PHOTO: ASB

It’s been a wild ride for New Zealand’s housing market, with lockdown and the COVID-19 fallout impacting Kiwis’ views on the outlook, according to the latest ASB Housing Confidence Survey. CLICK HERE: Housing-confidence-jul 2020

For the three months to July, price expectations were down overall, although this was heavily skewed by grim views during the deepest part of lockdown. As surveying proceeded, there was a clear lift in views and by July, price expectations were on balance back in net positive territory. Note only did the move out of strict lockdown spark huge swings in the outlook for house prices, it also sparked a big jump in people’s views on whether or not it is a good time to buy a house.

“In the immortal words of Janis Joplin, New Zealanders took the view that freedom’s just another word for nothin’ left to buy except a house,” says ASB chief economist Nick Tuffley.

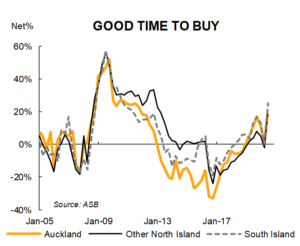

Views on whether it was a good or bad time to buy a house swung sharply back into positive territory once Level 4 lockdown was over. Impressively, respondents see now as the best time to buy since 2012. For those with job security, buying conditions are buoyed by ever-lower interest rates and the potential to find the right house without being in a boom-time bidding war.

“We have for some time had one of the most optimistic outlooks for house prices, having since lockdown begun expected a 6% overall decline in New Zealand-wide house prices. We now expect the housing market will perform better than that, circa a 3% decline,” says Mr Tuffley.

“We were pleased to see how quickly the housing market bounced out of lockdown, though noted that there has been an element of pent-up demand to be satisfied.

“The second lockdown may also briefly curb people’s enthusiasm. Nevertheless, the results of our latest Housing Confidence Survey and the prospect of further mortgage rate falls if the RBNZ indeed pushes the OCR down further, all point to the housing market remaining very resilient – despite the economic challenges that abound,” says Mr Tuffley.

Better Times are here

Following a downbeat March and April, there was a clear positive swing in the latest quarter towards more respondents seeing now as a good time to buy. For the three months to July, a net 21% viewed things positively – a sharp increase from the net 1% who viewed it as a bad time to buy in the previous three months to April.

“That 21% net balance of ‘good times’ is the strongest quarter since late 2012, when the housing boom back then was just getting started. Sentiment has been night and day between the dark depths of Level 4 April and relative lightness of May onwards.

“There was some tempering of this burst of optimism late in the quarter, but even so the mood points to people eyeing up the housing market as an opportunity for the taking,” says Mr Tuffley, adding that there are likely to be a variety of reasons for this.

“Mortgage rates have fallen steadily so debt servicing costs are lower and look more favourable compared to rents. Borrowing to invest in property also may appeal to those eyeing up the steady decline in term deposit rates. Muted house price growth and lower market expectations may mean more chance of finding a ‘bargain’, and, with New Zealanders ‘trapped’ within their own borders, it is also possible we see people suffering from cabin fever contemplate buying a second cabin in which to feel feverish,” he says.

This is backed up by respondents’ views of price expectations, with a net 11% expecting prices to fall in the coming 12 months – down from net 14% expecting an increase in the previous quarter.Tuffley notes the outlook may be more positive than the quarter’s overall results suggest, saying it is pretty evident in the finer details of survey responses that the state of lockdown had a material impact on people’s perceptions.

“Price expectations plunged to a net 39% and 38% expecting price falls during surveying done over April and May, the depths of New Zealand’s lockdown. For the month of July, expectations were back to a net 12% expecting increases. That is still a long way shy of respondents’ outlook at the start of the year and no doubt reflects how the outlook has been changed by the COVID-19 pandemic. But it does tie in with the shift back to a freer environment for personal actions, commerce – and real estate,” says Mr Tuffley.

Rate expectations – going down

Unsurprisingly, COVID-19 has turned interest rate expectations on their head, with net 31% of respondents over the three months to July expecting mortgage rates will fall over the next year, down further from the previous quarter’s net 19% expecting falls.

As with price expectations, views on interest rate direction also varied over the three months. In May, more than 50% of respondents expected interest rates would fall further, however as the three-month period progressed, the proportion of people expecting interest rate declines reduced in favour of expecting steady interest rates.

“Since July, the economics teams at all the major banks have moved to forecast that the RBNZ will cut the OCR next year to a negative rate. The impact on mortgage rates will be for them to drop even further, although still be above zero. The public commentary about the prospect of even lower interest rates may show up in the next round of survey results,” says Mr Tuffley.

Over the three months to July, 10% of respondents overall expect higher interest rates in the coming year and 41% expect lower interest rates, compared with 14% and 33% respectively last quarter.

The full ASB Housing Confidence Survey for the three months to July 2020 will be available online at www.asb.co.nz Other recent ASB reports that also include housing commentary can be accessed via a Search page https://reports.asb.co.nz by selecting the keyword ‘Housing’.

ENDS

MOST POPULAR