PHOTO: Auckland, New Zealand. QV

Declining Home Values in Aotearoa New Zealand: An Overview

Introduction

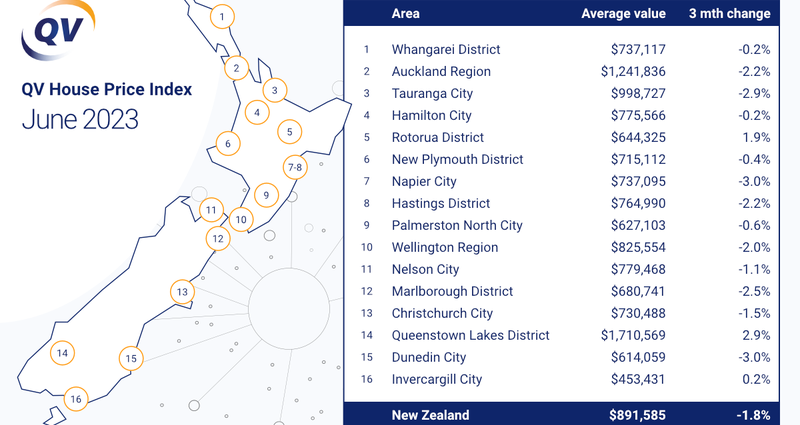

The housing market in Aotearoa New Zealand is experiencing a gradual softening of home values, although the volatility resulting from reduced sales activity is leading to fluctuations in the rate of decline. The latest data from the QV House Price Index for June 2023 indicates a smaller rate of decline compared to the previous quarter, with a national average decrease in home value of 1.8%. However, the market is likely to witness both upward and downward movements in the coming months.

propertynoise.co.nz to launch real estate industry recruitment site

National Home Value Trends

The national average home value in Aotearoa New Zealand now stands at $891,585, representing an 11.8% decline from the same period last year and a 5.6% decrease from the beginning of this year. The ongoing low sales volumes continue to contribute to significant volatility in key housing metrics. Consequently, short-term spikes in monthly value changes are observed across the country. While there are indications of overall flattening in value falls, the volatility is expected to persist for some time.

Regional Variations in Home Values

The latest QV figures reveal variations in the rate of home value decline across different regions in the country. While most urban areas experienced a slowdown in the quarterly rate of decline, Hastings (-2.2%) and Dunedin (-3%) saw continued decreases. Conversely, Rotorua (1.9%), Queenstown (2.9%), and Invercargill (0.2%) recorded positive growth in the three months ending June 2023. Auckland (-2.2%), Wellington (-2%), and Tauranga (-2.9%) witnessed faster-than-average reductions, with Tauranga’s average home value dropping below $1 million.

Influence of Market Participants

Areas with relatively low average home values are generally outperforming more expensive regions, except for Queenstown. This trend can be attributed to the significant presence of first-home buyers in the market, who constitute a larger share overall. As a result, lower-priced properties are more represented in sales activity, while cautiousness is observed among investors and individuals looking to move homes.

Market Outlook and Influencing Factors

Real estate agents and registered valuers are reporting growing interest from investors in certain locations that offer perceived good value for money. However, this trend is not yet widespread due to prevailing economic challenges. Household finances are expected to face pressure as many households reach the end of their fixed-rate mortgages, leading to downward market pressure. Although demand for housing continues to build up in the background, the current economic headwinds contribute to the market’s overall decline.

SPONSORED: Looking for a real estate database from $99 plus gst? | SALE

Regional Insights

Auckland

Auckland’s housing market continues to experience declining home values, albeit with signs of growing confidence. The average quarterly rate of reduction remained stable at 2.2%, with the average home value now at $1,241,836. Multi-offers, increased auction attendance, and a slight rise in new listings indicate some stability and narrowing gaps between buyers’ and sellers’ expectations. It is still too early to determine if this is a significant turning point in the market.

Northland

Kaipara District has proven to be the most resilient in the Northland region. Home values in the district decreased by 2.7% throughout the first half of 2023, while the Far North experienced an average reduction of 8.8%, and Whangarei saw a 6.8% decrease. Home values across the wider Northland region were on average 11.1% lower year-on-year, with Kaipara (-7.2%) showing stronger performance compared to the Far North (-11.3%) and Whangarei (-12%).

Tauranga

Tauranga’s average home value has dropped below $1 million, reaching $998,727. The quarterly rate of reduction slowed to 2.9% in June, indicating that the residential market may be close to its low point. Increasing sales turnover and declining value declines suggest growing interest from first-home buyers. The relaxation of loan-to-value ratio criteria by the Reserve Bank and some banks’ easing of loan application scrutiny further contribute to the positive market sentiment. However, investors are still cautious and waiting for potential changes to tax laws.

Waikato

The residential property downturn in the wider Waikato region has slowed, with a quarterly rate of reduction decreasing from 3.4% to 2.6%. The average home value in the region is now $801,289, 5.1% lower than the beginning of the year and 10.4% lower year-on-year. Reductions were most prominent in Thames Coromandel District (-9.6%), Otorohanga (-5.8%), and Hamilton (-5.4%). The decrease in sales volumes and a growing trend of borrowers refinancing their home loans are expected to impact the market in the coming months.

