PHOTO: Australian builders. FILE

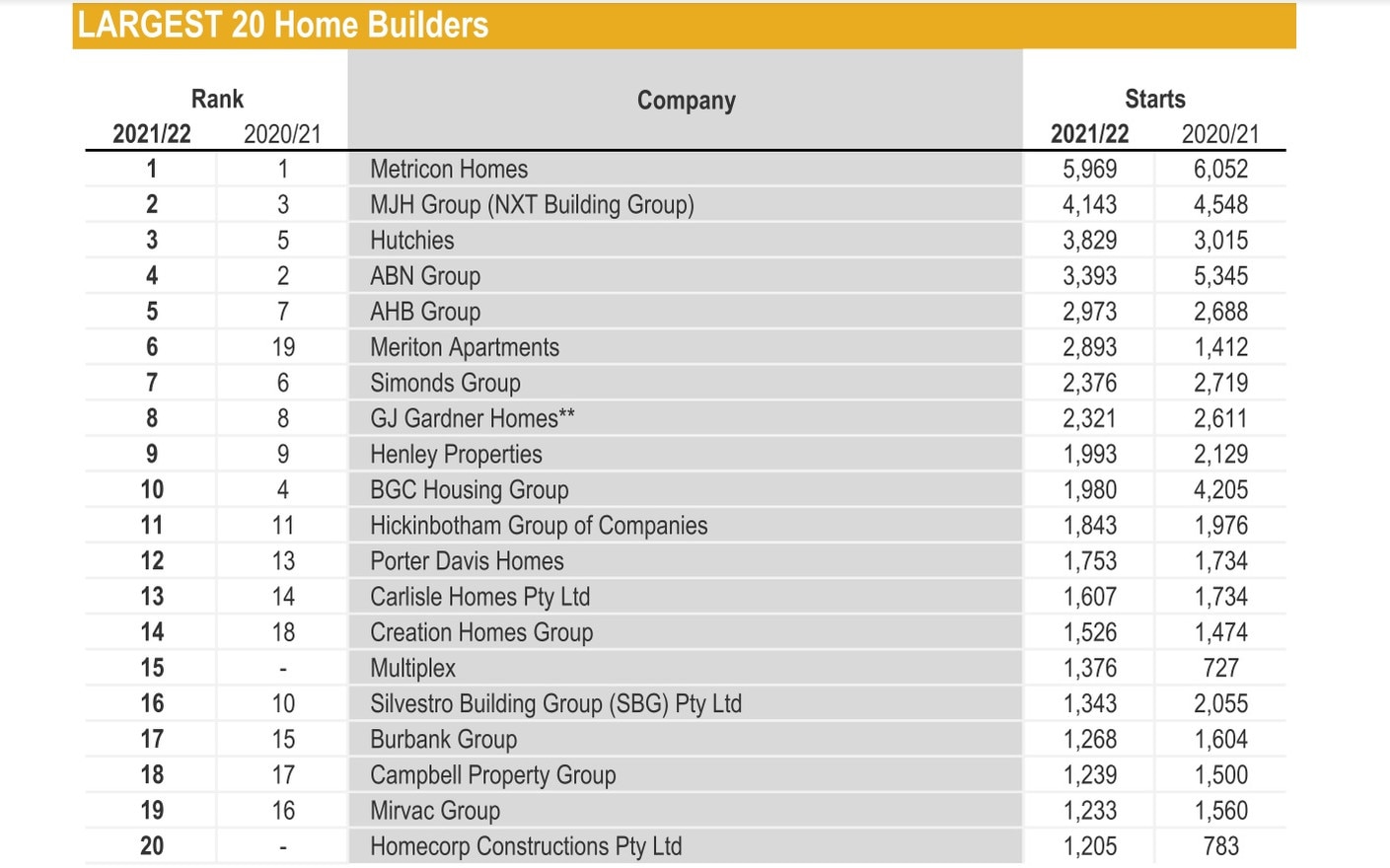

The nation’s top 100 residential builders have just been announced, with two thirds of the top builders starting fewer homes in the past financial year than the one prior.

Metricon has been named Australia’s biggest builder for the seventh year in a row.

