PHOTO: Kiwis are being smashed by higher mortgage rates. RAWPIXEL

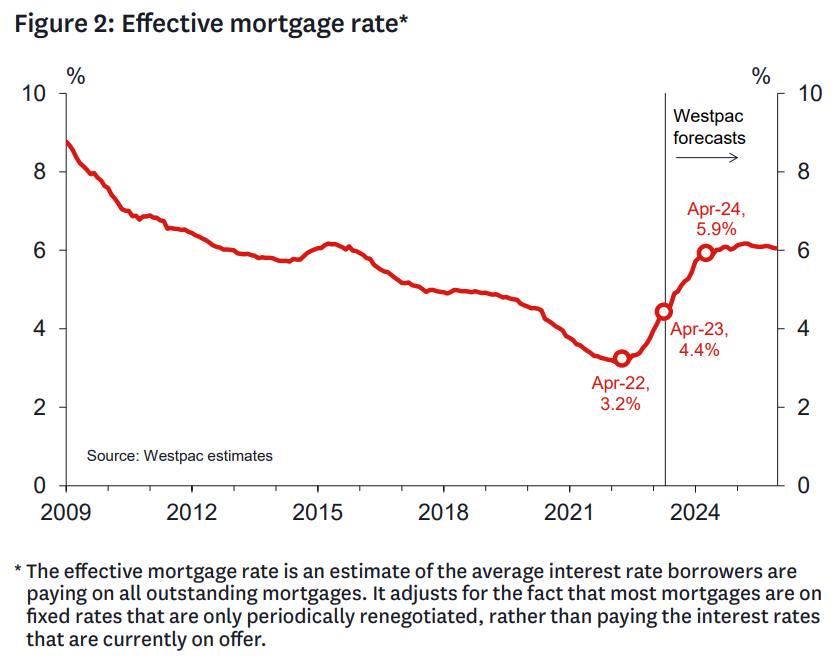

he Reserve Bank of New Zealand’s ultra aggressive monetary tightening, which has lifted the official cash rate by 5.25% since October 2021, has roughly doubled the mortgage rates paid by Kiwis:

The impact on the nation’s housing market has been brutal with a variety of indicators continuing to implode.

Reserve Bank data showed that New Zealand’s stock of outstanding mortgages grew at the weakest rate in the first four months of this year since the global financial crisis (GFC).

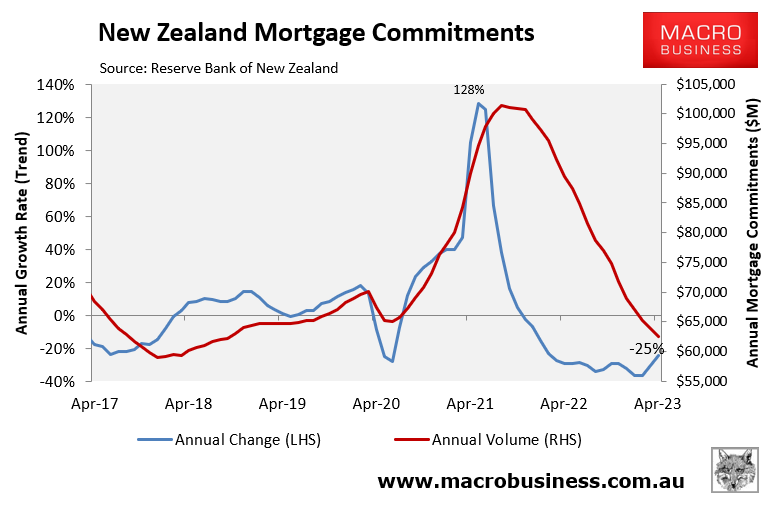

The annual value of new mortgage commitments has also crashed to its lowest level since 2018 with further downside to come:

Meanwhile, CoreLogic data revealed that the average value of a home in New Zealand continues to fall, declining a further $6,242 in May.

That implies the average New Zealand home is losing more than $200 each day.

Since reaching a peak of $1,043,261 in March of last year, the average price has dropped by $120,847 (-11.6%).

The average dwelling value in the Auckland region fell by $10,333 last month, from $1,314,546 at the end of April to $1,304,213 at the end of May. That’s a $333 per day decline.

Since the national peak in March last year, the average value of a home in Auckland has declined by $216,128.

Commenting on the result, CoreLogic NZ’s Head of Research, Nick Goodall, said “affordability, hindered by high prices and contractionary monetary policy will likely keep a lid on demand for the foreseeable future”.

“More than 50% of the average income is required to service an 80% LVR mortgage in Aotearoa compared to 43% in Australia”, Goodall added.

Leading real estate agent, Barfoot & Thompson, likewise recorded deteriorating conditions in May.

The median selling price at the Agency fell by $40,000 last month, to $955,000 in May from $995,000 in April.

That means the agency’s median residential selling price has now dropped $285,000 from its peak of $1,240,000 in November 2021, and is at its lowest point since September 2020.

Sales volumes have also crashed, sinking to a 15 year low, excluding the lockdown month in May 2020, suggesting the market remains weak heading into winter.

Finally, Realestate.co.nz received just 7359 new residential listings in May.

That was the fewest new listings the website had ever received in May, and was down 18% from May of last year.

But despite the dearth of new listings, the number of unsold homes continues to swell.

At the end of May, there were 26,685 residential homes for sale on the Realestate.co.nz website, the most for the month of May since May 2015.

Stock levels were also up 81% from May 2021, when the market was nearing the top of the previous boom.

The above data confirms that the Reserve Bank’s aggressive interest rate hikes have killed housing demand – a situation that probably won’t reverse until it begins cutting rates and the election is decided on 14 October.

READ MORE VIA MACRO BUSINESS

MOST POPULAR

- Drug-addled Australian real estate agent’s spiral

- Claims about Jacinda Ardern’s wealth

- THE ANCIENT STONE CITY: Proof of NZ civilisation before Kupe

- Abandoned land for sale

- He sometimes struggled to pay staff, but owns a $4m holiday home

- FOR SALE: The most expensive home in New Zealand?

- Property Brokers adds another office to it’s stable

- More than 100 damaged homes looted after floods | WATCH

- AREC 2023 – Day 2

- Barfoot & Thompson Awards 2023