PHOTO: Millennials. TRAVEL EARTH

Industry leaders say the slowing housing market should offer millennials some hope, despite home affordability for first-home buyers being the worst it has been in 65 years.

The long running debate over who had it harder – millennials or baby boomers – has finally been answered.

“Definitely the millennials,” said Infometrics chief forecaster Gareth Kiernan.

| Born | Ages | |

|---|---|---|

| Gen Z | 1997 – 2012 | 10 – 25 |

| Millennials | 1981 – 1996 | 26 – 41 |

| Gen X | 1965 – 1980 | 42 – 57 |

| Boomers II* | 1955 – 1964 | 58 – 67 |

And young, house-hunting Kiwis on the streets are disillusioned.

“We were looking about a year now, it was hard then, but looking now we’ve just put it on hold because its just impossible,” one first home buyer said.

Another said his family home just sold for double the price his parents bought it for.

“I have been grinding to buy a house but I have put it on the back burner. It’s definitely harder than my parents for sure.”

The responses were unsurprising to Kiernan.

“I know we’ve got inflation at a 30-year high at the moment but it’s still nowhere near the rates we saw 40-odd years ago.

“So it does mean that millennials are facing a lifetime of debt.”

Kiernan’s comments come following a new report by Infometrics concluding it is harder than ever for first home buyers to get a foot on the property ladder.

However, industry leaders point to softening house prices as reason to hope.

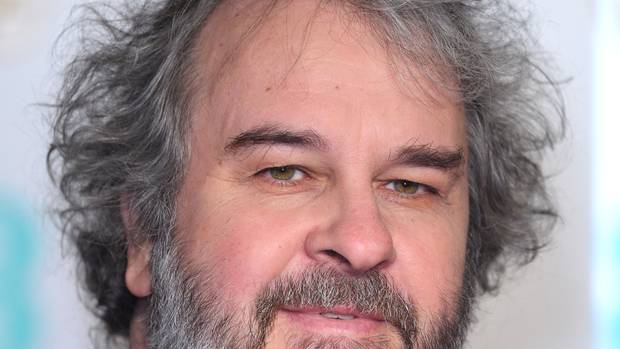

Infometrics chief forecaster Gareth Kiernan Photo: RNZ / Rebekah Parsons-King

READ MORE VIA RNZ