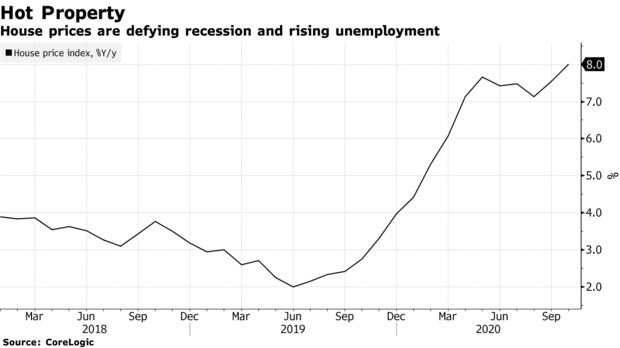

PHOTO: Record-low interest rates cause property frenzy in New Zealand

It’s just suffered its biggest economic slump since the Great Depression, its border is closed and unemployment is rising, but New Zealand’s housing market is booming.

Undeterred by the recession, buyers are rushing to take advantage of the record-low borrowing costs delivered by the central bank as it seeks to reflate the economy. House prices, which had been expected to drop during the pandemic, have instead surged to fresh record highs. The average price rose an annual 8% in October to NZ$753,000 ($519,800), the fastest gain in more than three years, while sales soared 25% from a year earlier in the busiest month since 2016

“Most regions are now experiencing double-digit house price growth. What recession?” said Jarrod Kerr, chief economist at Kiwibank in Auckland. “We no longer see a correction in house prices either this year or next.”

The housing frenzy has become a hot political issue, with politicians accusing the Reserve Bank of inflating prices through rock-bottom interest rates and making homes too expensive for those on lower incomes. It’s a dynamic that’s emerging in other countries with similar housing markets, even those that, unlike New Zealand, have yet to get the pandemic under control.

Australian home prices rose for the first time in six months in October after it stamped out a Covid-19 outbreak, while U.K. prices hit a record even as it braced for new restrictions. In the U.S., house prices posted the biggest annual jump in seven years in the third quarter.

New Zealand has a housing shortage that’s seen demand outstrip supply for many years. Prices have doubled in some areas over the past decade, cementing the perception that property investment is a safe bet.

But there’s little doubt that record-low mortgage rates are fueling the latest price surge. The major banks are currently offering one-year fixed mortgage rates of about 2.5%, down from more than 4.5% three years ago.

The RBNZ has cut its official cash rate to 0.25% and embarked on quantitative easing to drive down borrowing costs. Last week it unveiled a program of cheap loans to banks designed to reduce interest rates further, and it hasn’t ruled out taking the OCR into negative territory next year.

READ MORE VIA BLOOMBERG