PHOTO: QV House Price Index

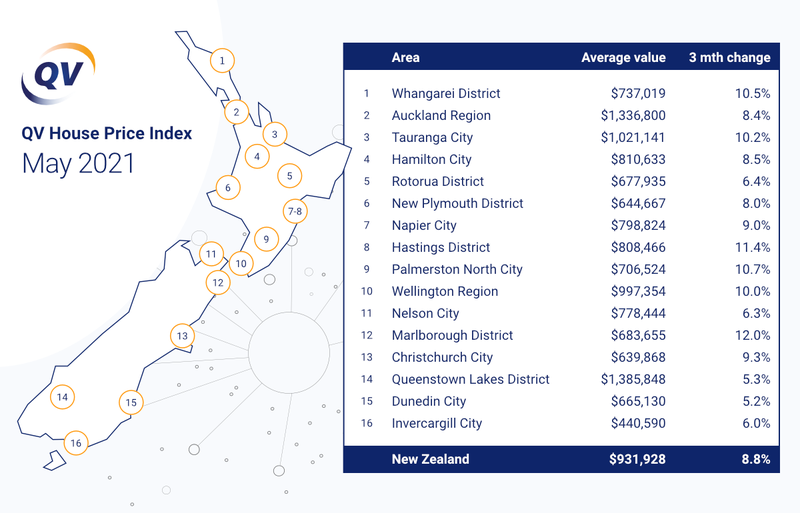

For the first time since July last year the QV House Price Index has shown a reduction in quarterly value growth from the previous month. The average value increased 8.8% nationally over the past three-month period to the end of May, down slightly from the 8.9% quarterly growth we saw in April, with the national average value now sitting at $931,928. This represents an increase of 23.7% year-on-year, up from 21.4% last month.

QV general manager David Nagel said: “This small reduction is particularly significant considering the QV House Price Index is a rolling average measure, which includes transactions from some of the most buoyant months earlier in the quarter. We can expect to see further reductions in the rate of growth as the impacts of the recent tax changes for investors and credit availability start to take effect.”

Of the 16 major urban centres we monitor, all except the four northernmost urban locations of Whangarei and the “golden triangle” of Auckland, Hamilton and Tauranga, have shown a reduction in quarterly growth compared to last month.

In the Auckland region, the average value now sits at $1,336,800, up 8.4% over the last quarter, with annual growth of 21.8%, up from April’s year-on-year growth of 19.0%.

However, the strongest gains in value are still mainly coming from within the centre of New Zealand. Growth in Napier, which led the pack last month at 14.2% per quarter, has reduced to 9% quarterly growth. Hastings was also showing exceptional quarterly growth last month at 14%, but has dropped down to 11.4% quarterly growth. Marlborough District leads the way this month at 12% quarterly growth, but this is also a reduction from the 13.7% quarterly growth we reported last month.

Of the major centres, Tauranga takes over from Wellington as the top performer at 10.2% quarterly value growth, up from 7.8% last month. Wellington remains close behind at 10% quarterly growth, down from 10.8% in April.

“There’s certainly plenty of signs that the heat is coming out of the market now since the March tax announcements, with a combination of investors taking a breather, first-home buyers exercising more caution and the seasonal downturn that normally accompanies the approach of winter, all contributing to a slowing market,” he said.

“But the market fundamentals are still strong with a supply shortage, combined with cheap money, still driving albeit-slowing value growth. Talk of interest rates potentially rising later next year, coupled with some dire price predictions from the Reserve Bank and Central Government doesn’t seem to have affected the market as much as they’d have hoped. We’ll likely see a continued slowing in the rate of price increases over the coming months as the property market finds its new normal,” Mr Nagel added.

READ MORE VIA QV