 0.1 per cent.

In a matter of days, Australia’s variable mortgage holders will feel the impact.

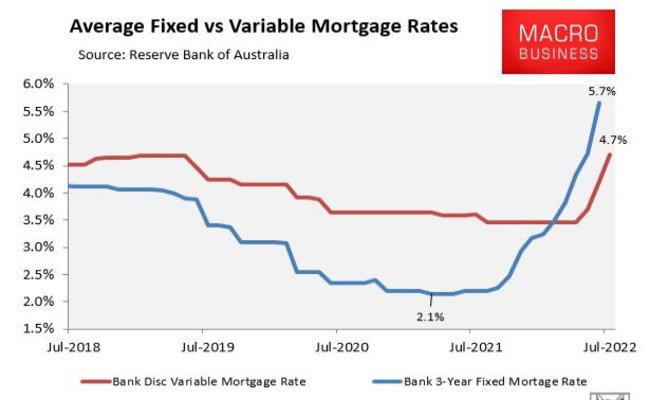

As illustrated in the next chart, the average discount variable mortgage rate will rise to 4.7 per cent, up from 3.45 per cent in April. Fixed mortgage rates have already risen sharply, with the average 3-year fixed rate climbing to 5.7 per cent in June – way above the pandemic low of 2.1 per cent.

This graph shows averaged fixed compared to variable mortgage rates.

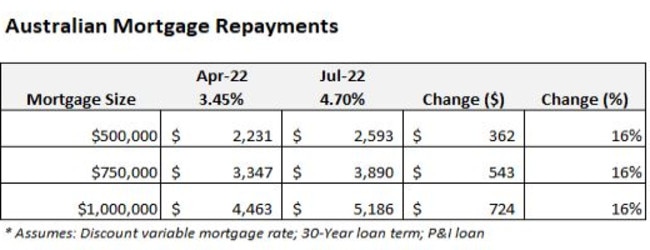

The graph illustrates the dollar impact on mortgage holders from the RBA’s three consecutive rate hikes.

Average monthly mortgage repayments have soared by 16 per cent from their April pre-tightening level.

For a household with a $500,000 mortgage, this represents a monthly increase in repayments of $362, whereas a household with a $1,000,000 mortgage will pay an extra $724 a month.

The mortgage nightmare has just begun

The Australian Financial Review’s latest survey of 31 economists revealed a median forecast for the OCR of 2.35 per cent by December and a peak of 2.85 per cent by mid next year.

If true, Australia’s OCR would rise another 1.5 per cent from its current level under the economists’ median projection.

The futures market remains even more bullish, tipping an OCR of 3.0 per cent by December and 3.5 per cent by June 2023.

If either interest rate forecasts come to fruition, it would see Australian mortgage rates soar.

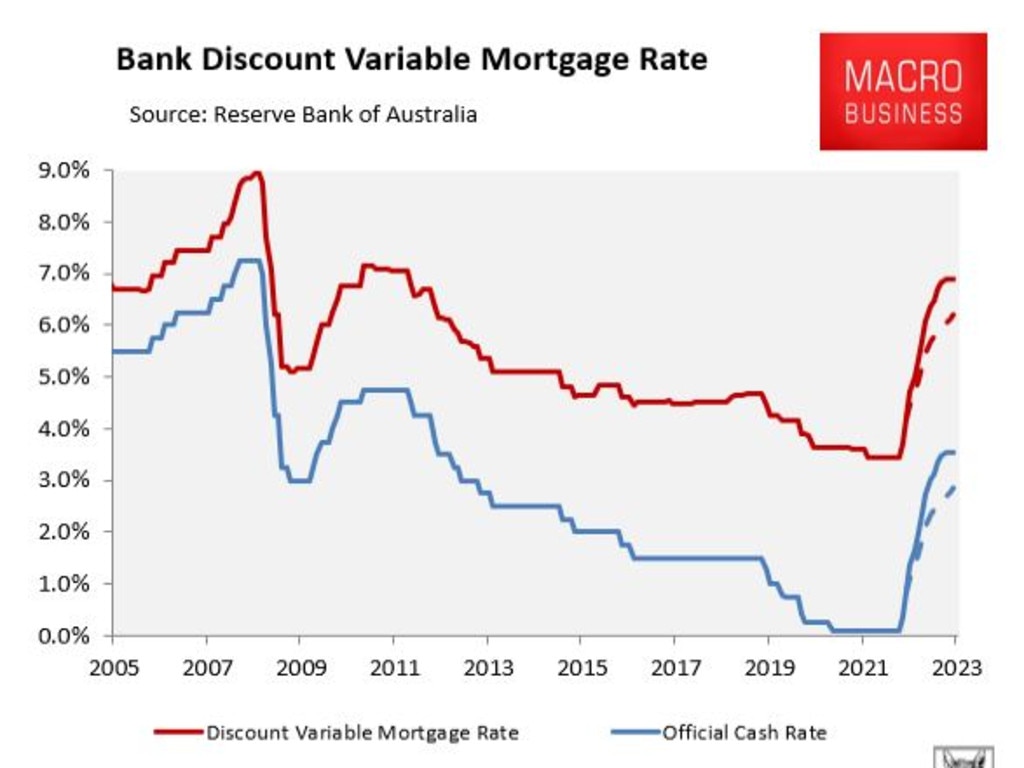

Australia’s average discount variable mortgage rate would climb to 6.2 per cent under the economists’ forecast (dashed red line below) and to 6.9 per cent under the market’s forecast (solid red line below).

