PHOTO: Vanessa Williams, spokesperson for realestate.co.nz. SUPPLIED

New Zealand’s Property Market Hits ‘Goldilocks’ Moment: Stability and Opportunity Align for Buyers and Sellers

The New Zealand property market has entered a rare phase of balance, with stable prices, strong stock levels, falling interest rates, and growing buyer activity. This ideal combination, dubbed the “Goldilocks market,” is creating opportunities for buyers and sellers alike.

Stable Prices Provide Certainty

For nearly two years, national property prices have remained consistent, offering the stability that buyers crave and the predictability sellers need. The national average asking price in November stood at $846,150, near the lower end of the $850,000 to $890,000 range that has persisted since late 2022.

Year-on-year, the average asking price dipped by 2.8%, while month-on-month, it declined by 1.1%. Central Otago/Lakes District and Wairarapa were the only regions to show growth in asking prices both monthly and yearly. Meanwhile, regions like Wellington, Bay of Plenty, and Marlborough saw declines.

“This is a market with more activity but fewer fluctuations,” says Vanessa Williams, spokesperson for realestate.co.nz. “Buyers and sellers can approach decisions with confidence.”

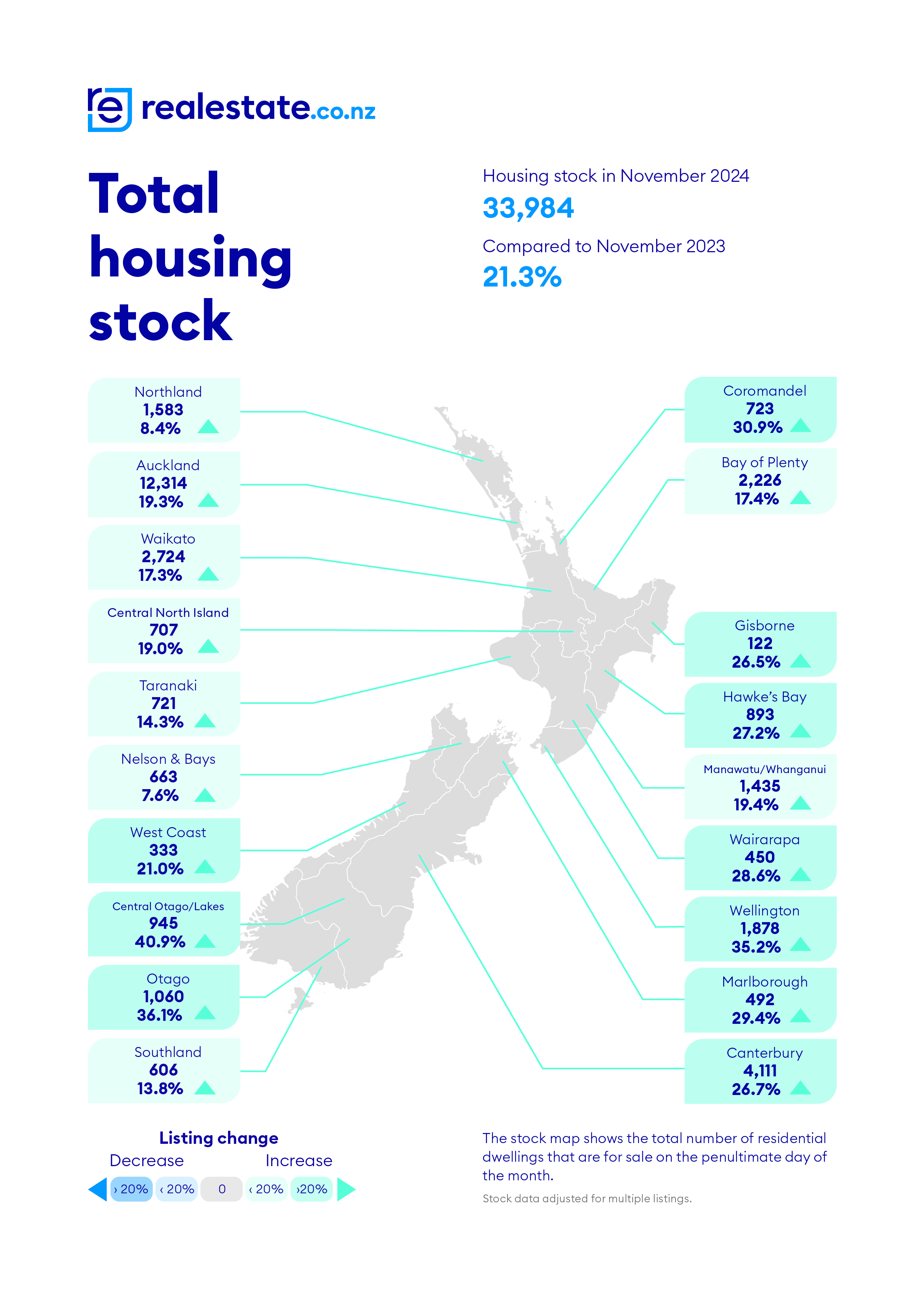

Record Stock Levels Offer Buyers More Choices

November 2024 marked the highest stock levels in eight years, with nearly 34,000 properties available nationwide—a 21.3% increase compared to the same time last year. All regions experienced stock growth year-on-year, except Gisborne and Coromandel, which saw slight monthly declines.

