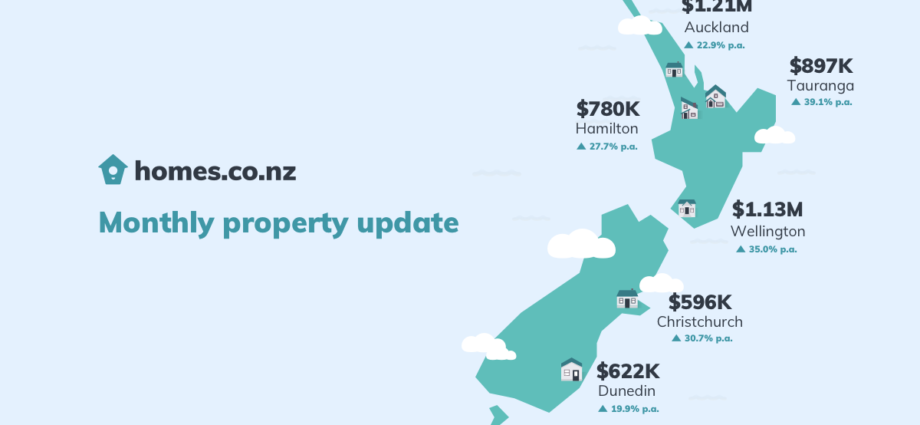

PHOTO: NZ house prices | homes.co.nz

The Reserve Bank has reported May’s average mortgage interest rates for 2, 3, 4 and 5 year fixed terms being higher than in April. This has followed a sustained period of falling interest rates, which has contributed to the property market being as strong as it has been.

Does this mean we’ve seen the end of record low interest rates? Can we expect interest rates to increase from here? Jarrod Kerr, Chief Economist at Kiwibank, believes so…

A “more confident” RBNZ has signalled two rate hikes next year, and a full normalisation in monetary policy back to 2%, from 0.25% today. There is little doubt that the RBNZ’s assertive message was a shot across the bows for indebted households and property investors. If all goes according to the RBNZ’s plan, mortgage rates will continue to rise into next year and beyond. We expect the first lift in the official cash rate (OCR) in May 2022, from a rock bottom 0.25%. Of course, a move in May means a follow up move in August, and 3 hikes to 1% next year. All mortgage rates would push higher as a result.

Can we expect million dollar mortgages?

With record prices being seen around the country, it’s easy to imagine some borrowers having a million dollar mortgage. In the last 12 months, 15% of sales have been for more than $1.25M which, assuming a 20% deposit, would require a mortgage of $1M. This is much higher in Auckland, where 37% of all sales in the last 12 months were over $1.25M. With the median HomesEstimate in Auckland now $1.21M, we can expect the share of sales in this price range to increase.

Although many of these buyers will not be borrowing to this extent, it’s safe to assume that some First Home Buyers (currently ~20% of the market) will be entering the market with this level of debt. Although this may be serviceable at current interest rates, even a slight increase could result in thousands of dollars or extra repayments each month.

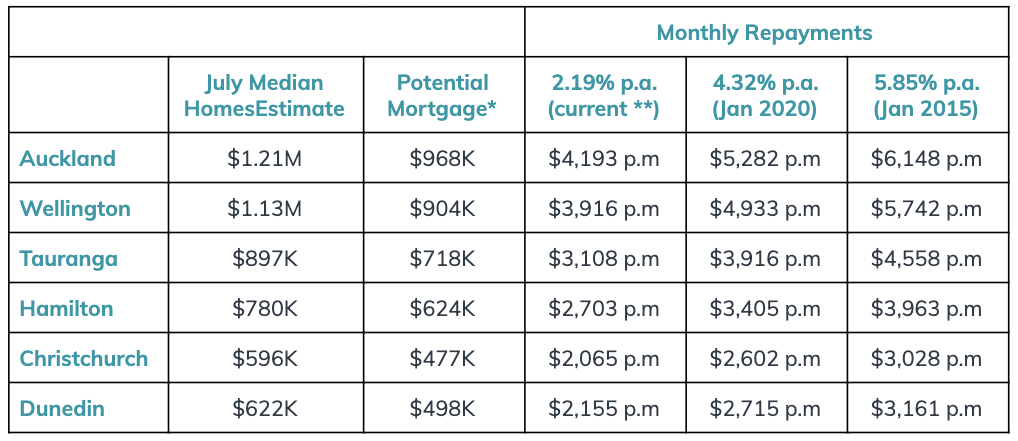

The impact of interest rate hikes on median property values in NZ’s main centres is below:

* Assumes fixed interest rate, principal and Interest payments on a 25 year term.

** Kiwibank’s current 1 year fixed term.

If we compare the differences between historical averages and today’s current special rates (offered by Kiwibank), we can see how quickly monthly repayments can increase. For example, a first home buyer of a typical Auckland property could expect a mortgage of $968,000 (assuming 20% deposit). At current interest rates, this could require monthly repayments of just over $4,000. If interest rates were to increase to their average just 18 months ago (4.32% p.a), repayments would be more than $5,000 per month. If we look back to where average rates were in Jan 2015 (5.85% p.a), the monthly repayments would be more than $6,000 per month. There is a similar story in the other main centres with potential mortgage repayments all increasing by more than $1000 per month.

The important thing to remember for new buyers and others with a mortgage is that interest rates will not stay at their current low values forever and you need to be prepared.

We suggest talking to your bank or broker about your options now before rates increase. Options include spreading your risk across different terms to buffer any rate changes. And if you can, get ahead in your repayments and pay more than the minimum now while interest rates are low.

Monthly Property Update

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s July 2021 HomesEstimates, providing an up-to-date perspective on house values around New Zealand.

Trends in our Main Cities

We’re not seeing quite the same growth in the Auckland market as previously, which may suggest price growth cooling slightly. Although with annual increases of 22.9%, it is a bit too soon to say. The property cycle in other centres often lags behind Auckland and we’re still seeing annual growth of more than 30% p.a in Wellington, Tauranga and Christchurch which suggests there is a bit more price growth to see. The median HomesEstimates in these cities are now $1.13M, $897K and $596K, respectively.

How do we calculate these figures?

The homes.co.nz Monthly Property Update is generated using homes.co.nz’s monthly HomesEstimates and provides an up-to-date perspective on house values around New Zealand. By valuing the entire housing stock, the homes.co.nz Monthly Property Update can compare median values from month to month in a consistent and reliable way. Our HomesEstimates are calculated for almost every home in New Zealand by an algorithm that identifies the relationships between sales prices and the features of a property.

Established in 2013, homes.co.nz is NZ’s first free property information portal eager to share free property information to New Zealanders.

NZ’s First Home Buyer HomesEstimate

The “First Home Buyer HomesEstimate” is homes.co.nz’s estimate of what a typical first home may cost. It is calculated to be the lower quartile HomesEstimate in a town.

READ MORE VIA homes.co.nz