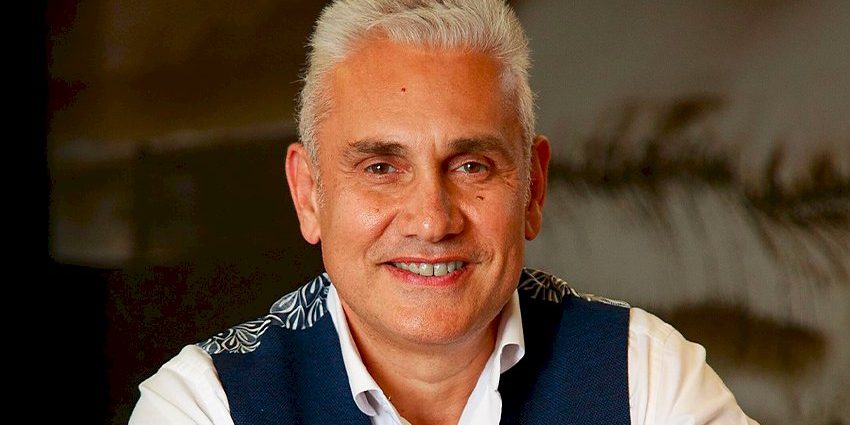

PHOTO: Tom Panos, Sydney-based real estate expert and auctioneer

Auctioneer said Chinese investors are back on the property scene

Resentment among locals as Chinese buyers outbid them

Chinese buyers spending up to $8 million on Aussie real estate

Tensions are running high at auctions across Australia as Chinese buyers make a notable comeback in the property market, causing resentment from locals who are missing out, says leading auctioneer Tom Panos.

During an interview with 2GB’s Ben Fordham, the well-known Sydney-based real estate expert and auctioneer pointed out that recent estimates suggesting Chinese investors were purchasing $8 million worth of Australian property daily was conservative and that the actual amount being spent was ‘actually a lot higher’. He emphasized, “The Asian buyer is back. I’ve been seeing it on Saturdays at auctions.”

According to Mr. Panos, Chinese buyers are outbidding local home hunters and spending more money than investors from anywhere else in the world, leading to some tension at auctions. He mentioned that foreign buyers needed approval from the Foreign Review Board, a process he described as ‘not difficult’ but required for acquisitions in Australia.

https://propertynoise.co.nz/au/wealthy-chinese-individuals-show-interest-in-australian-real-estate-market-with-700000-considering-relocation-by-2025/

Mr. Panos explained the appeal of Australian real estate to Chinese buyers, citing factors such as the education system, lifestyle, safety, and a less polluted environment. He noted that Melbourne was the primary destination for Chinese buyers, followed by Sydney. Interestingly, he mentioned that some buyers who appeared to be Australian citizens were actually representing overseas buyers, especially from Hong Kong or China.

As Chinese buyers return to the Australian property market, many locals are bracing themselves for skyrocketing prices. Some Aussies expressed concern over international buyers making it harder for local buyers to purchase property, while others argued that foreign buyers were acquiring properties that locals couldn’t afford in the first place.

Recent Treasury figures show that Chinese investors spent $2.4 billion on Australian residential real estate in 2021-22, with investment surging in the following financial year. Chinese buyers bought 2,317 homes in Australia in one financial year. During July 2022 to March 2023, Chinese investors spent $2.3 billion, snapping up 1,775 properties.

https://propertynoise.co.nz/au/chinese-buyers-snapping-up-australian-residential-real-estate/

Juwai IQI, a company that markets real estate to Chinese investors, reported receiving more enquiries about Australia than Canada, the United Kingdom, or the U.S. Kashif Ansari, the CEO of Juwai IQI, noted that Chinese demand for Australian property coincided with Chinese interest in studying at Australian universities.

The attraction to Australian real estate is also linked to a downturn in China’s property market, leading Chinese investors to consider investing in wealthy Anglo countries with world-leading educational sectors. The chief executive of Juwai IQI, Mr. Ansari, explained that overseas Chinese investors view real estate as a dependable long-term investment uncorrelated with the Chinese economic cycle.

With Australia’s interest rates at an 11-year high of 4.1 per cent, Chinese investors with access to ready capital see more potential for property price growth in Australia than in their home country, where consumers are reducing spending despite a recent rate cut.

As the property market heats up with Chinese buyers’ resurgence, the situation has sparked debate and concern among locals and policymakers alike, with some advocating for restrictions on foreign buyers to mitigate rising property prices.

https://propertynoise.co.nz/au/why-more-chinese-buyers-are-snapping-up-sydney-property/