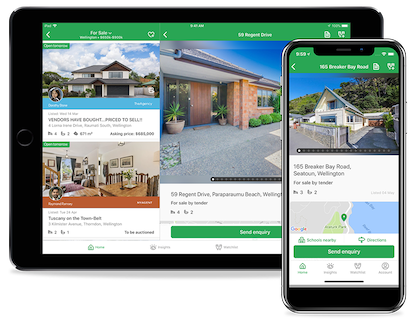

PHOTO: Trade Me Property

Many are complaining about the constant rise of Trade Me Property fees, with private sellers and landlords opting for the FREE option of Facebook marketplace.

The Rising Costs of Trade Me Property Listing Fees: Are They Becoming Too Expensive?

Trade Me, New Zealand’s most prominent online marketplace, has long been a go-to platform for buying and selling property. However, as the real estate market evolves, so do the associated costs. In recent years, there has been growing concern among users about the expense of Trade Me property listing fees. This article delves into the subject, exploring the factors contributing to the rising costs and their impact on property buyers, sellers, and renters.

The Evolution of Trade Me Property Listings

Trade Me, founded in 1999, quickly became a popular platform for various online transactions, including property listings. Over time, it has grown to dominate the New Zealand real estate market. The site’s user-friendly interface, extensive reach, and effective search tools make it a preferred choice for both buyers and sellers. However, as Trade Me has evolved, so have its pricing models.

The Costs of Property Listings

Trade Me offers several pricing packages for property listings.

Residential for sale

Apartments, houses, townhouses, units.

- Advertise with: asking price, enquiries, auction (offsite), tender, negotiation, or deadline.

- A listing fee applies when creating the listing.

- Listing durations are up to 56 days.

- Closed listings can be relisted – within 45 days of closing.

- Relisting is free if Bronze is selected – Silver and Gold relists have a reduced fee.

The Rising Costs

Trade Me’s pricing model, especially for premium and feature listings, has faced criticism for its steep fees. This increase in listing fees can be attributed to several factors:

- Market Dominance: Trade Me’s dominant position in the New Zealand property market allows it to charge premium rates, as sellers have few alternatives to reach a wide audience.

- Increased Demand: The demand for online property listings has surged, driven by the convenience of digital platforms. This has enabled Trade Me to raise fees in response to high demand.

- Added Features: Trade Me continually adds new features and tools to improve the user experience, but these enhancements often come at an additional cost.

Impact on Property Buyers and Sellers

The rising cost of Trade Me property listings has significant implications for both buyers and sellers:

- Sellers: Private sellers and landlords may find it increasingly challenging to justify the cost of premium listings, which means their properties may receive less exposure. Real estate agencies, too, face higher costs, which may ultimately be passed on to their clients.

- Buyers: With sellers potentially opting for cheaper listing options, property buyers may have to sift through fewer listings or miss out on potential opportunities.

- Real Estate Agents: The escalating costs of top-tier packages may put pressure on real estate agencies’ profit margins, potentially leading to higher commissions or service fees for clients.

Is There an Alternative?

While Trade Me remains the dominant player in the New Zealand property market, there are emerging alternatives and innovative startups seeking to disrupt the status quo. Homeowners and renters looking for cost-effective alternatives may explore these options to save money on listing fees.

The rising costs of Trade Me property listing fees have become a concern for many users, affecting both buyers and sellers in the New Zealand real estate market. While the platform offers a range of features and benefits, the increasing fees may be pushing some users to seek out more affordable alternatives. As the real estate landscape continues to evolve, it will be interesting to see how Trade Me adapts its pricing model to remain competitive while addressing the concerns of its user base.