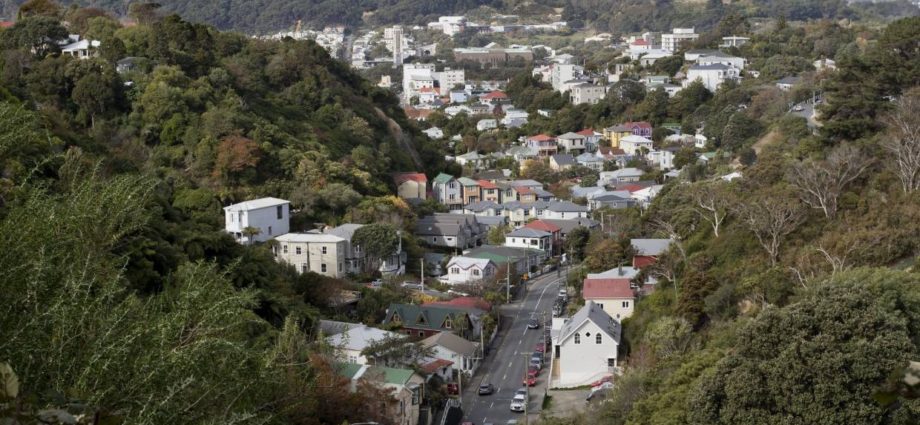

PHOTO:MONIQUE FORD/STUFF Home loan rates have dropped further over the past month, leaving some fixed-term borrowers frustrated.

Increasing numbers of New Zealanders are trying to break their fixed-term home loans, looking for a better rate, mortgage brokers say, but it rarely makes sense to do so.

Interest rates have fallen again over the past month as the country responds to the impact of Covid-19 on the economy, and the Reserve Bank has suggested that there could still be room for them to drop further.

Some commentators expect the official cash rate could turn negative, which could take fixed home loan rates below 2 per cent.

Two years ago, borrowers were being offered two-year rates of 5.05 per cent, Reserve Bank statistics show. Now, those rates have fallen as low as 2.99 per cent. ANZ on Wednesday revealed its new one-year rate of 2.79 per cent.

Kiwibank spokeswoman Kara Tait said the bank had experienced a 60 per cent increase in inquiries about breaking fixed terms since it rolled out its 2.99 per cent special. ANZ also reported a lift.

READ MORE VIA STUFF