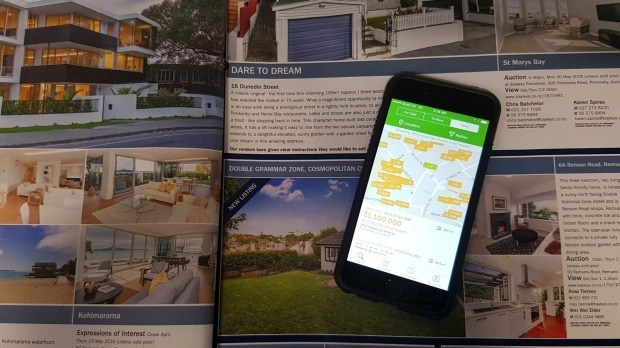

PHOTO: Trade Me Property

First-home buyers have spotted their chance to get into the market, Trade Me data shows – but whether they’ll be able to make it happen is another question.

Head of Trade Me Property Nigel Jeffries said younger buyers were browsing the site more than usual as interest rates hit record lows and the Reserve Bank removed loan-to-value restrictions.

“In the week following the Reserve Bank’s announcement it was scrapping the 20 per cent home deposit requirement, the number of 18-29-year-olds browsing property on Trade Me skyrocketed by 38 per cent when compared to the same period last year,” Jeffries said.

“This is remarkable, especially considering we saw no change in browsing activity from other age groups.”

Jeffries said supply and demand had both bounced back since New Zealand entered alert level 3, following an uncertain level 4 lockdown period.

“We’ve actually seen more buyers looking at properties on-site over the last couple of weeks when compared to the same period last year. In the first seven days of alert level 3, we saw a 10 per cent jump in the number of views on properties listed for sale than in the same week in 2019.”

But while the rules may have relaxed, there’s a warning it won’t necessarily make it any easier to get a loan because banks are still being cautious about their lending decisions.

Mortgage broker Glen Mcleod said Kiwibank had loosened its loan-to-value restrictions and would allow loans up to 80 per cent against investment properties and 90 per cent for first-home buyer purchasers.

READ MORE VIA STUFF