PHOTO: Nerida Conisbee

#1 The cash rate remains on hold – what does that mean to property?

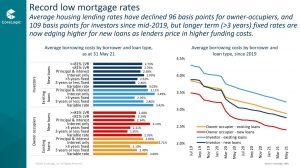

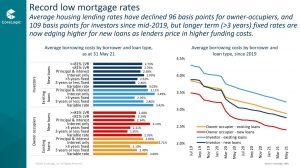

No surprises the RBA kept the cash rate on hold this month. The number everyone will be watching closely this month will be inflation with the June quarter number available on July 28. In March, inflation remained well below the RBA target of between two to three per cent. It is expected to creep up in the next available figures – as the economy re-opens, people are spending more and we are also seeing unemployment come down very quickly which is putting pressure on wages.  Interestingly, despite no move on the cash rate, an analysis by Corelogic research suggests mortgage rates are continuing to come down. It is likely that this will be short lived. Over the past month, we have seen some increases to fixed mortgage rates and serviceability criteria have tightened. Nevertheless, finance does remain incredibly cheap and this is part of what is turbocharging the property market. Across Australia, house prices have increased by 15 per cent since the start of the pandemic. At this stage, we are seeing very little evidence of a slow down although any increases to mortgage rates, plus higher than average properties for sale, should calm the very high price growth occurring.

Interestingly, despite no move on the cash rate, an analysis by Corelogic research suggests mortgage rates are continuing to come down. It is likely that this will be short lived. Over the past month, we have seen some increases to fixed mortgage rates and serviceability criteria have tightened. Nevertheless, finance does remain incredibly cheap and this is part of what is turbocharging the property market. Across Australia, house prices have increased by 15 per cent since the start of the pandemic. At this stage, we are seeing very little evidence of a slow down although any increases to mortgage rates, plus higher than average properties for sale, should calm the very high price growth occurring.

Interestingly, despite no move on the cash rate, an analysis by Corelogic research suggests mortgage rates are continuing to come down. It is likely that this will be short lived. Over the past month, we have seen some increases to fixed mortgage rates and serviceability criteria have tightened. Nevertheless, finance does remain incredibly cheap and this is part of what is turbocharging the property market. Across Australia, house prices have increased by 15 per cent since the start of the pandemic. At this stage, we are seeing very little evidence of a slow down although any increases to mortgage rates, plus higher than average properties for sale, should calm the very high price growth occurring.

Interestingly, despite no move on the cash rate, an analysis by Corelogic research suggests mortgage rates are continuing to come down. It is likely that this will be short lived. Over the past month, we have seen some increases to fixed mortgage rates and serviceability criteria have tightened. Nevertheless, finance does remain incredibly cheap and this is part of what is turbocharging the property market. Across Australia, house prices have increased by 15 per cent since the start of the pandemic. At this stage, we are seeing very little evidence of a slow down although any increases to mortgage rates, plus higher than average properties for sale, should calm the very high price growth occurring.READ MORE VIA RAY WHITE