PHOTO: Image by rawpixel.com

In a significant development, the commission system that forms the financial backbone of the US residential housing market is currently under intense scrutiny for potential antitrust violations by the Justice Department, alongside two private class-action lawsuits. These legal challenges pose a potential threat to the National Association of Realtors (NAR), the influential lobbying organization representing the real estate industry.

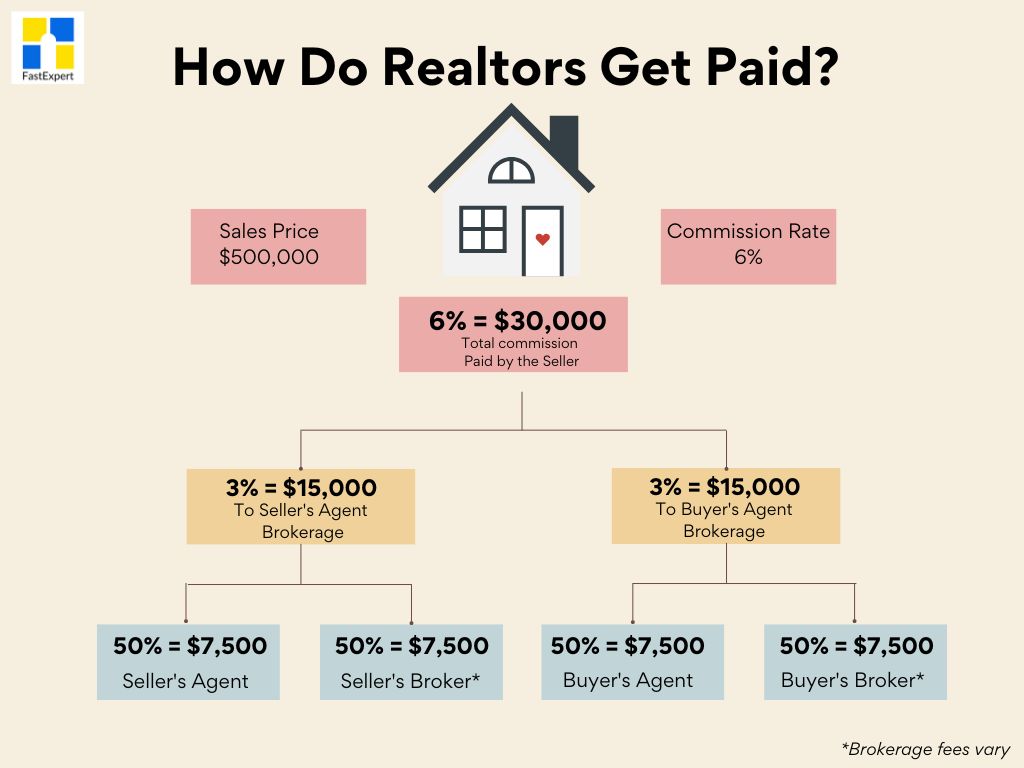

Federal antitrust enforcers are at a critical juncture, deciding whether to pursue their own case following a lengthy investigation. The Justice Department’s primary focus is on the real estate commission-sharing system, where home sellers are typically responsible for a 5% to 6% commission, which is split between their agent and the buyer’s agent.

This commission-sharing structure is distinct to the United States and has been upheld by NAR’s control of many multiple listing services, which are essential tools aggregating properties available for sale in specific regions. To access this system, NAR mandates that sellers provide compensation to the buyer’s representative, a practice criticized for potentially inflating home prices.

IMAGE: FAST EXPERT

Two antitrust class actions are poised to challenge this practice, with one commencing in Missouri, carrying potential damages of up to $4 billion, and another scheduled for early next year in Illinois, seeking as much as $40 billion.

National Association of Realtors (NAR) SAGA – Realtors Jumping

The assertion is made that the commission-sharing structure amounts to “collusion.” According to Michael Ketchmark, the lead plaintiffs’ attorney in the Missouri case, “The day of accountability is coming.”

The Justice Department initiated its investigation into residential real estate during the Trump administration. NAR initially agreed to certain measures, including increased price transparency, to settle the case. However, Biden administration officials withdrew from this agreement in 2021, desiring the ability to pursue future antitrust claims against NAR. In January, a federal judge ruled that the DOJ is still bound by the settlement, a decision currently under appeal as the Biden administration expands antitrust investigations into non-traditional sectors.

The damages sought in the two civil cases, linked to allegedly inflated commissions in their respective markets, would potentially harm NAR and major brokerages who have not already settled. Some brokerages, like Re/Max and Anywhere Real Estate Inc., have agreed to pay settlements of $55 million and $83.5 million, respectively, and no longer require their agents to belong to NAR.

However, the greater threat to the industry lies in the possibility of a nationwide case initiated by the Justice Department to dismantle the commission-sharing structure entirely. In a worst-case scenario for the industry, the federal government might attempt to prohibit sellers’ agents from compensating buyers’ agents.

Redfin Corp.’s CEO, Glenn Kelman, opined that such DOJ action would be necessary to bring about this level of change, and it would represent a seismic shift, potentially leading to significant job losses among real estate agents.

The focus on commission rates is heightened by the current housing market, characterized by low supply and rising mortgage costs, which has resulted in the least affordable housing market in four decades. In the case of a $407,100 home, which is the median existing-home sales price, a 5.5% commission amounts to approximately $22,390.

In contrast, other parts of the world have significantly lower total commissions per sale, with countries like Australia and the UK typically charging around 2%.

The Justice Department has drawn attention to these commission issues, urging a federal judge in Boston to postpone approval of a potential settlement in another antitrust lawsuit challenging commission rules. The agency is concerned about policies, practices, and rules in the residential real estate industry that may lead to increased broker commissions.

Untying buyer and seller agent fees could eventually reduce commissions by as much as $30 billion annually, according to a study by the Consumer Federation of America. This would encourage competition, as aspiring homeowners would have the option to shop around before hiring an agent or pay a flat fee for handling paperwork at closing.

NAR contends that the existing system is essential for facilitating the entry of first-time homebuyers, particularly from minority and lower-income groups.

These developments also raise questions about the future of the National Association of Realtors. The organization collects annual dues of $150 from over 1.5 million agents, making it one of the largest spenders on lobbying in the United States. The immense pressure it currently faces is seen as an existential threat, with concerns that reform could lead to buyers’ agents leaving the industry and taking their membership dues with them.