PHOTO: FILE

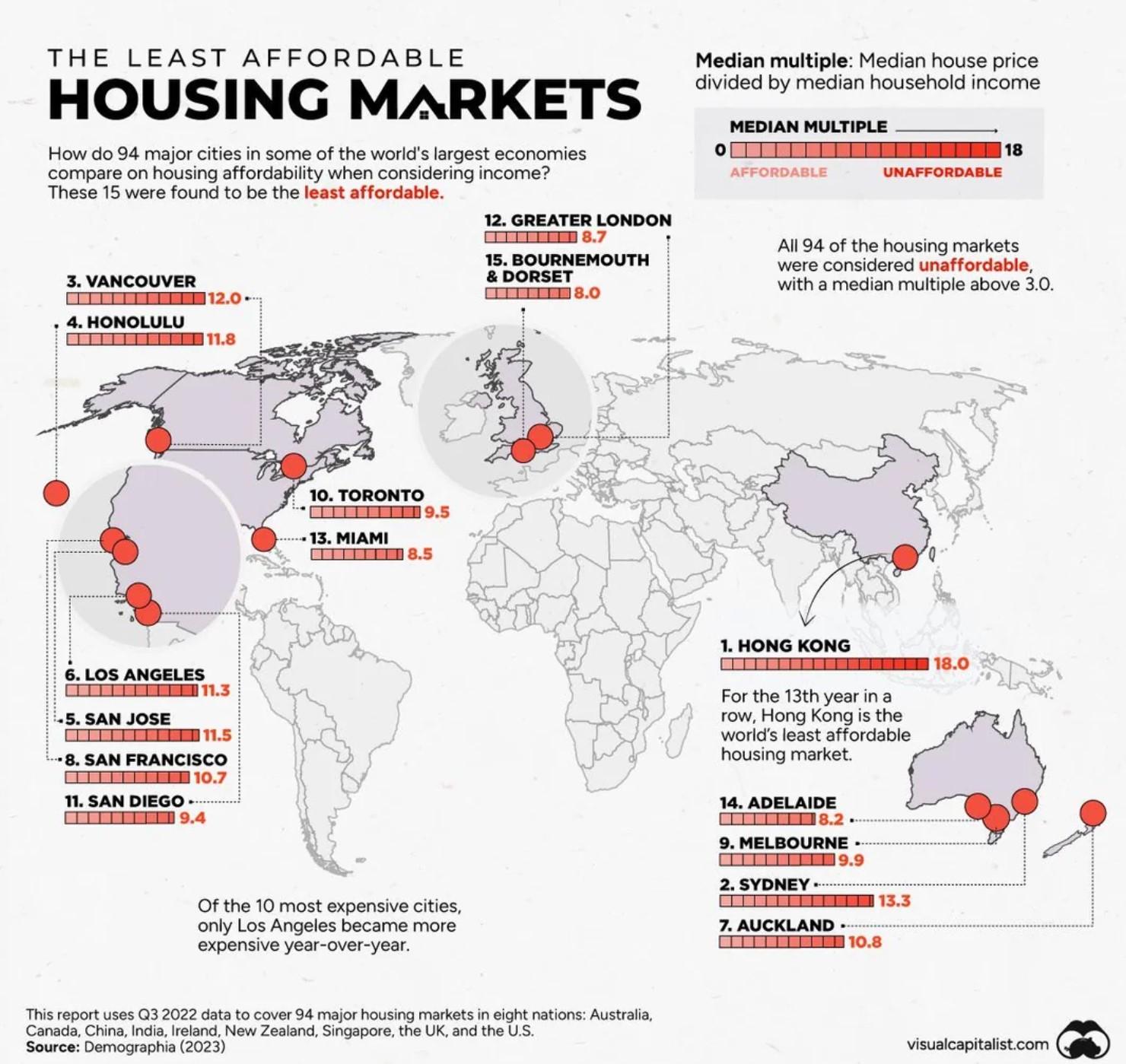

A disheartening map depicting the most unaffordable housing markets globally features three Australian cities, with one city ranking second-worst worldwide.

Utilizing the latest data from Demographia, which examined 94 major housing markets across eight countries, the illustration compares affordability in some of the world’s largest economies.

The map calculates an overall score by dividing the median house price in each city by the median household income as of mid-2022.

This grim map shows the least affordable housing markets in the world, with three Australian cities featuring.

Visual Capitalist plotted the 15 worst-performing locations, and the striking map has gained traction on social media locally, with Australians dismayed to find three of their cities listed.

Sydney secured the second spot globally with an index rating of 13.3 out of 18, trailing behind Hong Kong at the top with a perfect score of 18, and marginally ahead of Vancouver with a score of 12.

