PHOTO: Sarah Wood, CEO of realestate.co.nz. SUPPLIED

New Zealand Property Report: June 2024

Eighteen Months of Price Stability: Will New Regulations Disrupt the Trend?

The New Zealand property market has experienced remarkable stability in the past 18 months, but new regulatory changes might stir things up. These regulations, effective from July 1, 2024, include adjustments to debt-to-income ratios (DTIs), loan-to-value ratios (LVRs), interest deductibility, and the bright-line period.

Current Market Overview

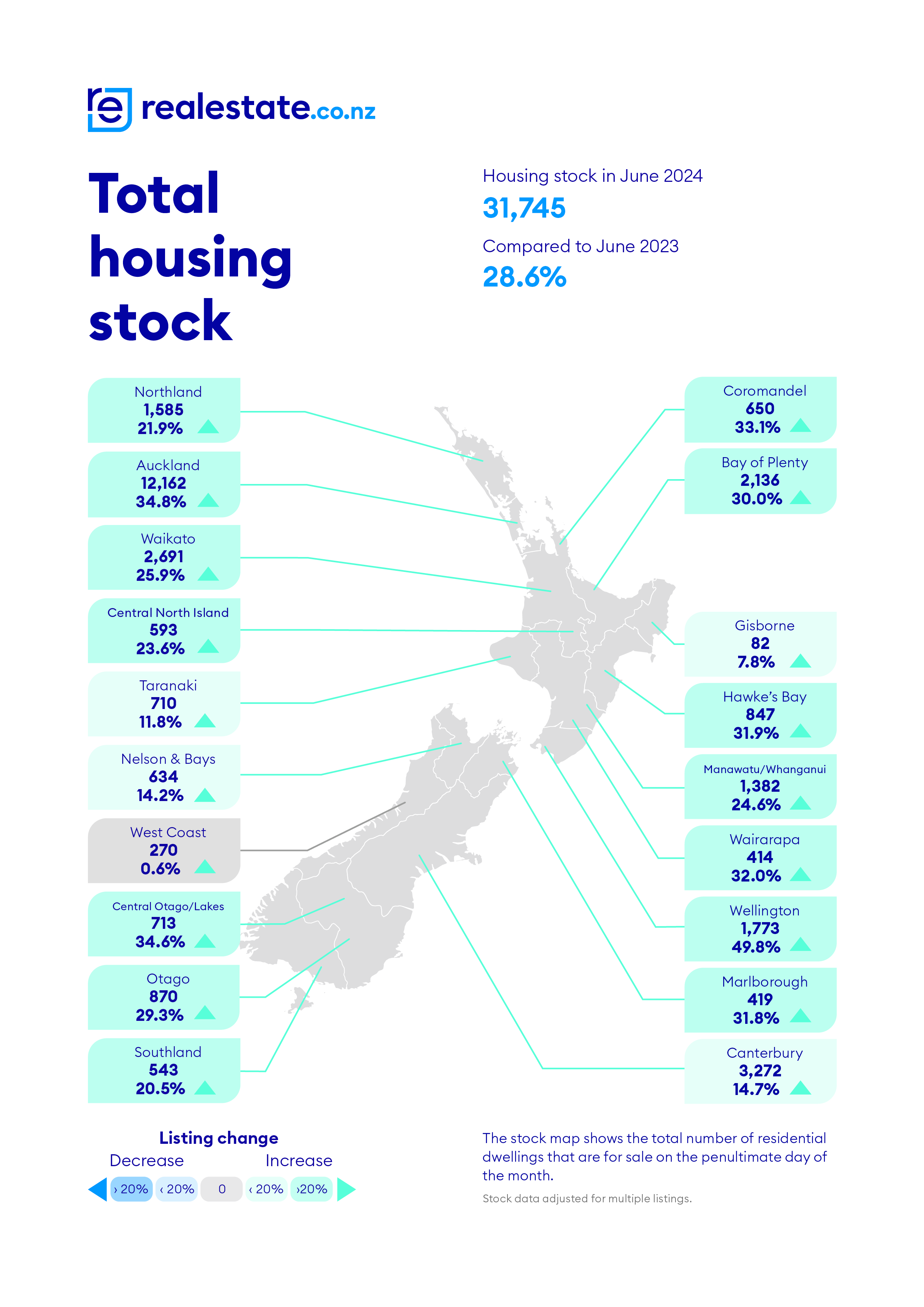

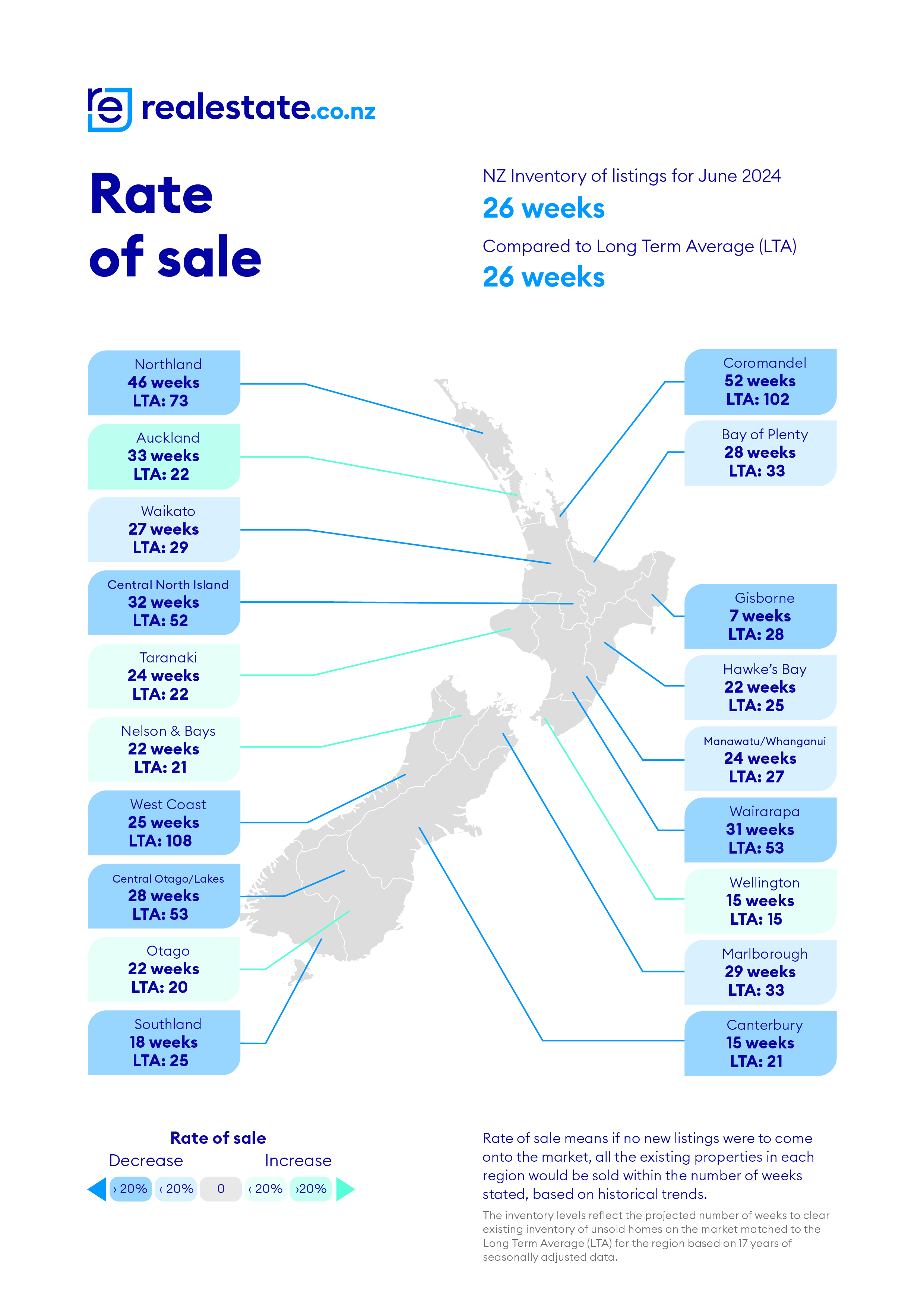

Real-time data from realestate.co.nz shows that average asking prices remained stable through June 2024, marking a year and a half without significant change. The total housing stock increased by 28.6% year-on-year in June and, although down 2.6% from May, has stayed above 30,000 for five consecutive months. New listings also rose by 25.5% year-on-year, returning to normal after the low levels of 2023.

Sarah Wood, CEO of realestate.co.nz, emphasizes the significance of this period of price stability but notes potential market changes due to the new regulations:

“Anecdotally, real estate agents have reported a backlog of properties waiting to be listed until the new bright-line rules took effect on 1 July. More landlords struggle to sustain their rental properties with high interest rates,”

Wood adds that these regulations, combined with current market conditions, make it essential for buyers and sellers to research their local markets:

“Stable prices could benefit those looking to buy an investment property. However, with a large supply of rental properties currently available, new investment buyers will need to really understand rental demand in their area.”

