PHOTO: Official Cash Rate is expected to stay at 5,5%. RAW PIXEL

According to ONE ROOF there could be “light at the end of the tunnel” for the housing market, property experts told OneRoof, but Kiwis shouldn’t expect interest rates to plunge or house prices to soar anytime soon.

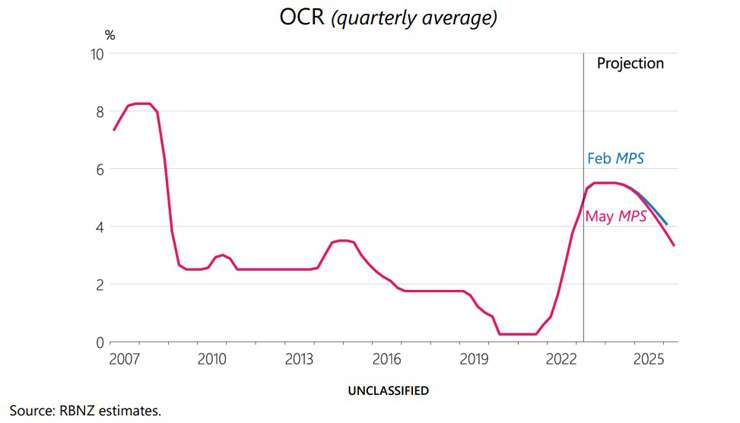

OneRoof canvassed the opinions of various economists following the Reserve Bank’s announcement that yesterday’s lift in the Official Cash Rate (OCR) to 5.5% will be the last this cycle.

The Reserve Bank’s Monetary Policy Statement noted that higher interest rates were required to return annual inflation to its target rate, and signalled that cuts to the OCR were unlikely to take place until the tail end of 2024.

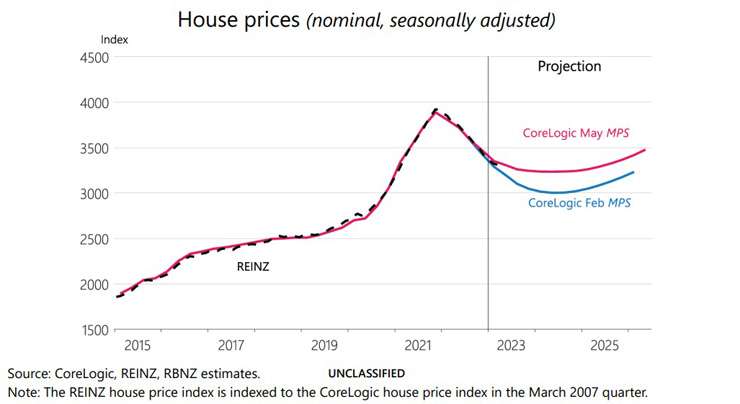

However, it also noted that house prices are unlikely to fall as steeply as it had previously assumed.

Bayleys head of insights, data and consulting Chris Farhi said there had been some concern last year that interest rates might “rage totally out of control” and the current tweaks by the RBNZ gave people more confidence around where interest rates were heading.

He felt the housing market would start to stabilise in the second half of the year, but different regions could reach the bottom at different times.

“Auckland and Wellington markets have corrected faster and harder than most other places around New Zealand, so we would expect to see those two markets stabilise earlier than others with maybe a lag effect in some of the other regions.”

The Reserve Bank’s May Monetary Policy State projection for the OCR, compared to the one it gave in February. Photo / RBNZ

The Reserve Bank believes house prices will fall less than it had previously assumed. Photo / RBNZ

Ray White chief economist Nerida Conisbee said the Reserve Bank’s strong signal that the OCR had peaked could provide people with some certainty after a stressful period of ongoing interest rate rises.

“It does provide a bit more certainty around the outlook that if you buy a home now, whatever interest rate you are at is going to probably be the peak of your repayments, and if anything, those repayments will start to reduce over time as those interest rates are cut.”

Conisbee said the biggest house price drops in both New Zealand and Australia occurred last year and it was a good time to buy at the lower prices if people could get financing.

“We are not going to see a rush of buyers coming in – that will absolutely start to happen when rates get cut, but you will start to see those more sophisticated investors coming back in and really taking advantages in conditions.”