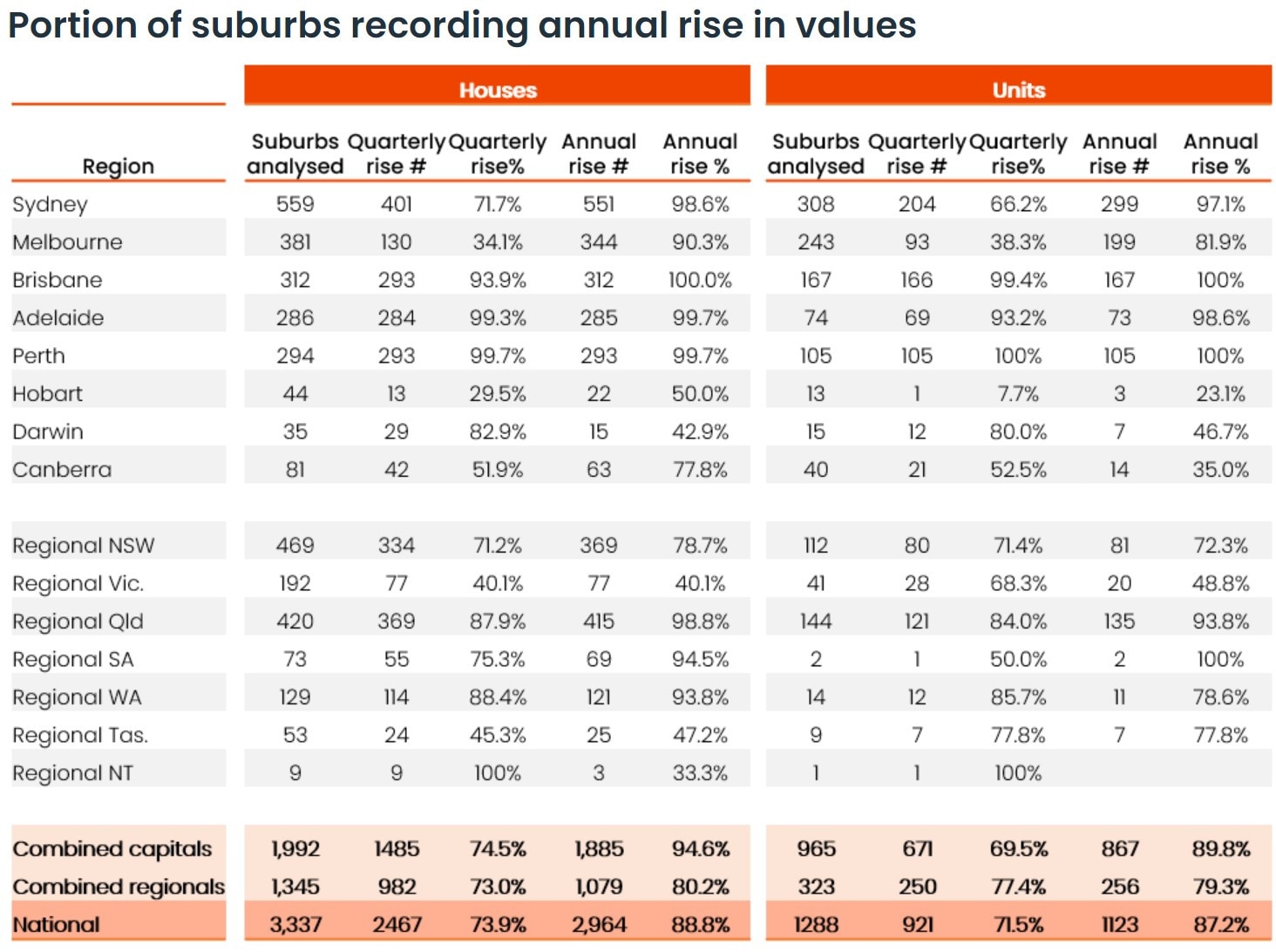

CoreLogic examined every suburb in the country to plot the proportion that saw home price increases in the past year.

Melbourne claimed the ninth spot with a score of 9.9, while Adelaide ranked 14th with a rating of 8.2.

Purchasing a house in Sydney proves to be less affordable than in notoriously expensive markets such as London, Los Angeles, and Miami.

