PHOTO: First home buyer grants push up property prices, experts say. Photo: Simon Schluter

Australian governments spent more than $20.5 billion on first home buyer help in the past decade, which made housing affordability worse by driving up property prices and left existing homeowners richer, new research found.

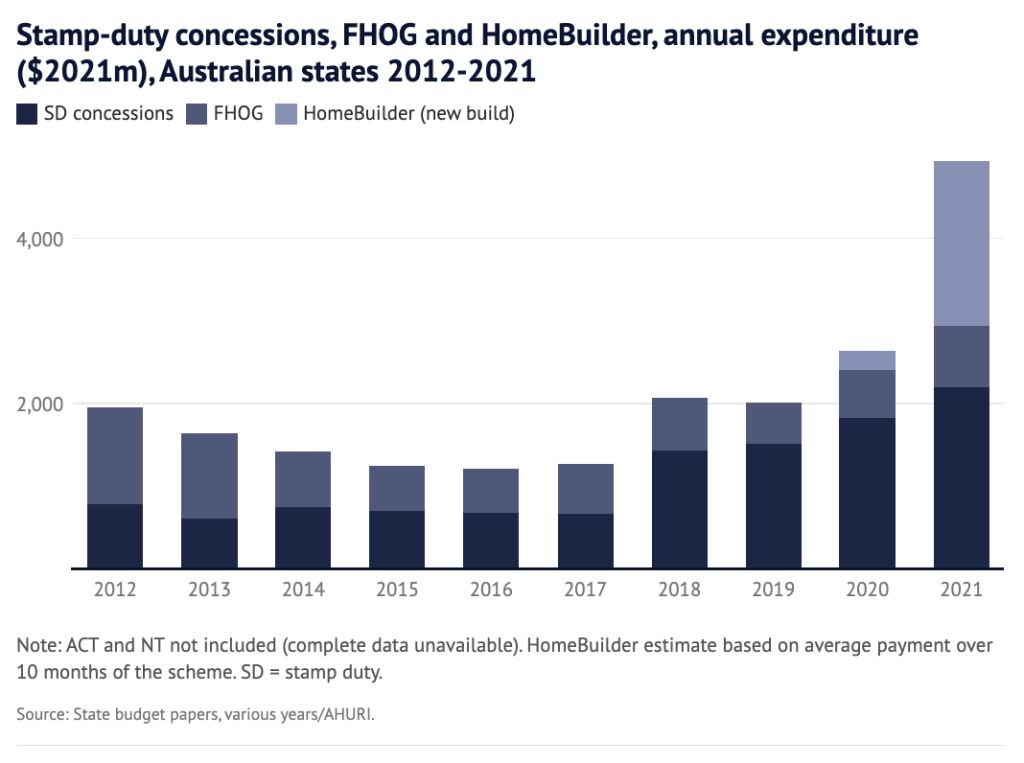

The money was largely spent on various forms of first home buyer assistance, such as cash grants and stamp duty concessions, which were on the rise even before the pandemic – more than doubling from $1.2 billion to more than $2.5 billion in the four years to 2020.

The Australian Housing and Urban Research Institute’s study examined first home buyer programs in Australia in comparison to seven other countries, including Canada, Finland, Germany, the Netherlands, Singapore, Ireland and the UK.

It found that Australia stood out for providing demand-side support instead of increasing the supply of homes available, as well as its lack of strategic framework and little improvement to the stagnant homeownership rate.

The report compiled total spending by state and federal governments over a decade on stamp duty concessions, First Home Owner Grants, and the pandemic-era HomeBuilder program.

It criticised the effect of these grants, which provide cash to buyers who then spend it at auction, flowing into the pockets of home sellers.

Senior Research Fellow in the City Futures Research Centre at the University of NSW and report author Dr Chris Martin said various governments in the decade to 2021 had very little to show for the billions spent.

“That’s $20 billion of public monies spent into the housing system for no housing policy outcome,” Martin said. “There are lots of other ways you could spend $20 billion to get housing policy outcomes like whether it’s rent assistance, which doesn’t have the same housing cost inflationary effect, or even better spending on housing that’s going to be affordable rental for the long term,” Martin said.

He said that money was wasted by making housing affordability worse, and it has benefitted existing homeowners instead.

“It’s worse than a waste [of money]. It’s money that has gone into making a problem worse … and it ends up going into inflating home values,” Martin said.

“It ultimately goes to first home vendors. That’s who it really assists and governments really don’t get anything to show for it.

“It’s people who already have housing wealth who ultimately benefit from the first home buyer assistance schemes we have and the refusal to do anything else to restrain speculation in housing.”

To give some sense of the scale of the money spent, the report said the $20.5 billion could have funded 60,000 social housing dwellings, or alternatively, 137,000 shared-equity dwellings.

READ MORE VIA DOMAIN

MOST POPULAR IN NEW ZEALAND

Real estate brand @realty brings 100% commission with no fees to NZ | WATCH

Real estate brand @realty brings 100% commission with no fees to NZ | WATCH Real agent is accused of killing pro cyclist | WATCH

Real agent is accused of killing pro cyclist | WATCH Bank allows homeowners to borrow up to $80,000 at a 3YR fixed rate of 1%

Bank allows homeowners to borrow up to $80,000 at a 3YR fixed rate of 1% Mortgage rates aren’t going to get as high as expected

Mortgage rates aren’t going to get as high as expected Timeshare Saga: Owners still out of pocket

Timeshare Saga: Owners still out of pocket 40 homes closer to being lost after busway decision

40 homes closer to being lost after busway decision Former real estate agent facing bankruptcy charges

Former real estate agent facing bankruptcy charges Abandoned land for sale

Abandoned land for sale Former Wallabies GREAT has been hit by the falling real estate market

Former Wallabies GREAT has been hit by the falling real estate market From a $10MILLION mansion and successful weight-loss business to grimy prison cell | WATCH

From a $10MILLION mansion and successful weight-loss business to grimy prison cell | WATCH