PHOTO: Houses in the Lyall Bay suburb of Wellington, New Zealand. Photographer: Mark Coote/Bloomberg

-

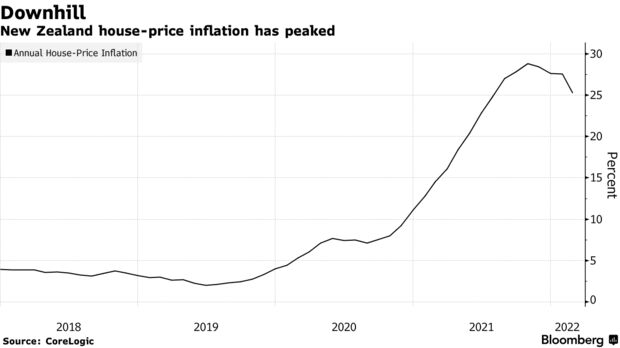

Credit squeeze and rising borrowing costs put brake on demand

-

House prices expected to fall by as much as 10% this year

There’s a new buzzword in New Zealand’s housing market — FOOP, the fear of overpaying.

After a year of frenzied price increases when the fear of missing out, or FOMO, prevailed, a credit squeeze and rising interest rates are now driving the market in the opposite direction. Some economists predict prices will sink as much as 10% this year.

“There is now a fear of overpaying among buyers,” said Jen Baird, chief executive at the Real Estate Institute of New Zealand. “As a shift of sentiment sets in and buyers are less willing, or unable, to pay the prices we saw toward the end of 2021, pressure will come on vendors to adjust their expectations to meet the market.”

Last year, New Zealand had one of the hottest housing markets in the world, with record-low borrowing costs and tight supply fueling annual price gains of close to 30%. But new government regulations have made it harder for people to get a loan, while the central bank has started to raise interest rates to rein in the fastest inflation in more than 30 years.

House sales in February were the lowest for the month since 2011, and prices are now 2.3% below their November peak, according REINZ data.

‘Credit Crunch’

Amendments to the Credit Contracts and Consumer Finance Act have acted as a brake on lending since they were introduced on Dec. 1. The rules require lenders to undertake an affordability assessment on all credit applications including home loans, and the result has been a squeeze on credit.

“Ever since it came in late last year we’ve seen the amount of lending coming off, the amount of approvals coming off,” said Jarrod Kerr, chief economist at Kiwibank in Auckland. “It’s clearly caused a bit of a credit crunch.”

The proportion of home-loan applications being converted into actual loans fell to just 33% in January from 39% in November, according to data from Auckland-based credit bureau Centrix.

“People who were getting credit prior to December the first weren’t getting it after December the first,” said Centrix Chief Executive Keith McLaughlin. He couldn’t recall the rate being as low as this, and “I’ve only been in the industry about 50 years,” he said.

READ MORE VIA BLOOMBERG

MOST POPULAR

Where is Clarke Gayford? At home in Sandringham? | PM Adern responds to rumours

Where is Clarke Gayford? At home in Sandringham? | PM Adern responds to rumours Warnie’s last moments – Samujana Villa resort | WATCH

Warnie’s last moments – Samujana Villa resort | WATCH Rich-list split among magnificent multi million-dollar real estate

Rich-list split among magnificent multi million-dollar real estate Real estate agents pay packets SKY ROCKET

Real estate agents pay packets SKY ROCKET Abandoned land for sale

Abandoned land for sale Shane Warne leaves behind a HUGE fortune | WATCH

Shane Warne leaves behind a HUGE fortune | WATCH WARNING TO AGENTS: The TRUE cost of my real estate career

WARNING TO AGENTS: The TRUE cost of my real estate career Thai police examine luxury villa where Shane Warne died | WATCH

Thai police examine luxury villa where Shane Warne died | WATCH New Zealand is crowned the 6th least affordable country to buy property in the world

New Zealand is crowned the 6th least affordable country to buy property in the world Real estate workforce hits record high as market tipped to fall

Real estate workforce hits record high as market tipped to fall