She advises sellers affected by the bright-line test to price their properties realistically:

“Those choosing to sell following the shortening of the bright-line test also need to price realistically. Some may struggle to get their desired price, especially if they bought at the peak of the market and potentially face selling for less than they purchased.”

Regional Price Dynamics

Southland recorded the largest increase in average asking prices, rising 12.1% year-on-year. After three months as the most affordable region, Southland was overtaken by the West Coast in June, where average asking prices dropped 13.6% month-on-month to $476,892. Wellington’s average asking prices rebounded to $818,352, up 10.9% from May. Nationally, prices remained stable across several regions, including Bay of Plenty, Manawatu/Whanganui, Waikato, and Wairarapa, with changes of less than 1.0% from May to June.

Wood highlights this consistency:

“Prices have fluctuated between $860,000 and $890,000 since November 2022. That’s a year and a half of buyers and sellers facing some level of certainty around prices, which is a silver lining in an uncertain economic environment.”

She advises sellers to market their properties well, work with experienced real estate agents, and understand local price expectations:

“Understanding your local market will be more important than ever now that DTI ratios will cap how much a buyer can spend at six times their income.”

Renters Enjoy Choices, Prices Yet to Reflect

The rental market has seen a surge in new listings, with a 26.9% year-on-year increase in June. Despite a 10.4% decrease from May, this marks the second consecutive month of high new rental listings. Financial pressures on investors could be driving the trend, leading some to convert short-term rentals into long-term options.

Wood notes the potential impact on average rental prices:

“Some landlords may have planned to sell with the new bright-line rules in July but have reconsidered after evaluating average asking prices, opting instead to place their properties back on the rental market.”

The national average weekly rental price rose 5.9% year-on-year to $653, but remained largely unchanged from May’s all-time high of $660. Waikato reached an all-time high of $572, setting records for three of the last four months. Wood suggests that despite increased listings, the rise has not yet impacted average rental prices:

“Landlords report a challenging environment. Even after lowering prices, some have found interest from potential tenants remains low, indicating a softening rental market.”

Navigating Market Changes

Wood predicts that both buyers and sellers might hesitate amid the new regulations and economic uncertainties:

“Typically, Kiwis don’t like to transact during uncertain times. Right now, there’s a lot of economic uncertainty, acronyms to decode, and property market regulations to process.”

She views the current market’s slower pace as an opportunity for more thorough due diligence and expert consultation:

“The slower pace of the current market allows buyers and sellers more time to conduct due diligence and seek expert advice.”

For June, the most common sales method was ‘display price,’ which simplifies the negotiation process.

The market’s stability over the past 18 months might face challenges due to the new regulations, but for now, informed decision-making and expert advice remain crucial for navigating the evolving landscape.