PHOTO: Jen Baird, Chief Executive at REINZ

REINZ March data: Market consolidates at new pace, supply continues to grow and demand ease

March solidifies the changes in the market seen over the past months as pressure on property prices eases, inventory levels increase, demand softens and sales activity decelerates, according to the latest data and insights from the Real Estate Institute of New Zealand (REINZ), home of the most complete, accurate and up-to-date real estate data in New Zealand.

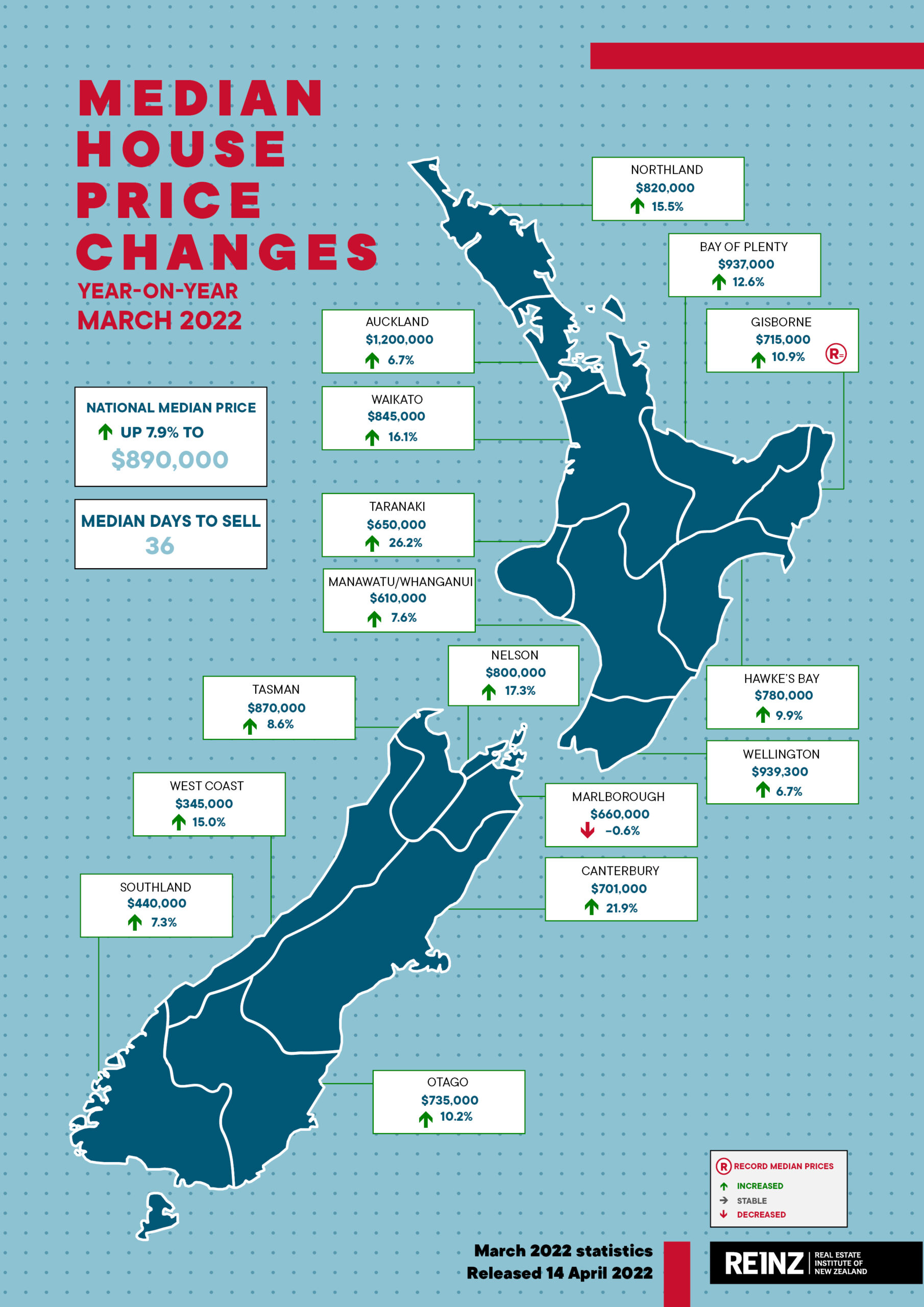

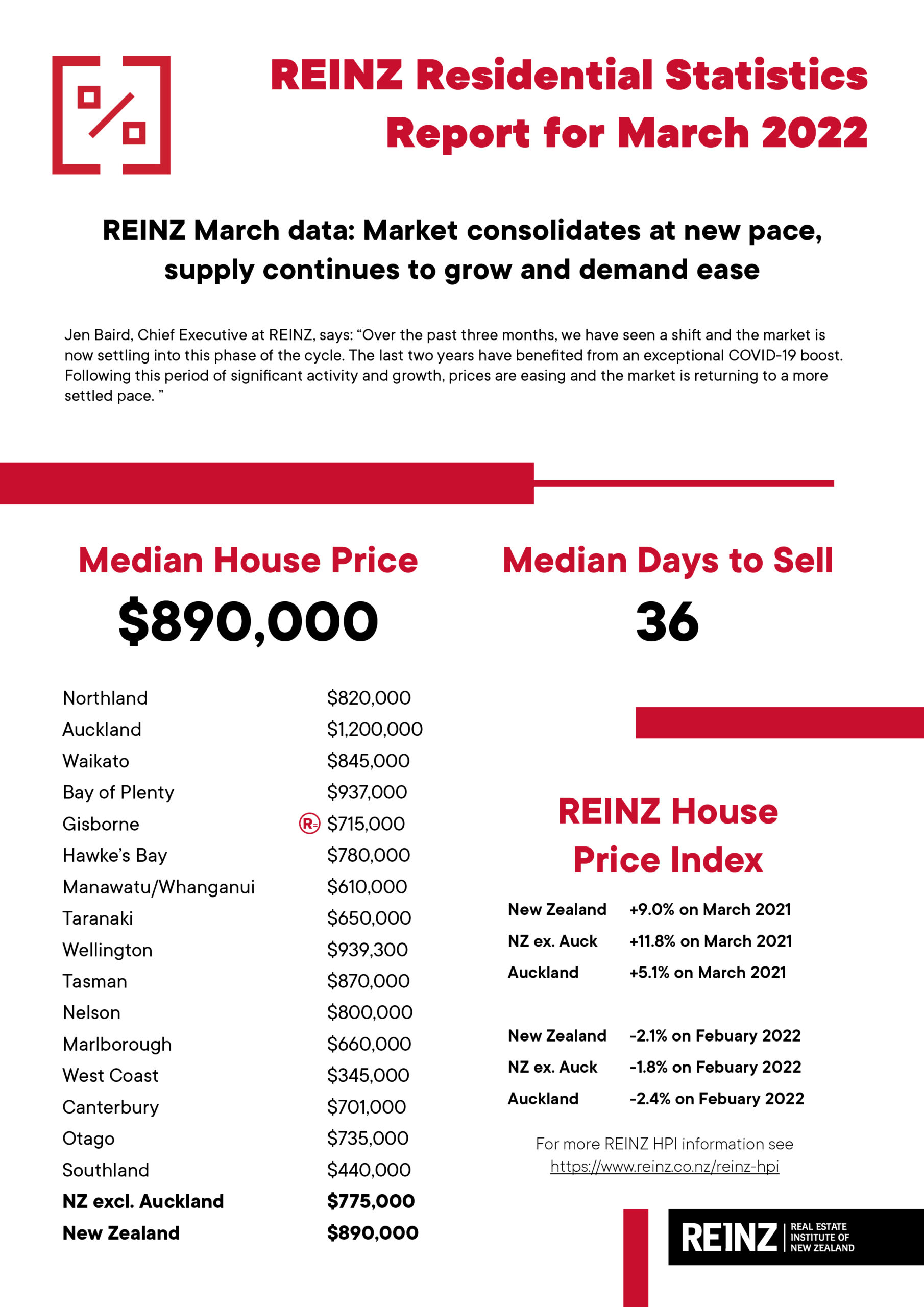

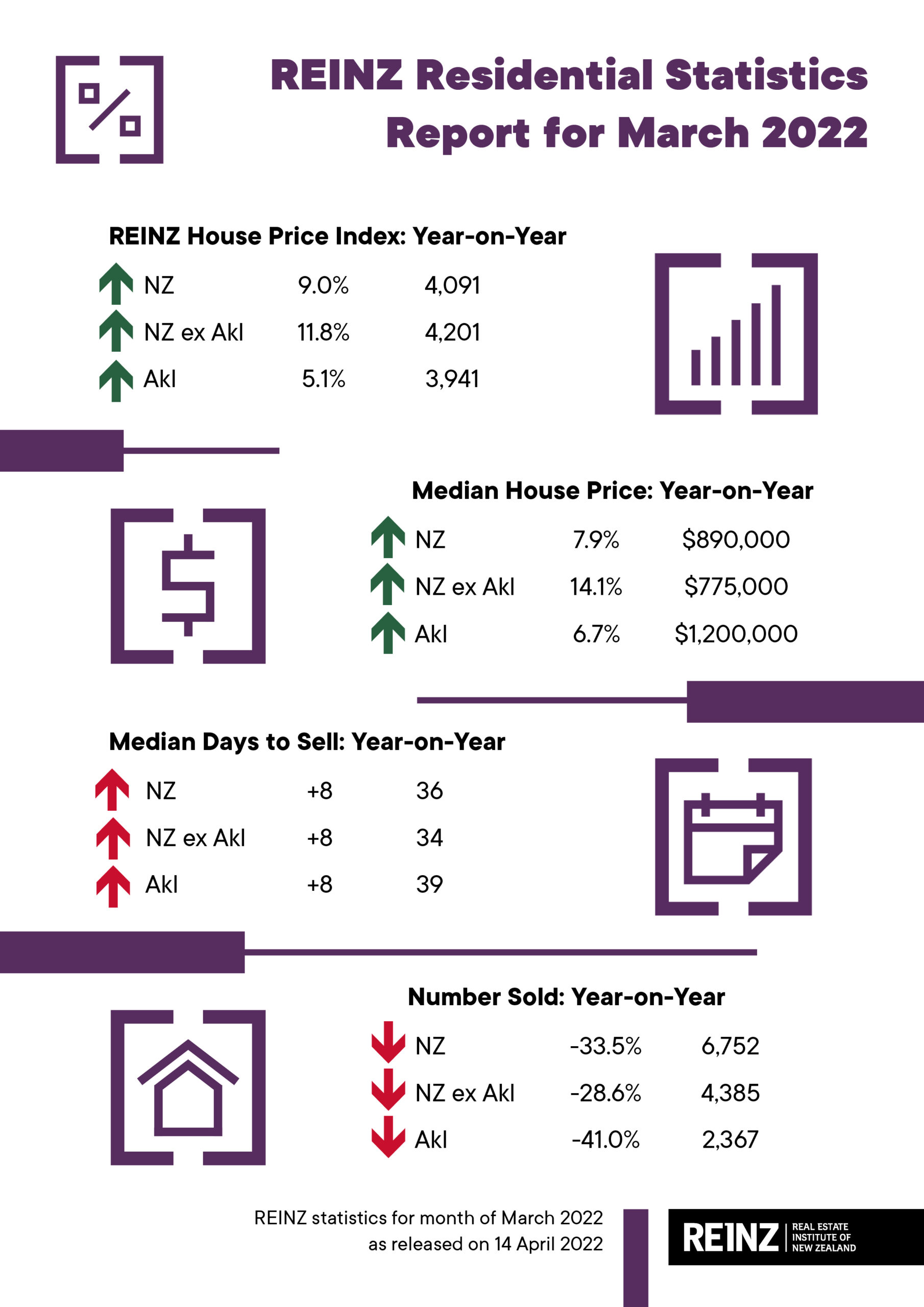

Median prices for residential property across New Zealand increased 7.9% annually, from $825,000 in March 2021 to $890,000 in March 2022. Moving from February to March 2022, the median property price increased a marginal 0.6%. However, the seasonally adjusted figure shows a decrease of 4.8% indicating a weaker price increase than expected moving from February into March.