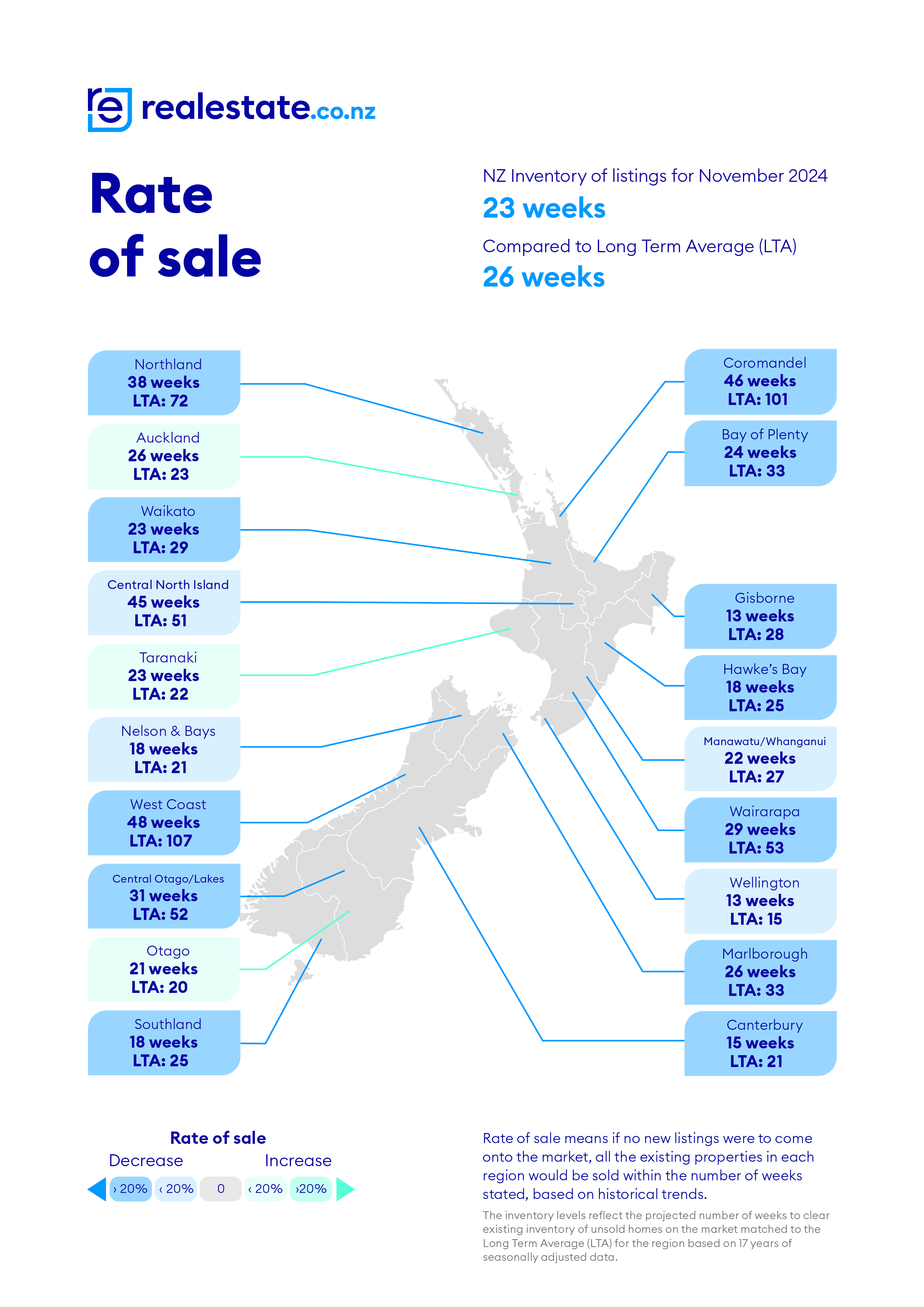

Despite the abundant choices, sellers are benefiting too. Properties are moving faster, with a higher proportion of listings being sold or withdrawn within 30 to 60 days.

“There’s plenty of choice for buyers, but sellers aren’t left waiting—it’s a win/win,” adds Williams. Properties listed with a displayed price remain the most popular selling method, simplifying the process for buyers and sellers alike.

Falling Interest Rates and Increased Buyer Activity

The Reserve Bank’s decision to lower the Official Cash Rate (OCR) to 4.25%—its third consecutive drop—has made borrowing more affordable, further energizing the market.

