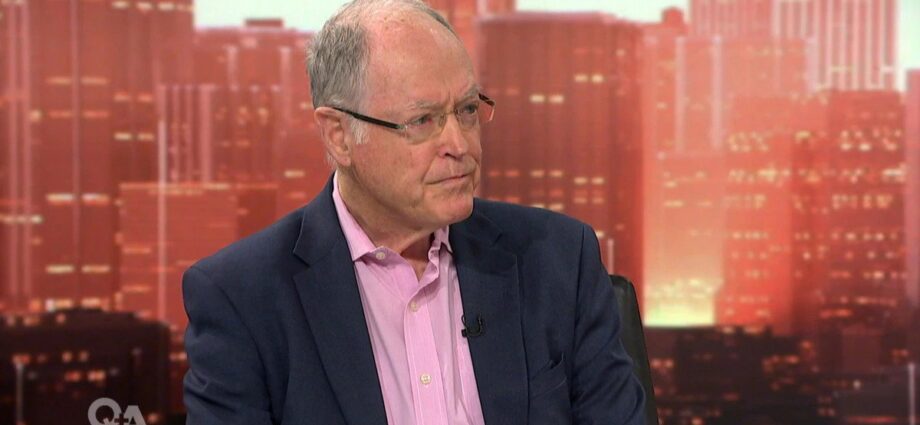

PHOTO: Former National leader and former Reserve Bank governor Dr Don Brash discusses how monetary policy affects inflation, and the tough political choices ahead about who will bear the pain of it. (Source: 1News)

Former Reserve Bank governor Dr Don Brash believes house prices need to fall, amid high inflation and a rise in interest rates.

Earlier this week, Reserve Bank governor Adrian Orr raised the OCR by 50 basis points, as well as signalling further rises to interest rates in future.

Former National leader and former Reserve Bank governor Dr Don Brash discusses how monetary policy affects inflation, and the tough political choices ahead about who will bear the pain of it. (Source: Other)

Brash said monetary policy had to be tightened when Government spending goes up, which it did in the most recent budget.

“It’s really therefore a question of who pays the cost to get inflation down. Is it the homeowner with a big mortgage seeing his interest rates go higher? Or is it other people who don’t get the benefits they’d otherwise get from public spending?” said Brash.

“As we both recognise house prices in New Zealand are outrageously over the top, particularly in Auckland but not just in Auckland, and a reduction in those prices is to be welcomed.”

The housing market appears to currently be softening, though that follows a longer period of significantly higher price rises.

Brash highlighted the cost of land as the primary cause of extremely high house prices, and said freeing up land was the best solution.

As examples of how that might be done, Brash suggested removing the urban-rural boundary around Auckland, or making changes to regulations on lifestyle blocks that only permit one house on the property.

“When you’re paying a million dollars for a tenth of an acre in Papakura, bare land, you can’t put a tent on that and make it affordable,” said Brash.

Brash said some of the inflation is a consequence of the Reserve Bank’s significant loosening of monetary policy at the start of the Covid-19 pandemic, a move which he said was appropriate given the context.

But with hindsight, Brash said the consensus among economists is now that monetary policy was kept too loose for too long, meaning more aggressive tightening is now needed.

READ MORE VIA TVNZ