PHOTO: A growing number of home owners are falling behind on their mortgage, and there are fears it could lead more investors to sell – putting more pressure on tenants.

The number of Australian homeowners falling behind on their mortgages is on the rise, with over $1.53 billion in loans currently in arrears.

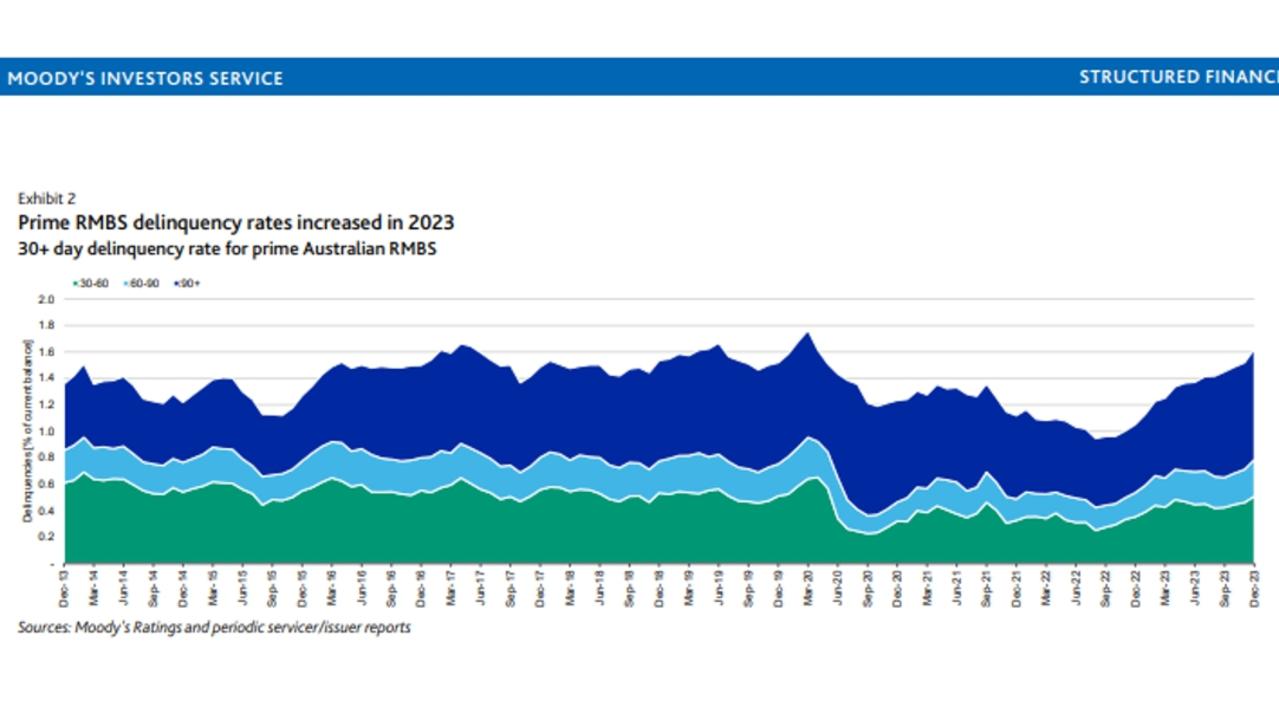

Fresh figures from reputable analysts Moody’s indicate that 1.62 percent of the assessed $94.188 billion worth of prime home loans are now at least 30 days overdue as of the end of last year, up from 1.45 percent in September.

Philip Au, a senior ratings associate at Moody’s, stated that they do not anticipate this trend to diminish, although it remains uncertain whether it will reach the peak level of 1.76 percent recorded during the Covid-19 pandemic.

This increase in mortgage delinquencies is concerning not only for homeowners but also for tenants. Kent Lardner, an AI data analysis specialist, pointed out that national trends suggest up to a third of struggling homeowners could be investors.

With the possibility of these landlords selling rental properties rather than risking the loss of their own homes, Lardner highlighted the potential for exacerbating an already dire situation for Victorian tenants.

Lardner stressed, “Landlords falling into arrears and exiting rental ownership, there’s nothing good about that. They are not all wealthy individuals; many are small-scale property owners.”

SPECIAL OFFER: Looking to advertise online but finding the ‘BIG BOYS” too expensive?

Recent data from SuburbTrends revealed a Rental Pain Index, which for the first time identified three Victorian towns or suburbs scoring the worst possible result of 100. These areas include Balwyn and Cobram in Victoria’s north, as well as regional Rochester, still recovering from severe floods in 2022 and 2023.

According to Lardner, Victoria is experiencing a noticeable uptick in rental distress, fueled by rapidly rising rents across much of the state and a growing number of markets where over 30 percent of homes are up for sale.

Moody’s delinquency rates by number of days up to December, 2023.

He warned, “There will absolutely be more pain ahead as the supply is just not keeping up with demand. I see a problem for at least the next 12 months.”

Observing a distressing pattern that could lead to a significant increase in homelessness among vulnerable populations, Lardner emphasized the need for immediate action to prevent a social disaster.

In Victoria, 25 suburbs scored 95 or more out of 100 on the Rental Pain Index, indicating that while the state is generally more affordable for tenants than others, it still faces worse pain points than every state except NSW and Queensland.

SOURCE: NEWS.COM.AU