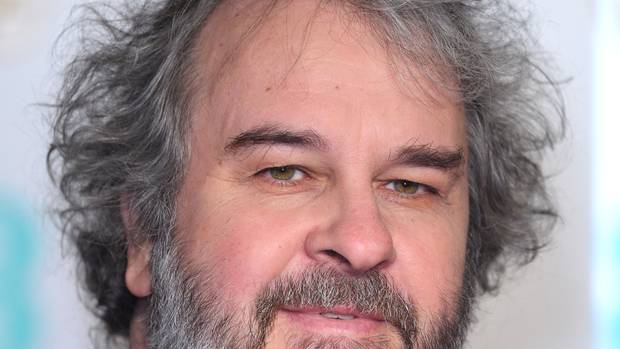

PHOTO: Sydney Harbour lower north Shore against city CBD waterfront around Circular quay and the Sydney Harbour bridge over red roofs of low-rise residential houses in aerial view. Image: Getty

Deutsche Bank has warned a potential house price crash in Australia is one of the top 20 risks to global financial markets in 2020.

In a note sent to clients, obtained by CNBC, Deutsche Bank said Brexit uncertainty, trade war concerns and an increase in wealth inequality and income inequality were also major concerns.

This is the complete list:

- Continued increase in wealth inequality, income inequality and healthcare inequality

- Phase one trade deal remains unsigned, continued uncertainty about what comes after phase one.

- Trade war uncertainty continued to weigh on corporate capex decisions.

- Ongoing slow growth in China, Europe and Japan Triggering significant US dollar appreciation.

- Impeachment uncertainty & possible government shutdown.

- US election uncertainty; implications for taxes, regulation and capex spending.

- Antitrust, privacy and tech regulation.

- Foreigners lose appetite for US credit and US Treasuries following Presidential election.

- MMT-style fiscal expansion boosts growth significantly in US and/or Europe.

- US government debt levels begin to matter for long rates.

- Mismatch between demand and supply in T-bills, another repo rate spike.

- Fed reluctant to cut rates in election year.

- Credit conditions tighten with more differentiation between CCC and BBB corporate credit.

- Credit conditions tighten with more differentiation between CCC and BBB consumer credit.

- Fallen angels: More companies falling into BBB. And out of BBB into HY.

- More negative-yielding debt sends global investors on renewed hunt for yield in US credit.

- Declining corporate profits means fewer dollars available for buybacks.

- Shrinking global auto industry a risk for global markets & economy.

- House price crash in Australia, Canada and Sweden.

- Brexit uncertainty persists.

READ MORE VIA YAHOO