PHOTO: Stock is down significantly on last June. Photo credit: Getty Images.

New Zealand’s national average asking house price is up more than 20 percent over the last year, new figures show, with 15 regions hitting record highs in June.

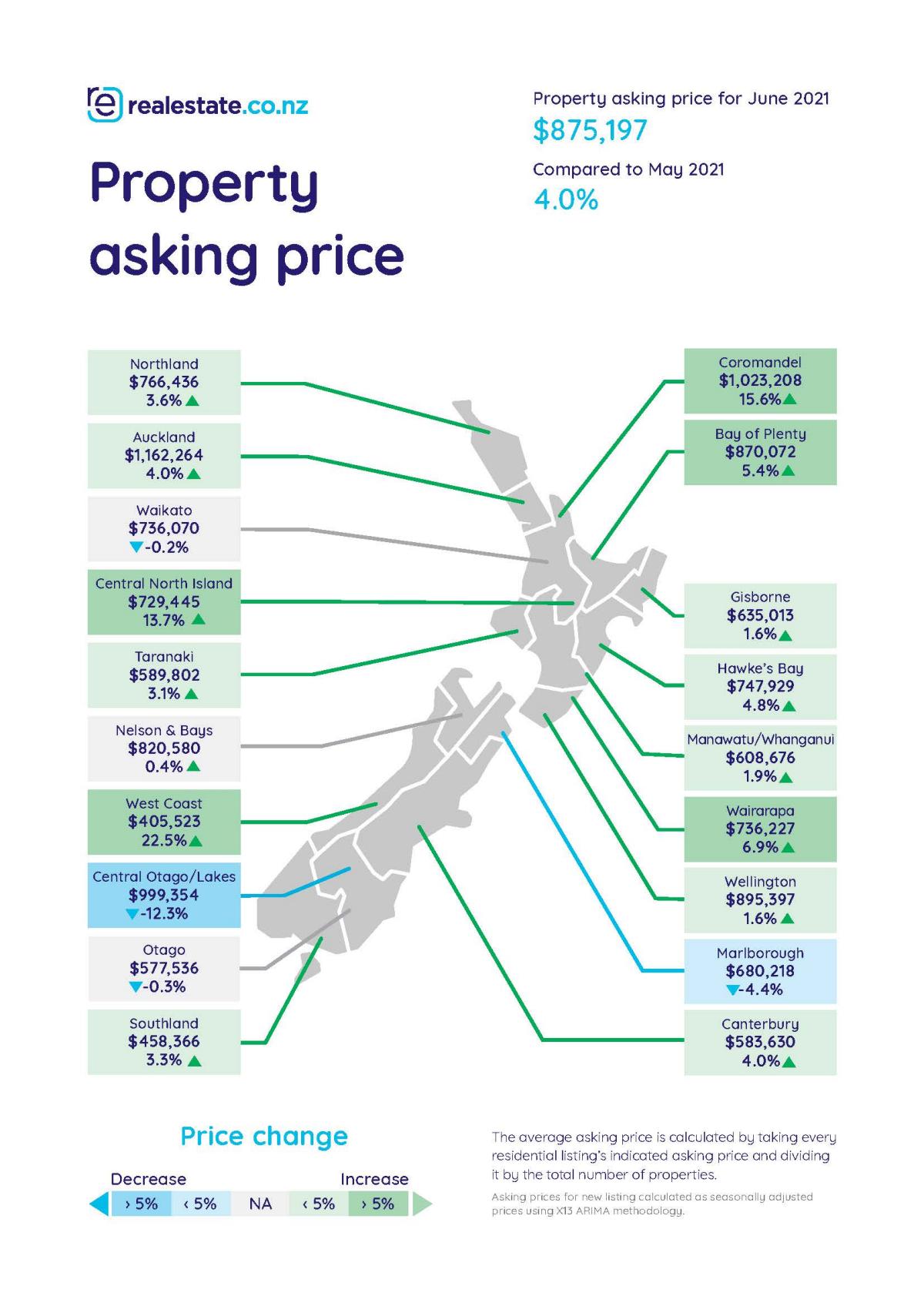

The housing market has defied the usual winter slump, with realestate.co.nz reporting the national average asking price has risen sharply to $875,197 from $841,816 in May. It’s also up 20.2 percent from $728,328 in June 2020. Fifteen of 19 regions hit record highs last month.

“On average, Kiwi homes are costing nearly $150,000 more than they did this time last year and there aren’t any signs to suggest it will slow down,” spokesperson Vanessa Williams said.

The largest annual jump has been in the West Coast, which has seen average prices increase 57.8 percent from $256,921 to $405,523 in June.

Auckland now has an average asking price of $1,162,264 while Wellington reached $895,397.

The only region to see a year-on-year fall was Central Otago/Lakes District, which is down 4.2 percent to $999,354.

“This region has been a noteworthy outlier recently. Central Otago/Lakes District was one of the five regions that hit record stock lows this month (-34 percent), so it isn’t as if there is a surplus of properties pushing prices down,” Williams said.

She said the rise in prices was a “classic case of supply and demand”.

“While Kiwis have closed borders and are unable to travel, property remains a focus. Demand is high, but there are not enough homes to purchase.”

Five of 19 regions are reporting record low supply, with stock down 33.3 percent nationally compared to this time last year. Northland is down 47.8 percent, Nelson and Bays dropped 57.9 percent, Canterbury fell 48.5 percent, Coromandel dropped 59.4 percent and Central Otago and Lakes fell 34 percent.

“There is a constant downward trend of the total inventory available for Kiwis to buy,” said Williams. “At the height of the market, we saw around 60,000 homes available at the end of April 2008. Today, we have under 14,000 homes available to buy.”

READ MORE VIA NEWSHUB