The median residential property price for New Zealand excluding Auckland increased 14.1% annually from $679,000 in March 2021 to $775,000 in March 2022.

In March, while there were no new regions with record median prices, Gisborne had an equal high to February 2022 with a median price of $715,000 — up 10.9% on March 2022. Fifteen territorial authority (TA) achieved median records. More information on activity by region and TA record median prices can be found in the monthly property report.

Marlborough is the first region to see negative annual movement in median price since May 2020. The region saw a 0.6% annual decrease from $664,000 to $660,000 in March 2022.

With the exception of Marlborough, all regions saw annual median price growth. However, the margin of increase is decreasing as prices ease. Auckland and Wellington had the lowest percentage change, with the median residential property price up 6.7% annually in both. The median price in Auckland was up from $1,125,000 in March last year to $1,200,000, and Wellington rose from $880,000 to $939,300 in March 2022. This is the fourth month Auckland has seen a drop in the rate of increase, and the third such drop for Wellington.

Manawatu/Whanganui saw the annual rate of increase contract again in March. This is the sixth consecutive decrease in the percentage of annual growth, down from a 37.3% annual increase in September 2021 to a 7.6% annual increase this month.

Jen Baird, Chief Executive at REINZ, says: “Over the past three months, we have seen a shift and the market is now settling into this phase of the cycle. The last two years have benefited from an exceptional COVID-19 boost. Following this period of significant activity and growth, prices are easing and the market is returning to a more settled pace.

“While we continue to see prices increase annually —in all but one region — the rate of growth is slowing, sales activity is down and the median days to sell is up. We’re seeing the market moderate as people settle into this phase of the property cycle.

“The impact of tighter lending criteria, LVRs, and increasing interest rates coupled with inflation, continue to reduce the pool of buyers who are willing and able to pay market prices. The increase in interest rates over the past months presents one of the greatest impacts to the market. Yesterday the Reserve Bank increased the official cash rate by 50 basis points — to 1.5%. The double rate hike will do little to alleviate concerns and rather see the market slow further as buyers reassess their ability to meet higher mortgage repayments should the dial be turned up further, tempering their spending.

“As the market shifts to a new pattern, we note volatility across regions. The data shows variation across regions and TAs within those regions. Last month, we saw strong prices in Otago, Southland and Canterbury, in March these regions are down — a reflection of what is happening across the country.

“House prices tend to be more sticky when decreasing than increasing, which is what we are seeing now. While market sentiment has quickly shifted, vendors are slower to adjust their price expectations. As demand drops, vendors tend to choose to wait longer to sell their property rather than sell below those expectations. Those who must sell often have to drop their price to meet demand. That tends to be the general experience at this stage of the property market cycle where the market power is leaning towards buyers,” observes Baird.

Sales activity slows further

Across New Zealand, the number of residential property sales decreased 33.5% in March 2022, from 10,151 in March 2021 to 6,752. Month-on-month, there was 17.7% increase in sales count from February across New Zealand. However, the seasonally adjusted figures show a decrease of 5.2% from February to March. Adjusting for what typically happens over this period, March was weaker than expected.

The sales count for New Zealand excluding Auckland, decreased 28.6% annually from 6,138 to 4,385.

With the exception of Tasman and Marlborough, all regions saw an annual decrease in the number of sales. Tasman had its highest monthly sales count since November 2020, with an increase of 15.7% — from 70 to 81 — and Marlborough saw the number of sales increase 8.0% — from 75 to 81.

