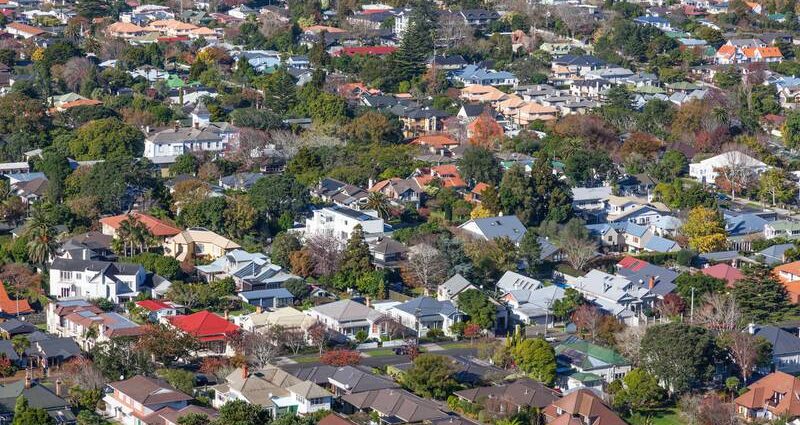

PHOTO: Houses in Auckland (file picture). (Source: istock.com)

The housing market is becoming more affordable but is still beyond the reach of the average household as the cost to service a mortgage is “alarmingly high”.

Property research firm CoreLogic said the average house value to income ratio dropped to 8.5 in the three months ended June from 8.9 in the first quarter, but was still well above the pre-Covid rate of 6.6, and the long-term average value of 6.

“This is at least a start and will provide some would-be first home buyers with a little more confidence,” CoreLogic chief economist Kelvin Davidson said.

Rising interest rates were another problem, he said.

“The amount of household income required to service a mortgage remains alarmingly high.

HAVE A STORY TO SHARE?

“The falls in property values that we’ve seen in recent months will have helped the required debt servicing costs for households [given smaller mortgages], but this effect has been outweighed by the rise in mortgage rates themselves.”

CoreLogic estimated it would take about 53 percent of gross household income to service an 80 percent loan-to-value (LVR) mortgage, based on an average property value over 25 years, compared with 50 percent just three months ago.

In Auckland, Hamilton, Tauranga and Dunedin, mortgage repayments were absorbing at least 50 percent of gross annual average household income, with Wellington’s figure of 47 percent a record high.

“Compared to the long-run average of 37 percent, the latest reading is still the most problematic area of affordability and surpasses the sustained 50 percent peak we hit in 2007-08,” Davidson said.

READ MORE VIA 1 NEWS

MOST POPULAR

AGENT CRISIS: Number of real estate agents DIVE in last three months

AGENT CRISIS: Number of real estate agents DIVE in last three months WHAT? Sandra Bullock is selling Graeme Norton’s Karaka home | WATCH

WHAT? Sandra Bullock is selling Graeme Norton’s Karaka home | WATCH NBR rich list 2022

NBR rich list 2022 Melissa Caddick’s parents and husband face being HOMELESS | AUSTRALIA

Melissa Caddick’s parents and husband face being HOMELESS | AUSTRALIA First home buyers awarded $900,000 in damages

First home buyers awarded $900,000 in damages New kiwi Property TV Show: RICH LISTERS

New kiwi Property TV Show: RICH LISTERS AUSTRALIA: Inside the lavish life and stunning $5million mansion of collapsed building boss

AUSTRALIA: Inside the lavish life and stunning $5million mansion of collapsed building boss Inside the epic world of gangster mum who went from public housing to a VERY lavish lifestyle

Inside the epic world of gangster mum who went from public housing to a VERY lavish lifestyle Auckland house prices tumble by over $100,000 | TRADE ME

Auckland house prices tumble by over $100,000 | TRADE ME THE PARTY IS OVER: Real estate agent commissions are likely to fall 30%

THE PARTY IS OVER: Real estate agent commissions are likely to fall 30%