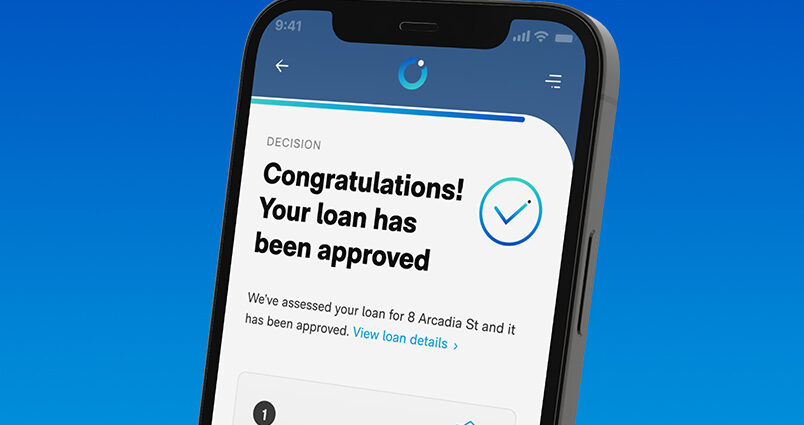

PHOTO: Automated Real-Time Digital Mortgage Application and Decisioning Engine – Nano Digital Home Loans

Consumer demand for digital services has generated significant investment in a new type of patented technology designed to dramatically cut the time it takes for lenders to process a mortgage application.

The patent owned by Sydney-based Nano Digital Home Loans, was backed with A$33 million series-A investment by New Zealand private investor Bolton Equities, while the Sydney-based company was run by New Zealand chief executive and co-founder Andrew Walker.

The product called the Automated Real-Time Digital Mortgage Application and Decisioning Engine was patented in Australia last month.

“Many are claiming to be digital, but a website application sitting on top of yesterday’s broken processes is not the future,” Walker said.

The key to Nano’s technology was open banking and a process called screen scraping, which gave it access to customer banking information held by other financial institutions.

“We get one time access through a portal to the applicant’s online banking details,” Walker said.

That data was then processed in real time, giving Nano a quick snapshot of a customer’s finances, income and expenses, in order to form a credit profile and write a home mortgage in about 15 minutes.

“Our patented technology platform and proprietary algorithms replace weeks of manual effort, rework and frustration with a fast, seamless, paper-free process.”

READ MORE VIA NEWSHUB

MOST POPULAR

How KFC car park deal brought down rising real estate star | AUSTRALIA

How KFC car park deal brought down rising real estate star | AUSTRALIA Abandoned land for sale

Abandoned land for sale Former Rugby league star and real estate agent pleads guilty in meth importation case

Former Rugby league star and real estate agent pleads guilty in meth importation case Ed Sheeran splashes out on even more properties for his empire | WATCH

Ed Sheeran splashes out on even more properties for his empire | WATCH Over 170,000 borrowers sue ANZ, ASB banks

Over 170,000 borrowers sue ANZ, ASB banks Property NZ asking prices fall- realestate.co.nz

Property NZ asking prices fall- realestate.co.nz Real Estate Authority didn’t know about Manu Vatuvei’s drug charges when granting licence

Real Estate Authority didn’t know about Manu Vatuvei’s drug charges when granting licence Prime Minister Jacinda Ardern is now a property millionaire

Prime Minister Jacinda Ardern is now a property millionaire Wage subsidies: Real estate agents claim more than $1m during lockdown

Wage subsidies: Real estate agents claim more than $1m during lockdown Karlene Jonkers | Quest & Co (EXCLUSIVE INTERVIEW – PODCAST)

Karlene Jonkers | Quest & Co (EXCLUSIVE INTERVIEW – PODCAST)