PHOTO: OCR hike have a particularly large cooling effect on the economy

The first Official Cash Rate (OCR) hike in seven years is expected to have a particularly large cooling effect on the economy.

ANZ chief economist and Sharon Zollner and Triple T Consulting managing director Sean Keane expect the economy to be more sensitive to an OCR hike – which markets are pricing in for November – than a cut.

Accordingly, Keane believes the Reserve Bank (RBNZ) won’t need to do a lot (make too many hikes) to meet its inflation and employment targets.

Zollner expects it to lift the OCR in steady steps from 0.25% to 1.75% by February 2023.

The last time the OCR was increased was in 2014, when four 25-basis point increases took it to 3.50%.

First hike the sharpest

In general terms, Zollner said the first hike is always the sharpest, just as the first cut is the deepest.

She said there was a risk financial markets could take a 25-basis point OCR hike and run with it, tightening monetary conditions more than the RBNZ might be comfortable with.

Keane noted that after seven years of money becoming cheaper, there is some uncertainty around how people will respond to having to get their heads around money becoming more expensive.

However, there are some specifics in the current environment that mean the RBNZ will get traction when it hikes interest rates.

Bulk of mortgage holders will be affected soon

Firstly, it’s hard to look past the big increase in mortgage debt that has accompanied years of interest rate cuts.

The value of bank mortgage debt has increased by 11% over the past year to $311 billion, meaning New Zealand’s mortgage debt is now worth almost the same as the entire economy, or annual gross domestic product ($325 billion).

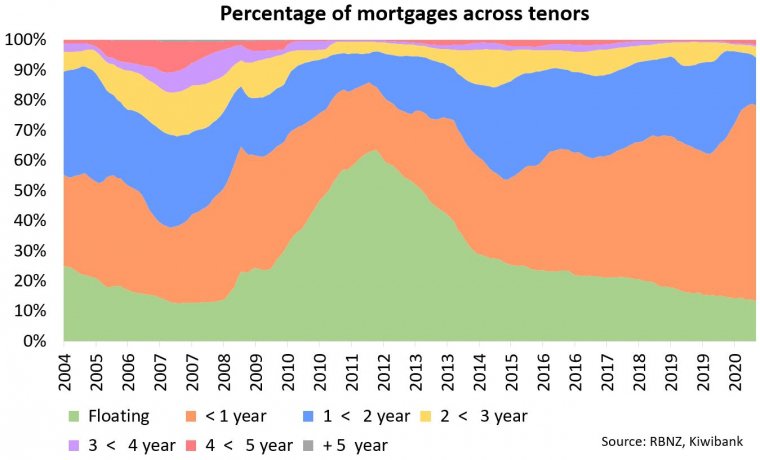

As interest.co.nz reported in May, the bulk of this debt is due to rollover within the next year, so the effect of higher rates will be felt by a number of people fairly soon.

According to Kiwibank chief economist Jarrod Kerr, 60% of mortgages are either floating or up for refixing in the next three to six months. Meanwhile 80% of the country’s mortgage book will refix in the next six to 12 months.

“That’s an enormous amount of fixing flow into a tightening cycle,” Kerr said.

Zollner also made the point that while mortgage rates may only go up by couple of percentage points, the increase is proportionally larger in a low interest rate environment.

For example, a mortgage rate hike from 2% to 4% is a 100% increase, while a rise from 6% to 8% is only a 33% increase.

READ MORE VIA QV