Rotorua

Rotorua’s residential property market has rebounded in the recent quarter, with the average home value increasing by 1.9% to $644,325. Despite this positive change, the value is still 4% lower than the beginning of the year and 11% lower year-on-year. Growing demand for housing, reasonably good open home attendance, and positive changes in the one- and three-month periods indicate a shifting market sentiment. Job security and falling house prices have contributed to improved home-to-income ratios, making housing more affordable for potential buyers.

Taranaki

The decline in home values across the Taranaki region has slowed, with a quarterly reduction of 0.6% compared to the previous quarter’s 2.2% decline. The average home value in New Plymouth decreased by 1.9% throughout the first half of 2023, while Stratford and South Taranaki experienced reductions of 7.7% and 3.3%, respectively. Economic uncertainty and rising costs have impacted building company failures and delays, leading to increased activity in the existing housing stock market.

Hawke’s Bay

The rate of home value decline in Hawke’s Bay has remained relatively steady this quarter, with a 2.3% reduction in the average home value. Napier and Hastings experienced declines of 6.7% and 4.2%, respectively, throughout the first half of 2023. While the rate of decline has slowed in Napier and increased in Hastings, indicating an ongoing downturn, a significant portion of sales in the region involved first-home buyers in the $600,000 price range. Realistic price expectations and market stagnation due to flood damage are key factors influencing the market.

propertynoise.co.nz to launch real estate industry recruitment site

Palmerston North

The decline in home values in Palmerston North has slowed over the past few months, with a reduction of 0.6% in June. The average home value is now $627,103, and while sales volumes remain low, lower-valued properties are showingnegative movements. The market appears to be holding firm, with a decline in listings balancing out the increase in activity. Demand for residential property remains subdued overall, particularly for infill sections that require maintenance or repairs. However, well-located sections and properties with nice outlooks are experiencing minimal reductions in value.

Wellington

Home values in the Wellington region decreased at a relatively consistent pace, indicating signs of stabilization. The average home value is now $825,554, with a quarterly reduction of 2% and a monthly rate of decline decreasing from 0.8% to 0.7%. The Kapiti Coast and Porirua experienced the largest reductions this year, while Hutt City had the smallest decline. The market is showing resilience with increased competition between buyers and a lack of stock. However, rising interest rates may impact the market in the future.

Nelson

Nelson’s residential property values continue to decline, although the rate of reduction slowed in the June quarter. Home values decreased by an average of 1.1% during this period, compared to a 2.4% decline in the previous quarter. Falling prices have made properties more affordable for first-home buyers, leading to increased interest in the market. Sellers have adjusted their price expectations, resulting in more realistic pricing and fewer price cuts. The market remains stable, especially in areas with limited property supply.

West Coast

Buller stands out in the West Coast region as home values have increased by 6.6% throughout the first half of 2023. In contrast, Grey and Westland District experienced reductions of 5.9% and 5.6%, respectively. Buller also leads in annual home value growth, with a positive average growth of 7.4%. Limited changes to the House Price Index since March indicate stability in the market, while interest rate increases and tax rule changes have deterred investors.

Canterbury

Christchurch’s residential property market has recorded small amounts of positive growth for two consecutive months. The average home value increased by 0.4% in June, following a similar increase in May. The quarterly rate of decline in Christchurch is lower than the national average at 2.8%. Across the wider Canterbury region, home values decreased by 1.3% this quarter and 2.8% for the year. Christchurch’s market is showing resilience with increased activity and declining listings, while neighboring districts continue to experience a slow decline.

Dunedin

Home values in Dunedin continue to decline consistently, with an average reduction of 3% this quarter. The average home value in Dunedin is now $614,059. Tightening supply versus demand is evident, resulting in a decline in sales and extended marketing periods for properties requiring maintenance or upgrades. Changes to the district plan have encouraged higher-density development and new townhouse projects. While vacant section sales have slowed due to economic uncertainty and rising costs, the market sentiment for new builds/developments is positive.

Queenstown

Queenstown’s residential property values have remained relatively stable in the first half of the year, with a marginal decrease of 0.3%. The average home value in Queenstown is now $1,710,569. The positive growth of 2.9% this quarter suggests a potential turnaround in the market. First-home buyers are showing increased interest due to falling prices and mortgage rate hikes. The market’s performance in the coming months may depend on changes in key market drivers and potential tax law reforms.

Invercargill

Invercargill has experienced a small increase of 0.2% in home values, marking its first quarterly growth since April 2022. The average home value is now $453,431, reflecting a 2.8% decline from the beginning of the year and 6.8% lower than the same time last year. Limited change to the House Price Index since March suggests levelling off of price declines. However, interest rate increases and changes to tax deductibility rules have limited investor activity. First-home buyer demand remains healthy, but caution persists in the market.