PHOTO: NZ’s residential real estate market is taking a hammering. FILE

The housing market’s slowdown is more pronounced with the growth in prices slowing further, fewer houses being sold and taking longer to sell, new data shows.

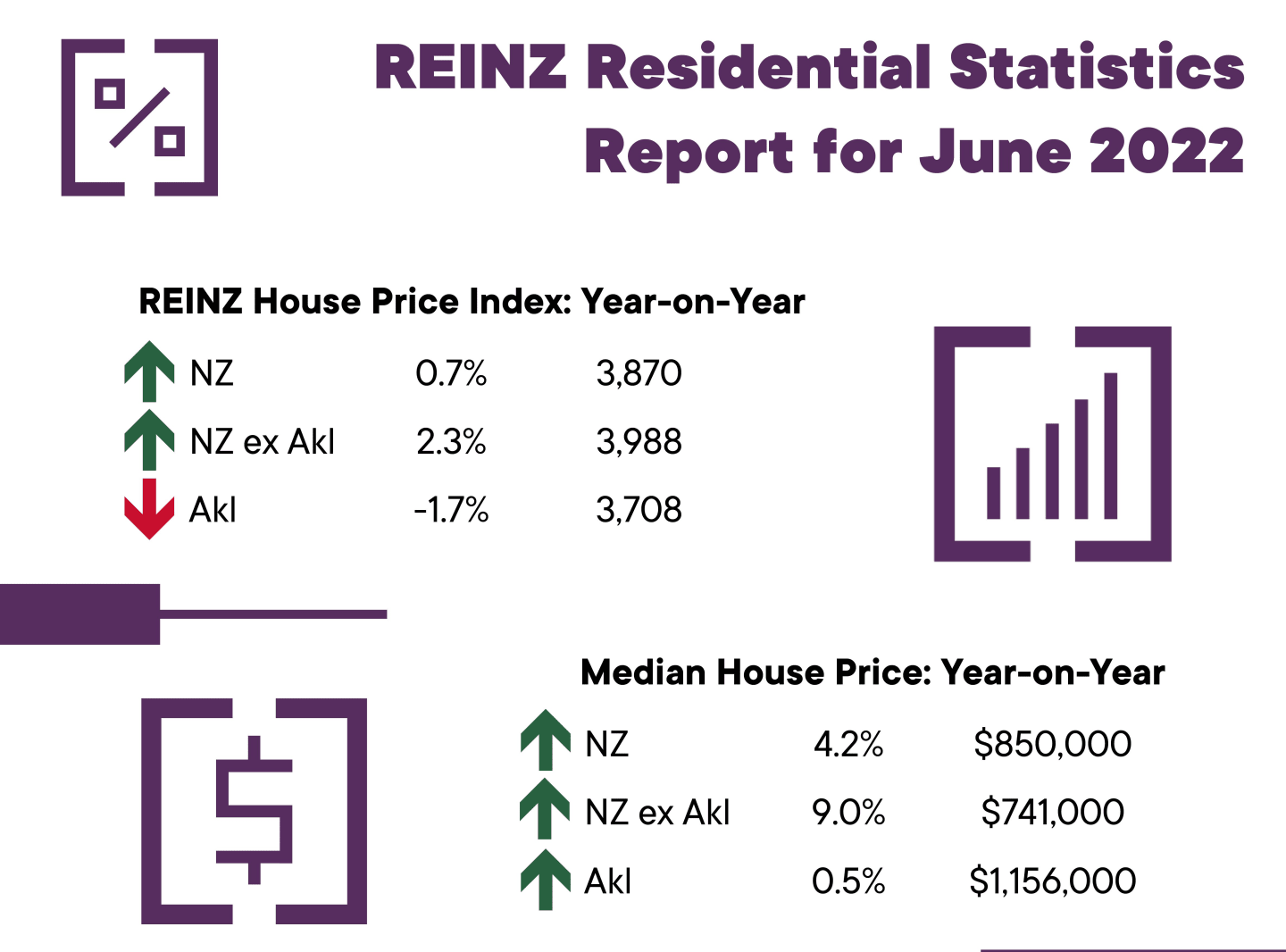

The Real Estate Institute’s latest market report shows the house price index, which measures the changing value of properties, increased 0.7 percent for the year ended June from 3.7 percent for May. It was 9.5 percent lower than the market peak in November last year.

