PHOTO: New Zealand housing market. FILE (Auckland, NZ)

When it comes to nations comparable to Australia, there is arguably no closer candidate than that of New Zealand.

From sharing resource-focused economies, to our respective migration-driven foundations of our modern nations, we share a great many similarities with our brothers and sisters across the Tasman.

But as the post-pandemic world of high inflation and rising interest rates continues to unfold, there will be some Australians who hope our nation takes a very different path to that being taken by New Zealand.

Since Kiwi housing prices peaked late last year in the wake of the Reserve Bank of New Zealand raising interest rates, prices across the country have fallen significantly, particularly in the cities of Auckland and Wellington.

How does Australia compare

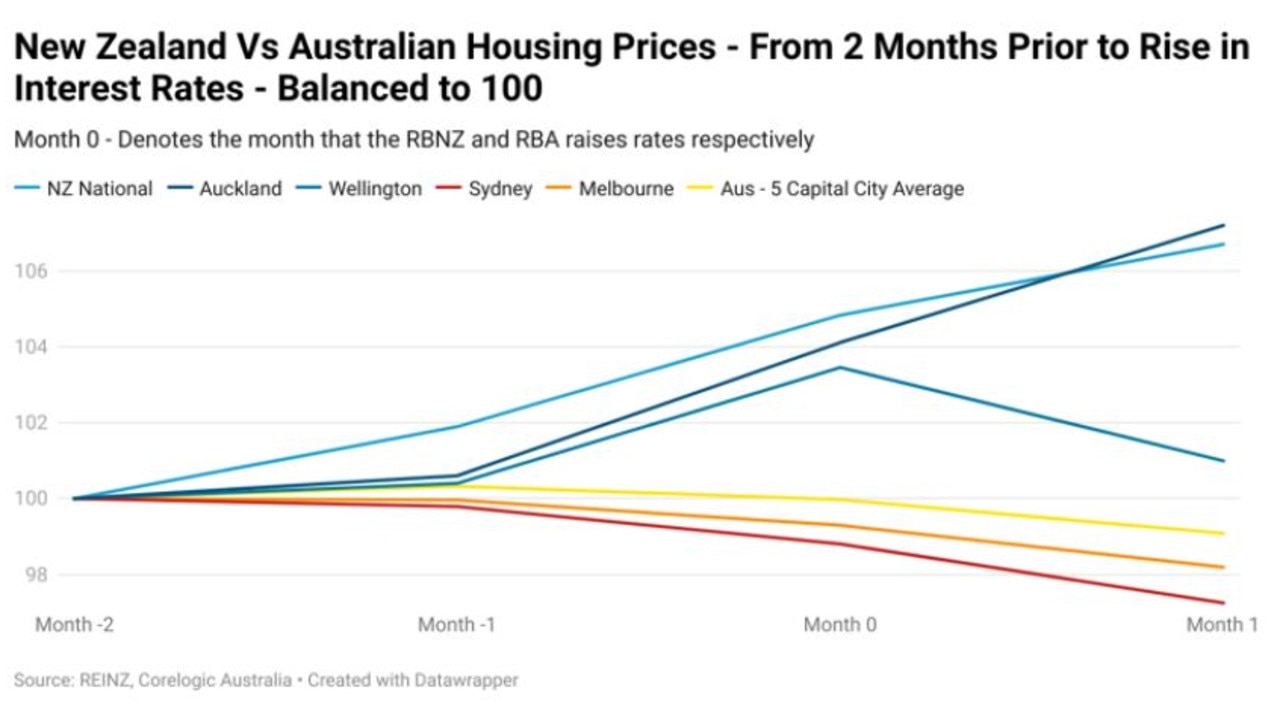

To gauge how the respective nations’ property markets are faring, we’ll be comparing them from two months prior to the rise in interest rates to contrast their respective performances.

In August last year the New Zealand housing market was still absolutely booming, prices were rising extremely strongly across the country and at a national level, prices rose by 4.8 per cent in these final two months before rates were raised.

But even rising rates weren’t enough to take the steam out of the Kiwi housing market immediately.

Prices nationally actually continued to accelerate all the way up to the end of November, rising 6.7 per cent in just the 4 months covered by our little snapshot.

A comparison of Australian and NZ housing prices.

In Australia, it was quite a different story. In the final two months before rates rose, prices fell by 1.2 per cent in Sydney, 0.7 per cent in Melbourne and were broadly flat on a 5 capital city average level.

Since the rate rise price falls have accelerated across the board, with Sydney down 2.7 per cent, Melbourne down 1.8 per cent and prices nationally down 0.9 per cent since the beginning of our snapshot.

How did things play out in New Zealand?

