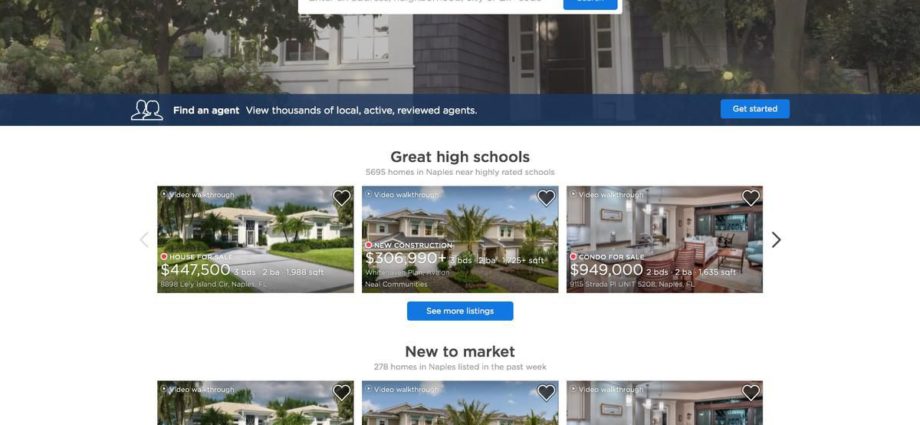

PHOTO: ZILLOW

Zillow Group Inc. Chief Executive Officer Rich Barton likens his effort to transform the company’s business model — and ultimately the way Americans buy and sell homes — to an attempt to walk on the moon. So far it’s been a bumpy ride.

Investors hammered Zillow shares after it reported earnings this week, as changes to the way the company sells ads, combined with mounting losses from its year-old home-flipping business, spooked investors.

Shares were down 21% for the week as of 11:50 a.m. New York time, the largest weekly decline since November, and a familiar slalom for investors, especially at earnings time.

Last August, the company told investors it had underestimated the time it would take to close home purchases, and that unpopular changes to its core advertising business had chased off real estate agents. Shares plummeted 16% that week, and suffered a weekly loss of 27% the next time it reported earnings, three months later.

“Any time you have significant business transformations, you’re going to have more volatility in the operating numbers, and more volatility in how the stock reacts to the numbers,” said Jason Deleeuw, a senior research analyst at Piper Jaffray & Co. “There’s just a lot going on there.”

READ MORE VIA BLOOMBERG