The regions with the greatest annual percentage decrease in sales volumes were:

- West Coast, which decreased 48.7% annually from 78 to 40

- Auckland, which decreased 41.0% annually from 4,013 to 2,367

- Gisborne, which decreased 38.9% annually from 54 to 33 — the region’s lowest sales count in a March month since records began 30 years ago

- Waikato, which decreased 38.8% annually from 996 to 610 — the region’s lowest sales count in a March month since 2014.

“REINZ data includes unconditional sales from the last month, ensuring our figures are the most current reflection of sales activity in the market. What we are seeing is that transactions are happening and properties are changing hands — just not as quickly.

“There is a pervasive feeing of uncertainty, and people are hitting pause. While more stock makes this a favourable market for buyers who find themselves in a position to wait for the right property and negotiate — particularly buyers with their finances lined up — many are balancing fear of over paying with an outlook of further interest rate increases. Conversely, sellers are holding out for the right price in a changed market.

“Pressure to attain finance remains a key issue, particularly for first home buyers, with further amendments to the Credit Contracts and Consumer Financing Act (CCCFA) still a number of months away. The continued impact of COVID-19 as it makes its way through New Zealand, is still seeing many people choosing to stay at home or isolating — further contributing to a decline in buyer presence.

“Combined, these factors are resulting in properties spending longer on the market, which increases the median days to sell, and causes the sales count, which is elastic, to slow,” says Baird.

REINZ HPI: house value increases show deceleration

The REINZ House Price Index (HPI) for New Zealand, which measures the changing value of residential property nationwide, showed an annual increase of 9.0% from 3,754 in March 2021 to 4,091. For New Zealand excluding Auckland, the HPI increased annually by 11.8% — from 3,758 in March 2021 to 4,201 in March 2022.

While no region showed an annual decrease on the index, only one region had a new high. The number of HPI records has not been this low since May 2020 when there were no records. Otago increased 13.4% annually from 3,673 to 4,167 and edged up 0.2% compared to February. Southland was the only other region to see an increase month on month, up 0.5% on the month prior to 4,593.

Wellington showed the lowest annual increase on the HPI, up only 0.3%. The region has ranked in the bottom two for five consecutive months for annual HPI movement.

Canterbury continues to demonstrate strength in its property market, increasing 23.9% annually — ranking top two for the last six months.

“While we still see annual increases in terms of HPI in all areas, the rate of annual increase is decreasing and we have come down 4.3% from our peak in November. In March, only two regions – Otago and Southland — saw a month-on-month increase.

“The HPI is indicating that month on month people are expecting to pay less, which suggests the market is shifting to one that favours buyers who are finance ready or cashed up.”

Annual increase in median days to sell

Nationally, the median number of days to sell a property increased eight days to 36 in March 2022. The median days to sell in New Zealand excluding Auckland also increased by eight days to 34.

All regions saw an annual increase in the median days to sell, with properties in Canterbury selling fastest at 29 days.

Taking a month on month view, Taranaki and Tasman were the only regions that did not see a decrease in the median days to sell from February to March 2022. Taranaki had its highest median days to sell since September 2021.

“Canterbury continues to buck the trend. While the median days to sell increased year on year, properties are still selling fast in the region — another signifier of the strength of that market underpinned by its relative affordability, proximity to one of New Zealand’s main hubs and economic opportunities.

“Nationwide, properties are selling, it is just taking longer — buyers have less urgency, securing finance is taking longer, and vendors are still looking to secure the high prices of 2021,” Baird observes.

Inventory levels continue to increase

In March 2022, the total number of properties available for sale nationally increased 32.0%, from 19,437 in March 2021 to 25,659. For New Zealand excluding Auckland, inventory increased 33.8%, from 11,155 one year ago to 14,923.

Wellington and Manawatu/Whanganui again recorded over twice as much inventory as they had one year ago, with increases of 158.7% and 105.2% respectively. Bay of Plenty, Hawke’s Bay, Nelson, and Waikato also had increases in inventory levels of over 50% since March 2021.