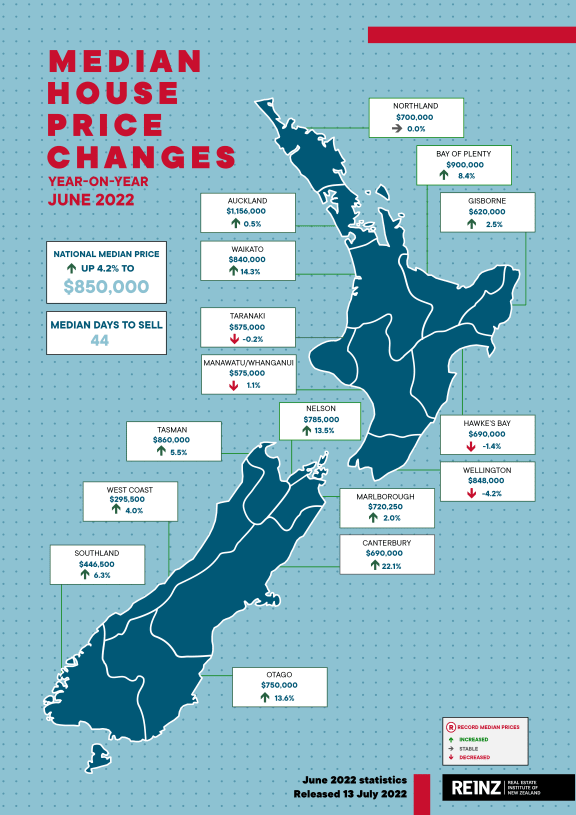

Photo: Supplied / REINZ

The seasonally adjusted national median house price rose 1.5 percent compared with May to $850,000 and the annual increase perked up slightly to 4.2 percent.

REINZ chief executive Jen Baird said the monthly numbers were slightly better than expected but the market was trying to find some balance.

“We’re seeing volatility across the country as the market seeks equilibrium at a more moderate pace.”

Auckland’s median house price rose 2.8 percent to $1.15 million after falling the month before, but the annual growth rate was 0.5 percent.

But it was a mixed picture for the rest of the country with a 22.1 percent annual rise for Canterbury, and 14.3 percent for Waikato, but four regions showed annual price falls, notably in Wellington with the median price falling 4.2 percent on a year ago.

Baird said housing affordability was still an issue for buyers, who were hesitant in the face of tighter lending restrictions, higher interest rates and concerns over inflation.

“As the market stabilises, and the high growth we saw through 2021 dissipates, downward pressure on prices may improve affordability. However, this is balanced with higher mortgage costs and wider economic headwinds that may continue to temper people’s appetite for entering the market – as a buyer or seller.”

She said recent changes to the Credit Contracts and Consumer Finance Act (CCCFA) relaxing some of the tight lending restrictions might ease the pressure on borrowers.

