PHOTO: REINZ Chief Executive Jen Baird. SUPPLIED

A subdued market amid economic challenges

Reasons for Trouble in the NZ Property Market (June 2024)

- Rising Interest Rates: The Reserve Bank of New Zealand has increased interest rates to combat inflation, making mortgages more expensive and reducing affordability for home buyers.

- High Inflation: Persistent inflation has driven up the cost of living, leaving less disposable income for potential homebuyers to invest in property.

- Stagnant Wage Growth: Wage growth has not kept pace with rising living costs and property prices, making it difficult for people to save for a down payment or afford mortgage repayments.

- Increased Supply: There has been a surge in new property developments, leading to an oversupply in certain areas, which has put downward pressure on property prices.

- Tightening Lending Criteria: Banks have implemented stricter lending criteria, making it harder for people to qualify for loans, especially first-time buyers and those with lower credit scores.

- Decline in Foreign Investment: Government policies aimed at reducing foreign ownership in the property market have led to a significant drop in foreign investment, reducing demand for high-end properties.

- Economic Uncertainty: Global economic uncertainties, including trade tensions and potential recessions in major economies, have made investors wary, reducing their participation in the property market.

- Government Housing Policies: Recent government interventions, such as increased taxes on property investors and changes in tenancy laws, have reduced the attractiveness of property as an investment.

- Population Growth Slowdown: The rate of population growth has slowed due to lower immigration rates, leading to reduced demand for housing.

- Negative Market Sentiment: Media reports and market analyses predicting a downturn have led to negative sentiment among potential buyers and investors, causing many to hold off on purchasing property.

- Affordability Crisis: Despite some price corrections, property prices remain unaffordable for a significant portion of the population, particularly in major cities like Auckland and Wellington.

- Rising Construction Costs: Increased costs of building materials and labor have made new developments more expensive, which in turn affects the overall property market dynamics.

These factors collectively contribute to the current challenges faced by the New Zealand property market in June 2024.

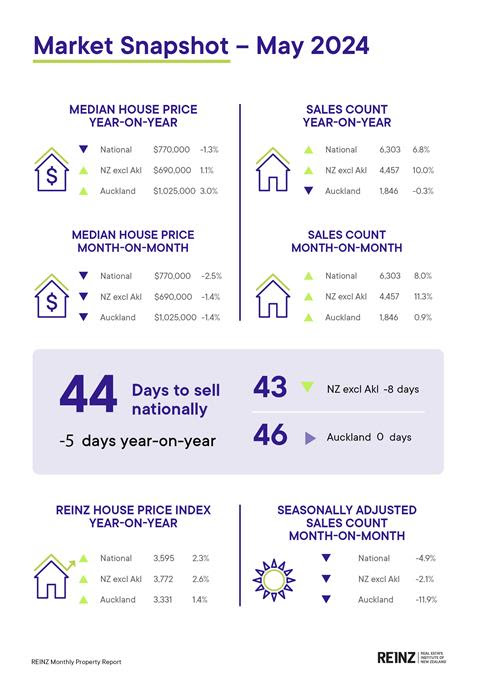

The Real Estate Institute of New Zealand (REINZ) released its May 2024 data today. The data shows a national and regional increase in listings and sales counts while median sales prices stabilise.

REINZ Chief Executive Jen Baird says the market shows a general theme of more this month with higher sales counts, increased stock levels, more listings, and properties selling more quickly than a year ago. These annual increases contrast with current challenges in securing finance, changes in the job market, and the wait on OCR and interest rate changes.

The full data sets are available by clicking the links below:

CLICK HERE for the May press release

CLICK HERE for the full property report

CLICK HERE for the HPI report