PHOTO: Lucia Xiao

The spark that reignites the predictions on the hot topic of interest rates has come again as The Reserve Bank of New Zealand (RBNZ) increased the OCR for the first time in seven years. With inflation running high, it came as no surprise that the OCR rose 0.25% to 0.50% in October. It seems the question on everyone’s lips on interest rates has gone from ‘How low can they go?’ to ‘How high?’

Inflation

As you probably already know, RBNZ’s core responsibility is to keep New Zealand’s inflation rate between 1%-3% and the OCR is their primary tool to manage this. However, we’ve been in a pretty low inflation environment for decades now, and if you’re a millennial like me (having never experienced the real effect of high inflation), you may be wondering, would it be so bad to if it were to run a little higher for the sake of keeping money cheap during this hard time for our local businesses?

The short answer is, yes. You only have to look at the property market as an example of how quickly your cash deposit can devalue when prices rise on something. A first home buyer with a $75k deposit could have bought this property in Mt Wellington one year ago, now you’d need at least another $60k just for the deposit to secure it, and your cost to hold it will have also increased.

The median Auckland house price has ‘inflated’ by 20.4% in the last year (according to REINZ*), however property prices aren’t part of RBNZ’s consideration when it comes to inflation. What this helps to show us though, is how quickly your money can become worthless if prices across all markets in the New Zealand economy were to rise too quickly.

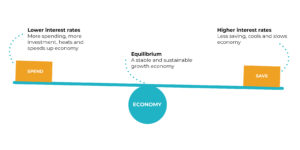

Changes to the OCR directly impact interest rates, it also signals to change behaviour and adjusts consumer and business spending. It’s a fine balancing act, particularly in these uncertain times as businesses struggle with lockdowns and market changes. Take interest rates too low and spending increases which pushes up prices. Take them too high and spending will slow, businesses will not be incentivised to hire new staff or invest in their business, as consumers decide to save more money when they start to earn more with it sitting in their bank accounts.

Why is inflation running high?

Last year RBNZ pulled many levers to encourage spending, the benefit of hindsight would say that they may have overshot in their predictions of how the economy would react to COVID-19. As with many central banks around the world, inflation is running higher than anticipated with the unpredictable consequences of the impact of lockdowns and border closures.

So, it could be fair to say that once the borders are open and when lockdowns are (finally) in the past, relative normality may resume and so would the economic environment that preceded the pandemic.

Where we see interest rates going

No one has a crystal ball, but Lucia believes that we are likely to see interest rates settle back into their pre-covid range. Right before the first New Zealand lockdown, the 1-year fixed interest rates were of 3.4%-4.0%*. The OCR had been at 1% for six months before it dropped in March 2020, with it historically over the last decade hovering around 2%-3%*.

As Lucia always reminds us, things like interest rates are out of your control and just a part of property investment, there’s no need to panic at the idea of interest rate rises. It’s good to be aware of what’s happening, but don’t fall prey to fear. No one regrets holding on to their properties through high interest rate periods, as it’s paid off for them in times like these where quality properties are seeing huge gains. Stay focused on your goals. Check out the video below for more detail on other factors influencing interest rates.

SOURCE: LUCIA VIAO