Average mortgage rates would rise 6.2 per cent under the economists’ forecast and 6.9 per cent under the market’s forecast.

This would send average monthly mortgage repayments soaring by 37 per cent (economists’ forecast) or 48 per cent (futures market’s forecast) versus their level in April before the RBA commenced its rate tightening cycle.

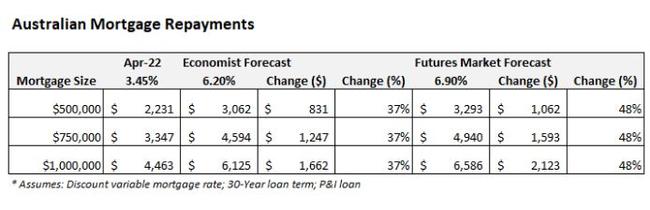

In dollar terms, a household with a $500,000 mortgage would see their monthly repayments rise by $831 (economists’ forecast) or $1062 (futures market’s forecast), whereas a household with a $1 million mortgage would see monthly repayments soar by $1662 or $2123.

This graph shows how mortgage repayments would climb in dollar terms under the different forecasts.

Australian house prices could crash

The RBA risks sending house prices into a tailspin if it hikes rates as aggressively as economists let alone the market are forecasting.

Given Australian house prices soared around 35 per cent over the pandemic on the back of deep cuts to mortgage rates, heavy price falls would necessarily arise from the sharpest lift in mortgage repayments in the nation’s history. Interest rates are a double-edged sword.

In its latest Financial Stability Review, the RBA estimated “that a 200-basis-point increase in interest rates from current levels would lower real housing prices by around 15 per cent over a two-year period”.

Therefore, the economists’ forecast 2.85 per cent OCR suggests a peak-to-trough fall in real Australian house prices of around than 20 per cent.

The futures market’s forecast 3.5 per cent OCR would drive real housing prices down by around 25 per cent in real terms under the RBA’s modelling.

The RBA risks driving Australia into recession

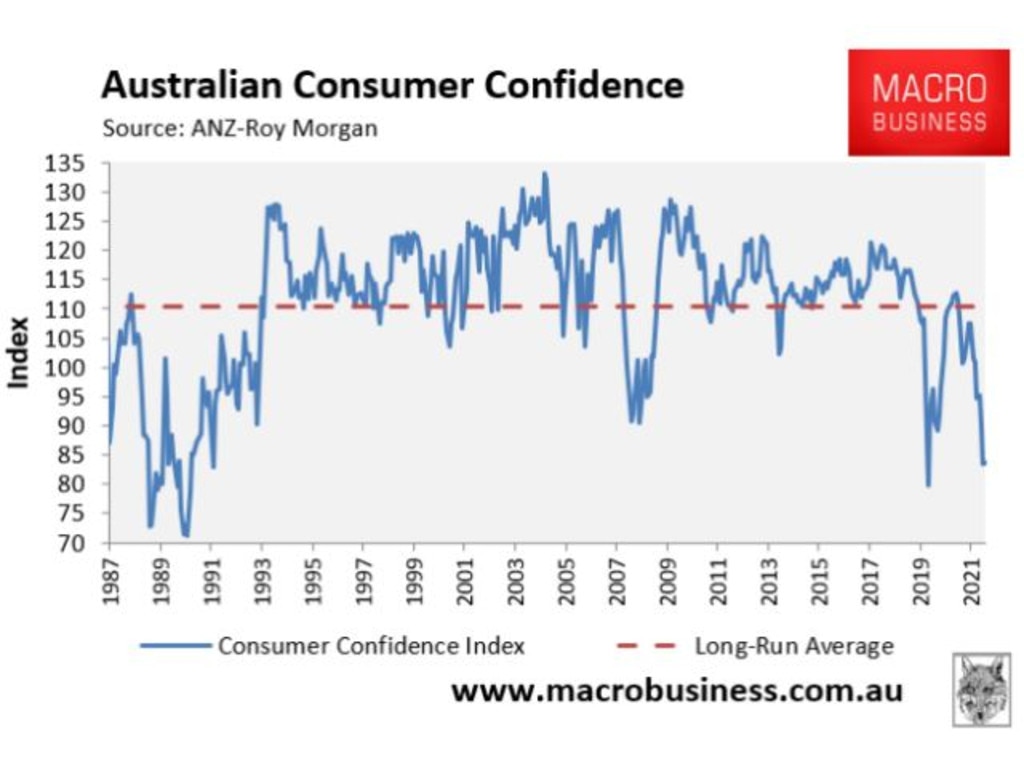

Never before has the RBA commenced a rate tightening cycle with consumer confidence in such a poor state. The latest ANZ-Roy Morgan Consumer Confidence Index has confidence tracking at its lowest level since the beginning of the pandemic in April 2020.

