PHOTO: Property Correction – GETTY

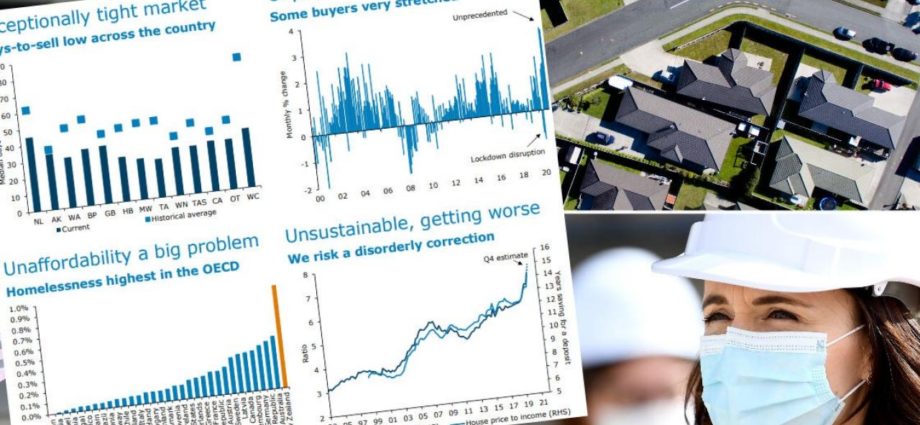

One of the country’s biggest banks is calling for “big, bold, urgent” action to stop house prices rocketing even further, saying a “managed supply-induced decline in house prices” would be better than the possible alternative – a “painful correction”.

House prices in New Zealand have lifted about 20 percent in the past year, despite the recession – the combination of a lack of supply and low interest rates. Median prices are now above $700,000 nationwide and $1 million in Auckland, where a third of the country lives.

One political party leader has warned of a “wicked divide” between the haves and have-nots if it continues, and a prominent economist says the growing gap is “ripping apart the social fabric of New Zealand”, with fewer Kiwis in their own homes than at any other time in the past 70 years.

“A co-ordinated Government policy response is urgently needed to stem continued price rises, acute housing unaffordability, and the large house price swings to which our market is vulnerable,” ANZ Bank warns in its latest Property Focus report, out this week.

READ MORE VIA NEWSHUB