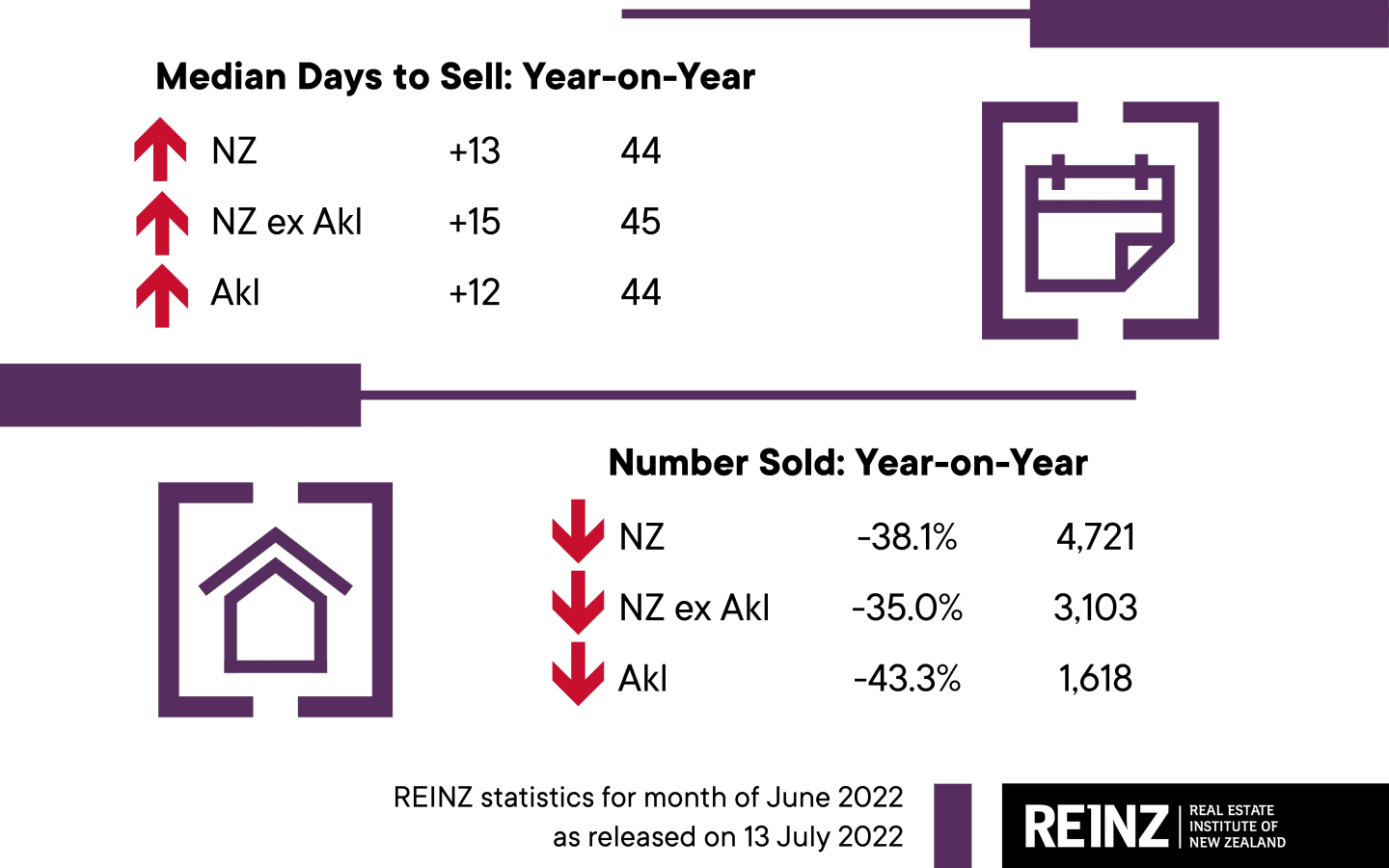

The number of houses sold last month – 4721 – was down 38 percent on a year ago, with the drop largest in Auckland where the volume sold was 43 percent lower.

Baird said the market was entering the seasonal winter slowdown but there were some positive signs.

“With more stock on the market, more opportunity for negotiation, and prices off their peak, for those with access to finance, there is opportunity here.”

She said agents’ reports pointed to owner occupiers remaining strong in the market, more first home buyers after the government’s budget move to increase the cap on the price of property eligible for a First Home Grant and the removal of caps for First Home Loans. Investors were subdued.

“There is much more negotiation happening in the market today as buyers are more cautious of potential price declines after they have purchased, and vendors understandably want the best prices possible in an uncertain market.”

Photo: Supplied / REINZ

Photo: Supplied / REINZ

MOST POPULAR

20-year-old buys first home after ditching waitress job for OnlyFans

20-year-old buys first home after ditching waitress job for OnlyFans Real estate brand @realty brings 100% commission with no fees to NZ | WATCH

Real estate brand @realty brings 100% commission with no fees to NZ | WATCH Mortgage rates aren’t going to get as high as expected

Mortgage rates aren’t going to get as high as expected Property investor charged with fraudulently obtaining millions of dollars in home loans

Property investor charged with fraudulently obtaining millions of dollars in home loans Real estate agent shares two radiant last pictures of his wife who tragically died

Real estate agent shares two radiant last pictures of his wife who tragically died Developer seeks to turn $12.5m heritage farm into luxury golf course | WATCH

Developer seeks to turn $12.5m heritage farm into luxury golf course | WATCH 40 homes closer to being lost after busway decision

40 homes closer to being lost after busway decision Abandoned land for sale

Abandoned land for sale Goodbye NZ, G’day Australia: Last one turn off the lights

Goodbye NZ, G’day Australia: Last one turn off the lights REDEMPTION: The Block NZ | 2022 is almost here

REDEMPTION: The Block NZ | 2022 is almost here