This graph displays Australian consumer confidence.

In fact, outside of the pandemic, consumer confidence is tracking at its lowest level since the early 1990s recession.

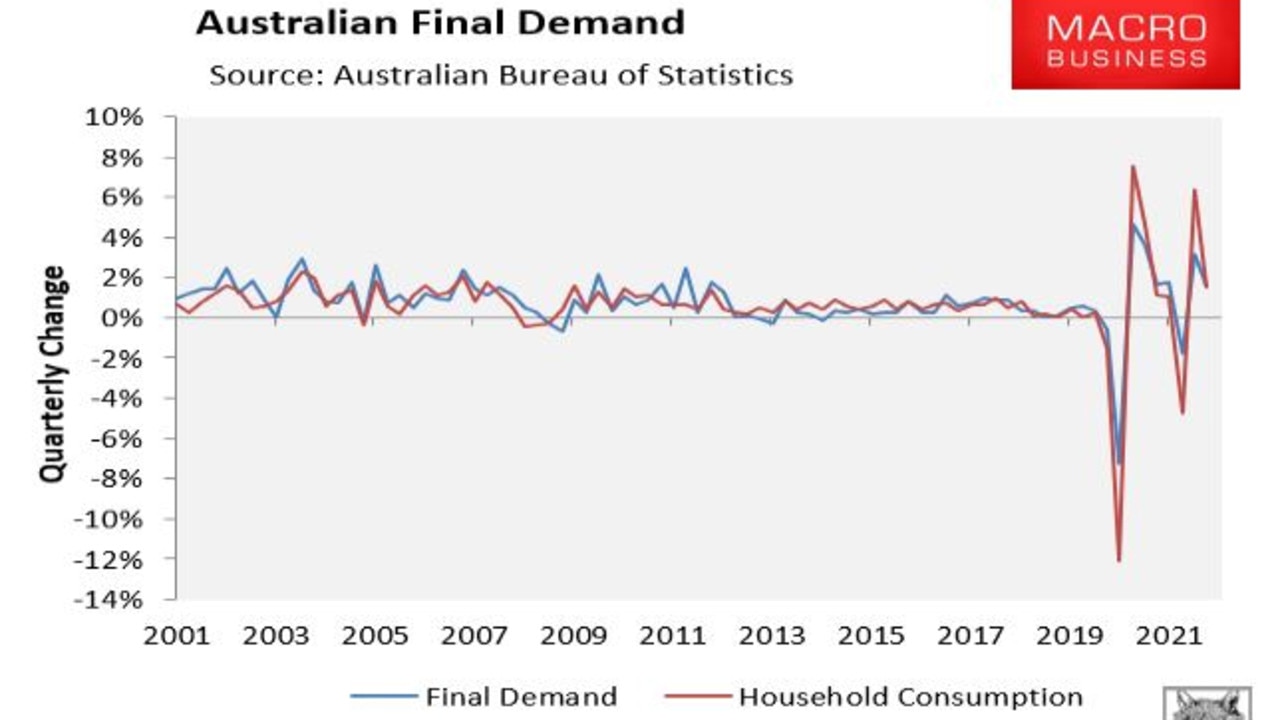

Household consumption is the engine room of the Australian economy, accounting for 55 per cent of final demand in a typical quarter. So, where household consumption goes the economy usually follows, as illustrated in the next chart.

The economy is likely to be impacted by household consumption.

READ MORE VIA NEWS.COM.AU

MOST POPULAR IN NEW ZEALAND

Real estate agent whose wife died on their honeymoon when he crashed their island buggy breaks his silence | WATCH

Real estate agent whose wife died on their honeymoon when he crashed their island buggy breaks his silence | WATCH Former real estate agent facing bankruptcy charges

Former real estate agent facing bankruptcy charges Real agent is accused of killing pro cyclist | WATCH

Real agent is accused of killing pro cyclist | WATCH From a $10MILLION mansion and successful weight-loss business to grimy prison cell | WATCH

From a $10MILLION mansion and successful weight-loss business to grimy prison cell | WATCH WARNING: New Zealand property at top of risk ranking | Bloomberg

WARNING: New Zealand property at top of risk ranking | Bloomberg Timeshare Saga: Owners still out of pocket

Timeshare Saga: Owners still out of pocket Real estate brand @realty brings 100% commission with no fees to NZ | WATCH

Real estate brand @realty brings 100% commission with no fees to NZ | WATCH Real estate agent closes 27 sales worth $12 million-plus in a month

Real estate agent closes 27 sales worth $12 million-plus in a month Bank allows homeowners to borrow up to $80,000 at a 3YR fixed rate of 1%

Bank allows homeowners to borrow up to $80,000 at a 3YR fixed rate of 1% Celebrity chef Ganesh Raj ‘s Tasting Shed owes $1M to the IRD | WATCH

Celebrity chef Ganesh Raj ‘s Tasting Shed owes $1M to the IRD | WATCH