PHOTO: Chinese buyers. FILE

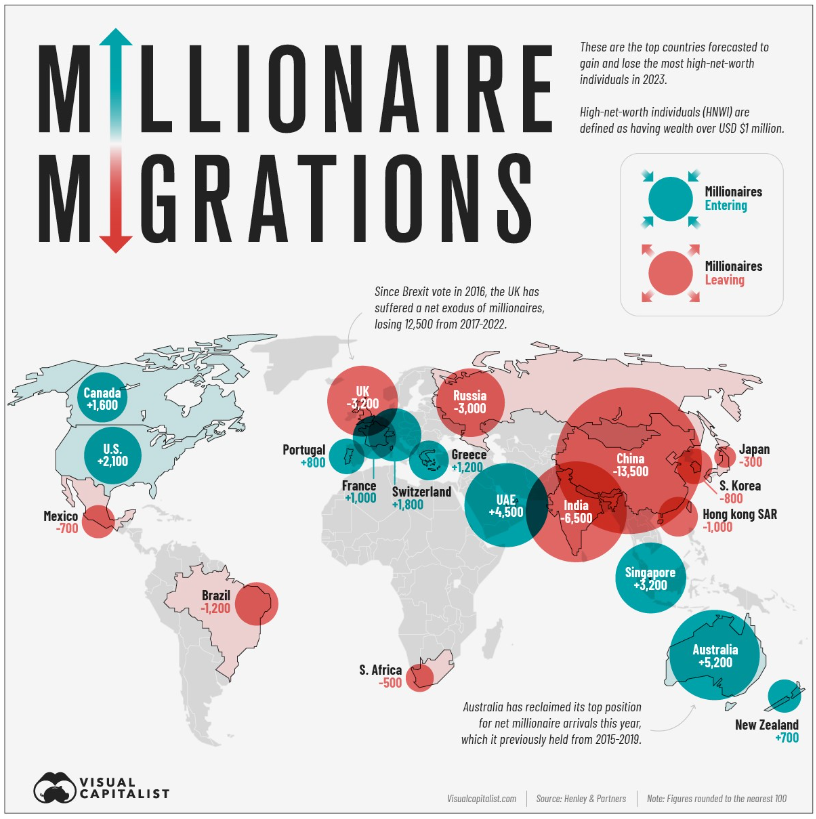

The Visual Capitalist has charted the global migration patterns of millionaires in 2023.

High Net Worth Individuals (HNWIs) are individuals with a minimum net worth of $1 million USD.

As depicted in the visual representation below, Australia saw the highest influx of millionaire migrants, with an increase of over 5,200 individuals. Conversely, China experienced a notable outflow, losing 13,500 millionaire migrants, while India lost 6,500. The majority of Australia’s millionaire migrants likely originated from China.

This phenomenon has had a significant impact on Australia’s real estate market. Recent research by Juwai IQI indicates that Australia has surpassed Canada as the preferred destination for Chinese property buyers looking for educational opportunities and prospects for migration.

Juwai IQI’s co-founder and group managing director, Daniel Ho, attributed this trend to the appeal of Australia’s education system and overall quality of life. He noted that these buyers are seeking homes, townhouses, and larger apartments with the intention of settling in Australia permanently.

Australia’s Significant Investor Visa (SIV) program, often referred to as “Golden Ticket Visas,” allowed affluent foreign nationals to acquire Australian citizenship by investing $5 million in eligible assets or ventures. The program was predominantly utilized by Chinese nationals, accounting for nearly 90% of SIVs issued.

However, the Albanese Government announced the discontinuation of the SIV visa program last year, following the lead of several other developed nations that had already terminated similar “golden ticket” visa schemes. Australia’s Productivity Commission had long advocated for the abolition of such visas, citing concerns about money laundering and the influx of illicit funds into the country.

House associated with the alleged murder of Yanfei Bao has been sold

The decision to end the SIV program was a prudent move, as it lacked stringent background checks on applicants and did not require English proficiency, employment, or societal contributions.

The termination of the SIV program may have marked the peak of millionaire migrants arriving in Australia. Nevertheless, it’s worth noting that the surge in Chinese property investments in Australia, which peaked in 2016/17, was primarily curbed by Chinese capital controls rather than measures taken by Australia. China is now working to ease stringent capital control measures:

In Shanghai’s pilot free-trade zone and Lingang area, foreign investors can now freely transfer investment-related funds in and out of China without delay, provided the funds are “real and compliant.” Similar regulations are being proposed for Beijing.

Despite these developments, the housing crisis in Australia continues unabated, leaving many Australians without stable housing solutions.

SOURCE: MACRO BUSINESS