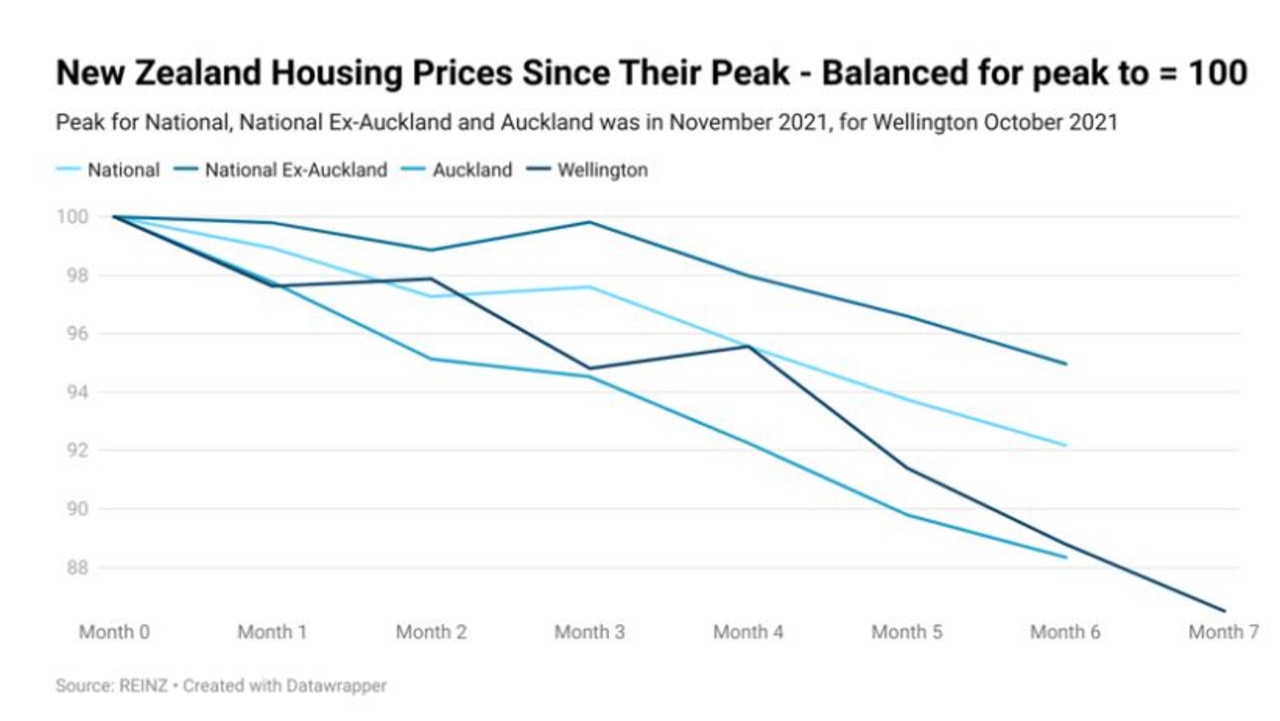

Despite the strength the Kiwi housing market carried into an atmosphere of rising rates, it would ultimately not last. Since prices peaked across the Tasman in October and November of last year depending on the market, the direction of Kiwi housing prices has very much been down.

Nationally prices have fallen by 7.8 per cent, with Auckland and Wellington bearing the brunt of the falling market down 11.7 per cent and 13.5 per cent respectively.

While there are factors that may have accelerated the falls within the New Zealand property market which we will explore in a bit more detail in just a moment, the performance of Kiwi property provides a concerning touchstone of what may lay ahead as the RBA pursues its own interest rate rise cycle.

The NZ property performance provides a concerning hint of what could come for Australia.

Some key differences

In September 2021, the Ardern government ended negative gearing for new purchasers, with the ability of existing property investors being able to continue to negatively gear being phased out by the end of March of 2025.

Negative gearing in this context is the ability to deduct operational day-to-day losses on an investment property against taxable income from working and other sources.

Meanwhile in Australia, negative gearing remains in place and is arguably a sacred cow on the government’s balance sheet. After Labor took a similar policy to that of the Ardern government to end negative gearing for new purchases to the 2019 election, Labor has since changed its viewpoint dramatically.

During the Channel 9 leaders debate for the recent federal election, now Prime Minister Anthony Albanese stated that “negative gearing is a good thing”.

Property investment has also been somewhat disincentivizied in New Zealand since March 2021, with investors now needing to hold a property for 10 years instead of 5 years in order to pay no tax on the profits from the property’s sale.

However, it is important to note that this made little impact on the market and prices continued to rise until interest rates began to rise.

READ MORE VIA NEWS.COM.AU

MOST POPULAR IN NEW ZEALAND

Real estate agent whose wife died on their honeymoon when he crashed their island buggy breaks his silence | WATCH

Real estate agent whose wife died on their honeymoon when he crashed their island buggy breaks his silence | WATCH Former real estate agent facing bankruptcy charges

Former real estate agent facing bankruptcy charges WARNING: New Zealand property at top of risk ranking | Bloomberg

WARNING: New Zealand property at top of risk ranking | Bloomberg From a $10MILLION mansion and successful weight-loss business to grimy prison cell | WATCH

From a $10MILLION mansion and successful weight-loss business to grimy prison cell | WATCH What is blockchain and what does it mean for real estate? | REINZ

What is blockchain and what does it mean for real estate? | REINZ Real estate agent closes 27 sales worth $12 million-plus in a month

Real estate agent closes 27 sales worth $12 million-plus in a month Celebrity chef Ganesh Raj ‘s Tasting Shed owes $1M to the IRD | WATCH

Celebrity chef Ganesh Raj ‘s Tasting Shed owes $1M to the IRD | WATCH Timeshare Saga: Owners still out of pocket

Timeshare Saga: Owners still out of pocket ANZ “pauses” low-equity lending

ANZ “pauses” low-equity lending Real agent is accused of killing pro cyclist | WATCH

Real agent is accused of killing pro cyclist | WATCH