Sales activity is surging, with the Real Estate Institute of New Zealand (REINZ) reporting over 6,500 properties sold in October 2024, the highest monthly total since March 2022. Vanessa Williams notes that the absence of election-year uncertainty has also contributed to market stability.

“This isn’t a frantic rebound,” says Williams. “It’s a steady, sustainable uptick that benefits everyone.”

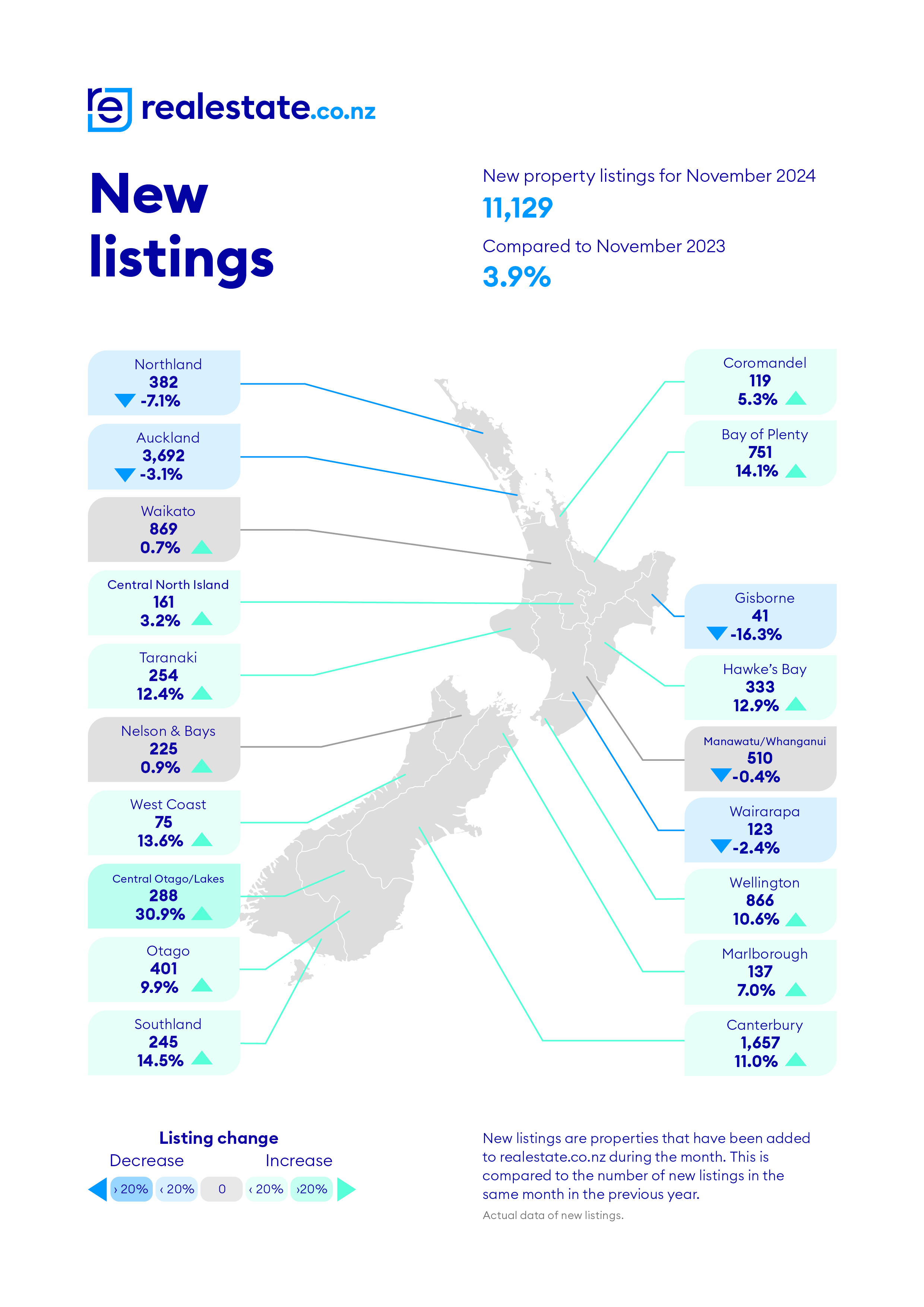

Slowing New Listings Reflect Market Stabilization

New listings in November grew by 3.9% year-on-year, the first single-digit increase after months of double-digit surges throughout 2024. Month-on-month, new listings dipped by 3.8%, following seasonal patterns seen in past years.

“This steadying of new listings gives buyers predictability while offering sellers confidence in a consistent market,” says Williams.

The ‘Goldilocks’ Market

After years of volatility, Kiwis have longed for a property market offering both stability and opportunity. November 2024 appears to deliver just that.

“After 18 years of tracking the property market, this is one of those rare moments where certainty and opportunity align,” says Williams. “It’s a true ‘Goldilocks market’—not too hot, not too cold, but just right for buyers and sellers.”