PHOTO: Property Values. FILE

Article: InfraNews

The CoreLogic House Price Index (HPI) for October has found nationwide property value growth accelerated more than any other month this year, increasing by 1.3%

Property values have remained robust since the onset of the economic downturn catalysed by the arrival of COVID-19 and the resulting lockdown in late March. But now, just as the economy appears to have bounced back – the Treasury’s New Zealand Activity Index (NZAC) shows economic activity in September 2020 was 1.0% higher than September 2019 – the property market is growing at a faster rate than before COVID (1.1% monthly growth in February 2020).

The support mechanisms put in place by the Government (wage subsidies) and banks (mortgage deferrals) have helped cushion the market, while the Reserve Bank of New Zealand’s (RBNZ) intervention (Quantitative Easing programme lowering interest rates, temporary removal of loan-to-value ratio (LVR) restrictions) now appears to be boosting demand and therefore contributing to the uplift in value growth.

CoreLogic Head of Research, Nick Goodall, says, “Indeed, the RBNZ has acknowledged a consequence of its monetary policy is increasing asset prices, but that this is a better outcome than the counter-scenario of a loss in confidence, resulting in decreasing property values.”

A lack of supply of available properties on the market is also a key contributor to increasing prices, with listings hovering at all-time low levels across the country. According to CoreLogic partner Trade Me, there has been no improvement in supply in the last year. Trade Me Property Spokesperson, Logan Mudge, says, “In September, the number of properties for sale nationwide remained relatively flat on the year prior.”

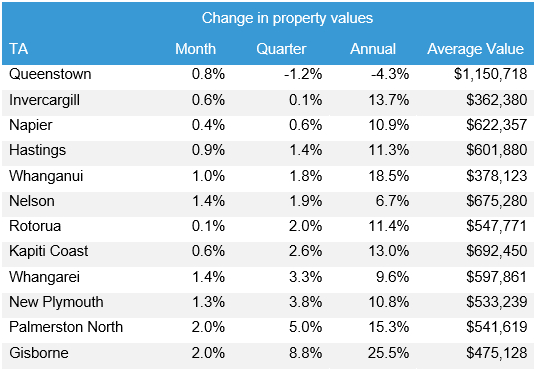

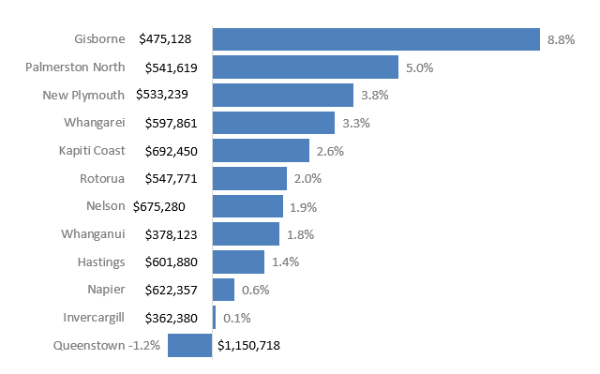

All 21 main urban areas analysed experienced value growth over the month, including in Queenstown, although it must be noted the 0.8% growth here only partially recovered the decrease from earlier, with values remaining 1.2% lower than at the end of July, and 5.6% below the peak before COVID hit the market.

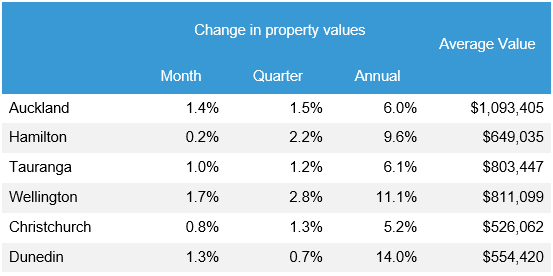

Main Centres

Wellington remains the strongest growing market of the main centres, with 1.7% growth over the month and 2.8% over the last three months. Investors here, much like across the rest of the country, are increasing their presence in the market, with a four-year record of 29% of sales going to investors using a mortgage as security.

