PHOTO: They identified price bubbles as regularly recurring phenomenon in property, defining them as “a substantial and sustained mispricing of an asset.”

Housing prices in Hong Kong are the most overvalued and at the greatest risk of collapse, according to a report focused on 20 major cities.

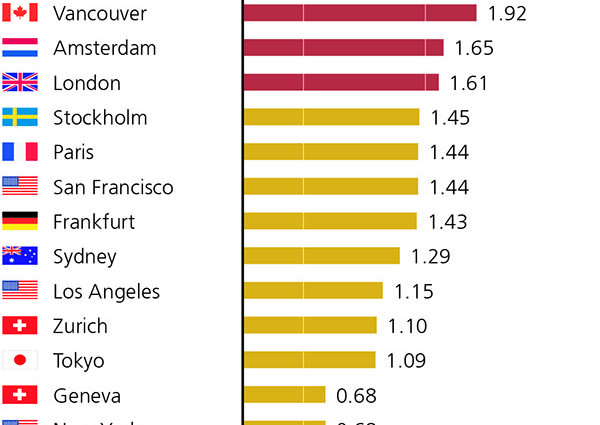

UBS Group’s Global Real Estate Bubble Index puts Munich, Toronto, Vancouver, London and Amsterdam alongside Hong Kong as cities currently in property bubble territory.

“Major imbalances” are also found in Stockholm, Paris, San Francisco, Frankfurt and Sydney, the report said.

READ MORE CNBC