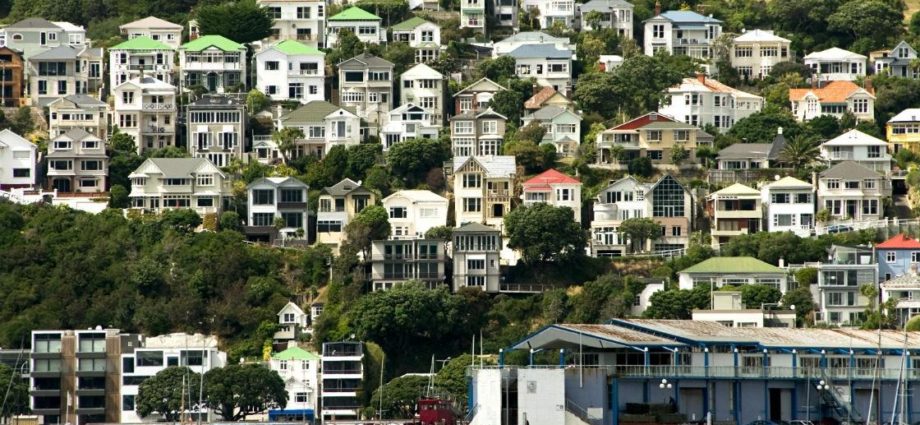

PHOTO: Investors accounted for 27 percent of the housing market in the last three months of 2020. Photo credit: Getty Images

Bank lending restrictions are expected to be increased to curb a surge in the number of investors buying residential property.

Property research company CoreLogic said investors accounted for 27 percent of the housing market in the last three months of 2020, compared with 24 percent in the June quarter.

The research company said the increase in investor activity coincided with a large 6.1 percent increase in property values in the quarter.

CoreLogic senior property economist Kelvin Davidson said there was a rising possibility that a 40 percent deposit requirement for investors could be officially mandated later in the year by the Reserve Bank.

“While we’ve already seen the Reserve Bank move to reinstate LVR (loan-to-value restrictions) speed limits at 30 percent from 1 March, the question is, will this be the end point,” Davidson said.

“The last time that mortgaged investors had a market share near this high was 28 percent back in Q3 2016 when the Reserve Bank imposed a 40 percent deposit requirement.”

READ MORE VIA NEWSHUB.CO.NZ