The presumed ‘safety’ of property, alongside low mortgage interest rates (and similarly low deposit rates) and the temporarily removed LVR limits are all helping to encourage investors (and other buyers into the market).

As mentioned nationwide, the lack of listings in Wellington is also a key factor, in fact it’s even worse. “In the Wellington region, supply was down 6 per cent on September last year, while in Wellington City it was down 9 per cent,” says Mudge.

Growth in the Porirua market continues to increase at a rate of 5.7% over the last three months, while Upper Hutt, the most affordable of the four main cities in the Wellington region, has also seen strong growth in the past three months (4.5%).

The uptick in values is also very evident in Auckland, as the 1.4% growth experienced in October takes the average value in our largest city to a record high of $1.09m. The growth in the last two months has more than made up for the 1.2% dip in values witnessed in the three months following the end of the original alert level 3 lockdown in May.

The change in value across the Super City has been uneven, with the more affordable areas (e.g. Papakura) holding up better compared to the more expensive areas (Auckland City, North Shore); however, the recent recovery in these more expensive areas (1.9% monthly growth in Auckland City) indicates that the strong demand being seen in the market is occurring across the board.

In Dunedin, where consistently strong value growth has led to a significant reduction in affordability over the past few years, values are once again beginning to increase (up 1.3% in October). Investors remain a consistently strong presence here, and first home buyers are also taking advantage of favourable lending conditions.

Christchurch has experienced relatively consistent modest growth for the last year, with the annual growth rate now exceeding 5% for the first time since March 2015. Christchurch is sometimes referenced as a ‘well-functioning’ market, off the back of a significant lift in construction in response to the 2010/11 earthquakes and generally low growth. The increase in construction was assisted by changes made to the Resource Management Act (RMA) which streamlined the resource consenting process to enable homes to be built quicker. With a reform of the RMA being something the incumbent Government has spoken about, Christchurch may prove a valuable case study.

Provincial Centres

Outlook

Looking ahead, there is increasing discussion on the role of the LVR limits. Recent data from the RBNZ reported $7.3bn of lending activity taking place – almost $2bn more than the same month last year. And while the amount of lending done above an 80% LVR hasn’t changed too much, it’s the lift in investor lending above 70% LVR which is garnering the most attention. A year ago only 22% of investor lending was advanced above 70% LVR, while in September 2020 that figure increased to 36%.

“It must be recognised that part of the reason for the temporary removal of the LVR limits was due to technical reasons around the mortgage deferral scheme, which runs until March next year, so it seems unlikely there will be a change before then,” says Goodall.

“With all the election campaigning now done and dusted, we know our new Government will be Labour strong. The first few weeks following a general election are always interesting to see what promises, compromises and targets are set out. With the RMA coming to the forefront of politicking, it’s likely most announcements will centre on the Government’s plans for construction.

“Analysing the state of the construction market, the industry has so far shown impressive resilience. Building consents issued have held up relatively well and Stats NZ’s reporting of the number of filled jobs in construction has actually increased since the onset of COVID-19. Of course, the question arises about how many of those jobs are supported by the wage subsidy, and while the data isn’t provided by industry, the overall figures are dwindling, with no significant signs of excessive redundancies following.

“In fact, the data is intriguing. At the peak of support, which was the end of May, the wage subsidy supported 1.66m jobs. The scheme closed to new entrants in September, at which point there were a total of 380,000 jobs being supported by the scheme. As of 2 October, there were fewer than 95,000. And by the end of October, the Ministry of Social Development projects there to be fewer than 500 jobs being supported by that benefit.

“With our economy seemingly operating at near-normal levels, despite closed borders, businesses have appeared to have survived better than first thought, and the winding down of the wage subsidy has had less impact than expected.

“The next major milestone will be the end of the mortgage deferral programme, now pushed back to March 2021, but if interest rates reduce further and demand for property holds strong, it’s hard to envisage a lift in motivated sellers causing values to seriously drop.

“Certainly, short-term demand is looking very strong. According to the CoreLogic Early Market Indicators report, valuations ordered by banks for mortgages are up 11% month-on-month after a noticeable jump at the start of October. We’d expect this to persist through to Christmas at the very least.”