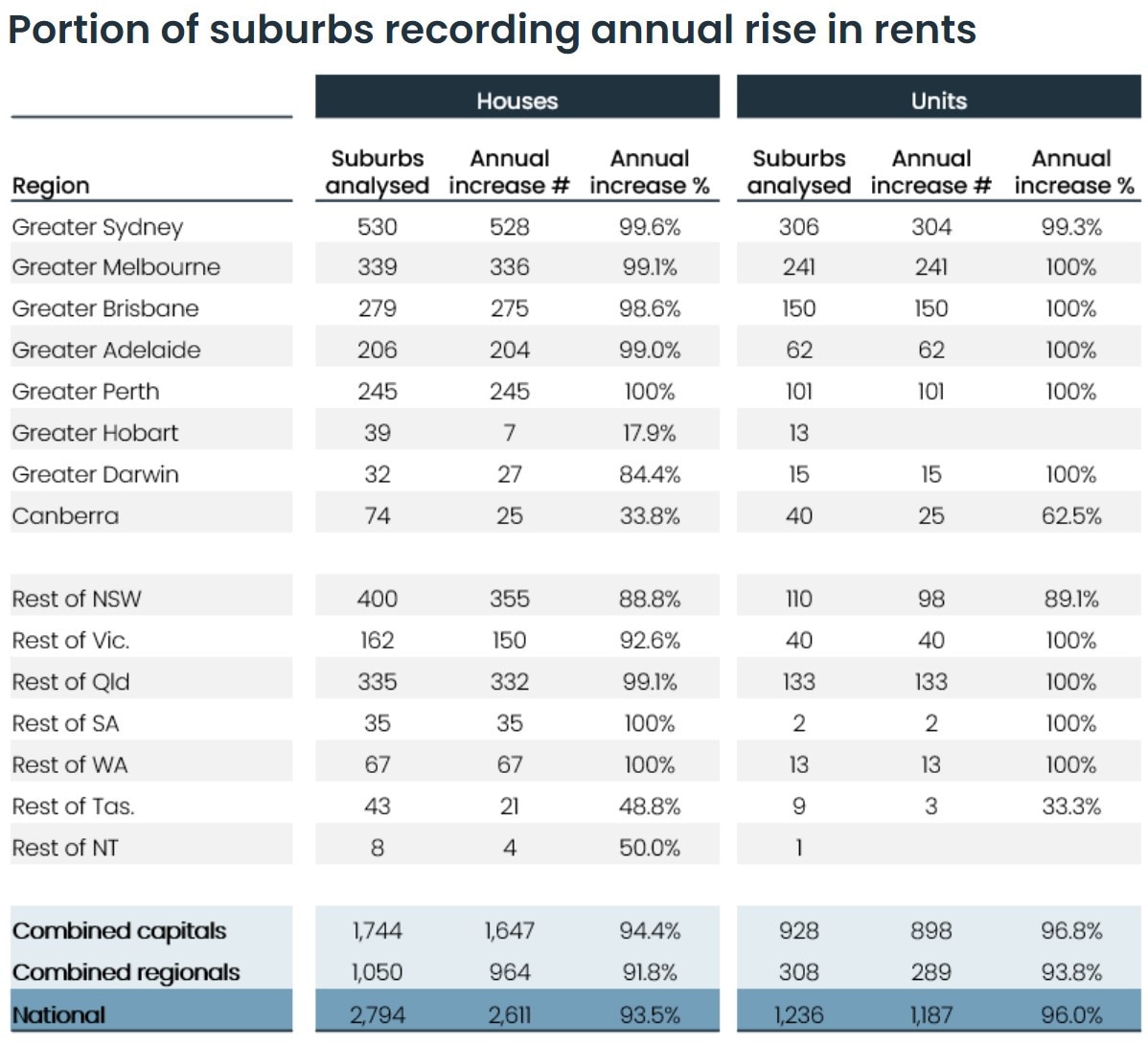

CoreLogic examined every suburb in the country to plot the proportion that saw rent price increases in the past year.

It’s important to note that the dataset, limited to eight countries, excludes expected entries such as Paris and Singapore, among others.

Moreover, the absence of renowned expensive cities like New York and the inclusion of unexpected areas like Adelaide can be attributed to higher incomes offsetting high home prices in the former and vice versa in the latter.

Nevertheless, the illustration underscores the severity of the housing crisis in Australia, which has only worsened since the compilation of the map’s data.

The majority of suburbs are experiencing increased prices.

Last week, research conducted by CoreLogic indicated an 8.9 percent rise in its Home Value Index over the past year, adding approximately $63,000 to the national median dwelling price.

CoreLogic’s monthly index reached an all-time high in February, according to economist Kaytlin Ezzy.

Home prices continue to surge nationwide.

Ms. Ezzy conducted suburb-level analysis, revealing that 88.4 percent of Australia’s 4625 suburbs witnessed value hikes over the past year, a significant increase from previous periods.

CoreLogic’s examination of every suburb in the country illustrates the widespread rise in home prices.

Despite three rate hikes, worsening affordability, and escalating living costs, Ms. Ezzy attributes the continued increase in housing values to an entrenched undersupply of housing stock and robust net migration, driving demand.

Renters are also feeling the pinch.

According to CoreLogic’s analysis, 94.2 percent of all Australian suburbs experienced rent price increases, with nearly 40 percent witnessing increases of 10 percent or more over the course of a year.

Finding a rental, let alone an affordable one, is becoming increasingly challenging across Australia.

Angus Moore, an economist and author of PropTrack’s Rental Affordability Report, described the current rental market as the worst in at least 17 years, with renters in New South Wales, Tasmania, and Queensland facing the greatest difficulties.

The report highlights a substantial decline in rental affordability for median income households, indicating a pressing need for action to address Australia’s broken housing system.

Cassandra Goldie, CEO of the Councils of Social Services, characterized the housing system as “utterly broken,” citing a “tsunami of homelessness” sparked by soaring housing costs.

More than 640,000 low-income households are grappling with housing insecurity, prompting calls for comprehensive measures to address the crisis.

ACOSS advocates for measures such as cracking down on unfair tax concessions for investors, boosting social and affordable housing supply, adequately funding homelessness services, and establishing nationally consistent tenancy protections.

The consequences of inaction could be far-reaching, impacting community wellbeing and equality of opportunity.

SOURCE: NEWS.COM.AU