PHOTO: CoreLogic’s Quarterly Property Market & Economic Update New Zealand Q2 2019

New Zealand housing values have risen 2% in the year to June 2019, with the nation’s property growth supported by low mortgage rates and a rising population. CoreLogic’s Quarterly Property Market & Economic Update New Zealand Q2 2019 paints a picture of two property markets – Auckland and other major centres.

While Auckland’s housing market is down 2.7% in the 12 months to June 2019 (-1.2% in the second quarter to June 2019), Dunedin is up 12.2% up in the 12 months to June 2019 (2% in the second quarter to June 2019). This quarter has shown a continuation of Auckland’s soft demand while the more affordable regional markets have continued to perform well.

New Zealand’s broader economy is respectable and the lending market is good for borrowers with more rate cuts forecast, but housing affordability in Auckland is still low with the average property value at $1,027,113. The volume of sales fell dramatically in Auckland (-10% year on year) and Tauranga (-9%) in the second quarter of 2019, but rose 11% in Dunedin.

This is the sort of pattern you would expect to see as the cycle winds down to a more subdued level, which is in line with the overall growth outlook of the New Zealand economy.

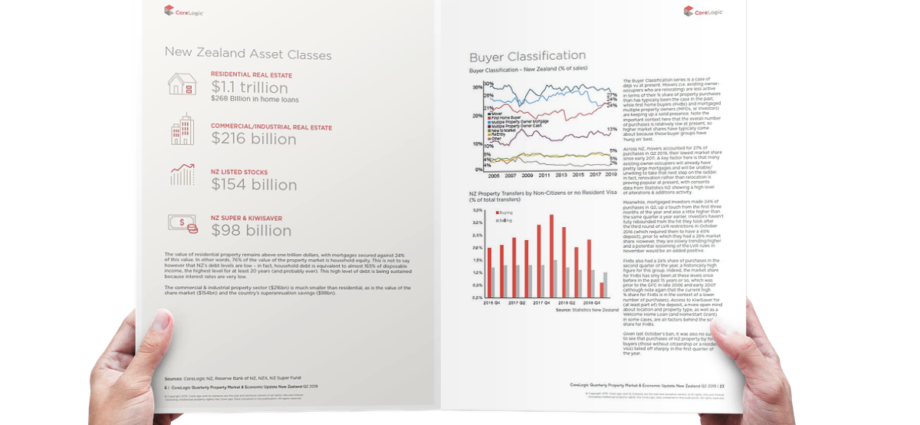

First home buyer lending is up 17.2% in the year to June 2019, while investor lending is down 7%. New Zealand’s first home buyer activity is relatively strong – with first home buyers’ market share at 24% – on par with previous record highs prior to the Global Financial Crisis.

First home buyers and investors are taking their time and waiting to find value before they pounce and with listing volumes down in the bigger cities (bar Auckland), it can be slim pickings.

READ MORE VIA CORELOGIC