Inventory levels decreased in three regions. West Coast saw a decrease of 42.1% compared to March 2021, from 304 to 176, Northland saw a decrease of 22.4%, from 1,176 to 913, and Marlborough saw a decrease of 4.1%, from 242 to 232.

While inventory climbs, the number of new listings nationally decreased annually by 0.9%. Auckland, Gisborne, Marlborough, and Taranaki had a decrease in new listings of over 10% compared to March 2021. Hawke’s Bay, Nelson, and Wellington had an increase in listings of over 10% compared to March 2021.

“In March, we saw inventory levels continue to increase. More stock means more choice for buyers, alleviating competition for properties and upward pressure on prices. While this is good news for all buyers, as property prices remain firm and access to finance a challenge, the greatest benefit will be to those who are upsizing, downsizing or making a lifestyle change. Backed by equity and spoiled for choice – this is a great time to make the move.

“Stock levels are being maintained, in part due to time longer time on the market due to the time taken to move a sale through to completion.

“At the same time, we have seen the number of new listings decrease in some areas — suggestion that some potential vendors are showing caution and choosing to delay selling due to continued market uncertainty around COVID-19, interest rates, and financial and economic factors.”

Inventory and Listings data come from realestate.co.nz.

Auction sales dip in March

March saw 1,333 properties sell by auction, with auctions falling from 33.5% of sales in March 2021 to 19.7% in March this year. The percentage of sales by auction recorded in New Zealand excluding Auckland was 14.5% in March 2022 compared to 21.7% in March 2021.

The highest percentage of sales by auction was in Gisborne at 45.5% (15) — down from 61.1% (33) at the same time last year. Canterbury was the only region to see an increase in the percentage of properties sold by auction year on year — from 32.7% to 33.2% — the second highest percentage of sales by auction nationally.

In Auckland, where auction representation tends to be relatively high, the percentage of sales by auction was 29.4% in March 2022 — down from 51.5% the year prior. This trend is reflected nationwide, with 10 of the 16 regions seeing a significant 50%-plus drop in the percentage representation of auctions annually.

“The auction process is an effective way of selling in any market – however, the dynamics.

“Through 2021, demand side pressure caused an urgency to ‘buy now or miss out later’, and activity in auction rooms reflected this buyer sentiment. Comparatively, the volume of stock on the market paired with current market headwinds, have eased competition as buyers step back to consider their options — decreasing the number of sales by auction. Auctions are unconditional and require finance to be confirmed in advance. With access to finance becoming a barrier to entry for some buyers, a conditional sale becomes the only option.

“In the current market, quality counts. Buyers are still present and bidding for the right properties, in the right price range. Sellers with desirable properties, or properties ripe for development, can still achieve competition at auction,” Baird concludes.

ENDS

MOST POPULAR

Melissa Caddick’s parents and husband face being HOMELESS | AUSTRALIA

Melissa Caddick’s parents and husband face being HOMELESS | AUSTRALIA ‘Unacceptable’: top real estate agents axed

‘Unacceptable’: top real estate agents axed Forbes Billionaires 2022: The Richest People In The World | WATCH

Forbes Billionaires 2022: The Richest People In The World | WATCH Inside Putin’s ‘secret’ daughter’s gaudy, $10K-per-month home in Russia

Inside Putin’s ‘secret’ daughter’s gaudy, $10K-per-month home in Russia Wellington’s red-hot house prices are finally cooling … why, then, is no-one buying?

Wellington’s red-hot house prices are finally cooling … why, then, is no-one buying? Homeowner is left fuming

Homeowner is left fuming OCR decision: How high will the Reserve Bank take the official cash rate?

OCR decision: How high will the Reserve Bank take the official cash rate? Star real estate agent – ‘I work 12 hour days, seven days a week | WATCH

Star real estate agent – ‘I work 12 hour days, seven days a week | WATCH Elderly owner of old brick house refused to sell to developers

Elderly owner of old brick house refused to sell to developers Abandoned land for sale

Abandoned land for sale