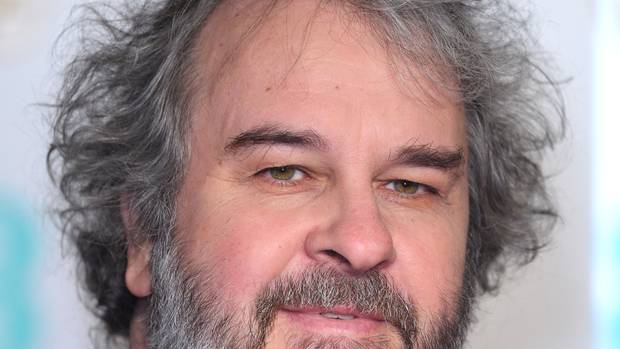

PHOTO: Capital city prices have been the most overblown in this recent property bubble that is now slowly deflating.

I’m about to retire, aged 68, single and own my home worth about $ 1.7 million, plus an investment property also worth about $1.7 million, with a principle-and-interest mortgage of $1.1 million, charging 3.8 per cent interest. Rental income is $4000 a month and mortgage repayments are $5950 a month. I have $350,000 in an offset account and $520,000 in super, which returns on average six per cent a year. Living costs, other than the mortgage, are about $45,000 per annum. I am trying to work out rest-of-life income strategies. I think I can do the following: 1. Draw on the cash account for about five years. 2. Sell the investment property. After capital gains tax and paying out the mortgage, I calculate proceeds of about $650,000, which would last about 15 years. 3. I then start drawing down on super, which would be a bit over $1 million, assuming current rates of return. Does this seem reasonable? I am being advised by others to sell the investment now, however, it seems I’m sacrificing five years growth unnecessarily. P.D.

READ MORE VIA SMH