PHOTO: Mortgage. If you are buying a house 99% of house need one! GETTY

With the reserve bank continuing to ratchet up interest rates, more and more households are finding themselves in financial stress.

But there’s one simple thing mortgage holders can do to save thousands of dollars a year, experts say.

Put simply, if you want a cheaper home loan, in many cases all you have to do is ask.

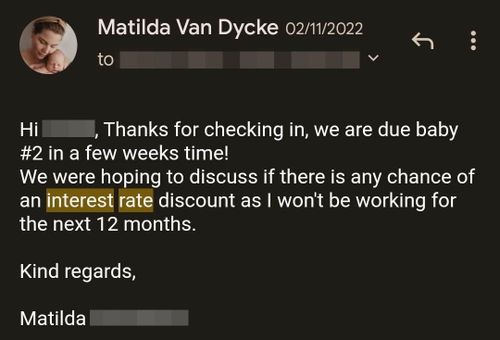

This was the case for Western Australian mum and former real estate agent, Matilda Van Dycke, from Bunbury, when she got an email out of the blue from her home loan provider, Bank of Queensland, in November last year.

Rather unusually, a lending assistant had reached out to Van Dycke and her partner to ask if all was going well with their home loan.

With a second baby on the way, and maternity leave meaning she would be away from work for a year, Van Dycke took the email as an opportunity to ask if there was any way they could get a discount on their variable home loan rate.

Within 24 hours, the bank came back with an offer, emailing to say they could reduce their rate by 0.7 percent, taking it from 5.04 percent to 4.34 percent.

With a mortgage of $330,000, the discount meant the couple would be saving $2300 a year.

Van Dycke told 9news.com.au she had heard of other people getting discounts on their loans after asking, but was surprised with how easy it was.

“I had asked my partner to call the bank, but he hadn’t got around to it,” she said.

“So when they emailed me to check in a year after we refinanced I replied and asked them myself.”

Melbourne financial advisor Billy Norman, from Link Wealth Group, said people were often taken aback by how easy it was to get a discount on their home loan interest rate.

Norman said he knew of some clients who had been able to negotiate an interest rate reduction of a full percentage point, all by making just one phone call to their bank.

“The average home loan is roughly $600,000 to $650,000,” Norman said, “So on a $650,000 loan, a 1 percent reduction is $6500 bucks a year. That’s a very profitable phone call.”

Norman said everyone with a home loan should be checking at least once a year to make sure they were on a competitive interest rate, as the difference between rates offered to new and existing customers tended to grow over time.

“I usually say it should be once a year, but, at the moment, people might want to do it even more often because rates are changing every single month,” Norman said.

“It’s a really simple thing, but loads of people don’t know, or they just need to be reminded to do it again.”

What to do before you call the bank

Preparation is key and it is always best to do some quick research on the cheapest loans out on the market before picking up the phone or sending an email.

“When you’re talking to the bank, you should use a live example of the best interest rate that you have found online,” Norman said.

“You can use that as bargaining chip to say, ‘If you can’t match it, then maybe I’ll just take my loan elsewhere.'”

One of the cheapest home loans currently on offer was a variable home loan from Westpac at 4.99 percent, Norman said, adding that it was often better to quote a rival rate from one of the major banks when trying to negotiate with one of the big four lenders.

“Westpac is offering 4.99 percent. So, if your rate is well above 4.99 percent then maybe you’re not on the best rate,” he said.

Another aspect to consider is loan-to-value ratio (LVR) on a home loan, which measures how much is owed in relation to the value of a property.

“If your LVR is less than 80 percent, then you’re in a strong position to get the best interest rate,” Norman said.

“When you shop around and find the best interest rates, those rates are only on offer to people with an LVR of less than 80 percent.”

What if your bank won’t play ball?

Even if a bank refused to match a particular interest rate, they might offer a significant discount, Norman said.

“Usually they can apply the discount immediately, so it can reduce your payments straight away,” Norman said.

If the offer wasn’t good enough, there was always the option to leave and refinance with a new bank, he added.

Many banks are currently offering cashbacks of up to $4000 in a bid to offset the inconvenience of refinancing and sweeten the deal.

Another option was to consider going to a mortgage broker, Norman said.

“It can be very helpful having a good mortgage broker. They can do the negotiating for you, and they can often get better rates than you can get yourself by calling the bank.

“Most mortgage brokers don’t charge fees, they just get paid commission, so they can very quickly tell you if they can get you a better rate.”

A good broker should also be willing to negotiate with your current bank for you, Norman said.

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.

READ MORE VIA 9 NEWS