The latest Housing Institute of Australia Housing 100 Report recorded the beleaguered builder as the nation’s busiest in the past financial year, with a total of 5969 new home starts.

It was a slight fall from the 6052 starts they reported for the prior 12 months, when numbers were heavily buoyed by the federal government’s HomeBuilder scheme that ran during the 2020-2021 financial year.

But it’s still more than 1800 ahead of second biggest builder the NSW based MJH Group, also known as NXT Building Group, which reported 4143 starts.

Two thirds of the nation’s top builders started fewer homes in the past financial year than the one prior, with building trades and materials shortages hitting the industry that relies on fixed-price contracts hard throughout much of 2022.

With building giants including ProBuild and Condev Construction having failed earlier this year, there are question marks over the viability of many builders.

Metricon has repeatedly denied issues relating to their solvency since the passing of former chief executive and founder Mario Biasin in May.

About 200 Metricon staff were let go in a restructure in August this year.

Metricon has been named the nation’s biggest builder for the seventh year in a row.

The business’ owners personally tipped in $30m to allay public fears in June.

Metricon chief executive Peter Langfelder said after grappling with escalating costs, interest rate rises and speculation over the industry’s stability, their success was a “very tangible proof point of our continued business strength”.

Mr Langfelder estimated the firm would contract an average 100 homes every week for the next year, in line with pre-pandemic volumes.

“It’s been tough – navigating challenging market conditions while restructuring the business,” Mr Langfelder said.

“But from the beginning all the directors and the Biasin family were determined Metricon would navigate through and thrive.

“Being ranked HIA’s top builder once again has proven our strength and important place in The Australian building industry.”

Metricon chief executive Peter Langfelder. Picture: Kiel Egging

The figures revealed the nation’s top 100 builders market share plunged 8 per cent from the year before, with HIA senior economist Tim Reardon noting this reflected a return to trend after the nation’s biggest builders absorbed most of the increased demand caused by the HomeBuilder scheme in the prior financial year.

“Two thirds of builders in this year’s top 100 started fewer homes than they did last year, which is not surprising given the historically high volumes of the prior year,” Mr Reardon said.

Source: HIA economics

The economist predicted 2023 would pan out very similarly to 2019, when there was also a strong national economy, buyers had difficulty obtaining finance and the volume of building work was declining from a recent peak.

However, Mr Reardon warned recent Reserve Bank of Australia indications that they may yet raise the nation’s cash rate to 3.6 per cent to tackle inflation could lead to serious consequences, given the “treacherous lag” at play with inflation data.

He warned a big pipeline of building work across the nation was obscuring impacts caused by rising rates, and that with the construction industry absorbing large portions of the workforce, there could be a surge in unemployment when its pool of work was exhausted in 2024.

The nation’s top 100 builders market share plunged 8 per cent from the year before

Mr Reardon added that those hoping to build a new home should expect to see costs continue to rise in the coming year, but at a much slower rate than in the past year.

While previously surging timber prices were now likely to remain stable, he said costs for energy-intensive materials such as cement and glass were likely to continue rising.

READ MORE VIA NEWS.COM.AU

MOST POPULAR

New kiwi Property TV Show: RICH LISTERS

New kiwi Property TV Show: RICH LISTERS Rich Listers: The KIWI real estate reality series

Rich Listers: The KIWI real estate reality series Rich Listers: Luxury real estate show | WATCH

Rich Listers: Luxury real estate show | WATCH Costco reveals opening date for first KIWI store | WATCH

Costco reveals opening date for first KIWI store | WATCH NBR rich list 2022

NBR rich list 2022 NZ property: House prices continue to slide, Auckland and Wellington leading the charge downwards

NZ property: House prices continue to slide, Auckland and Wellington leading the charge downwards Economist warns of recession

Economist warns of recession Property values plunge in more than 80% of New Zealand suburbs

Property values plunge in more than 80% of New Zealand suburbs Former bankrupt property tycoon and TV star Terry Serepisos back in business

Former bankrupt property tycoon and TV star Terry Serepisos back in business Melissa Caddick’s parents and husband face being HOMELESS | AUSTRALIA

Melissa Caddick’s parents and husband face being HOMELESS | AUSTRALIA