PHOTO: The Lucky Country. FILE

Australia has regained its status as the preferred destination for net millionaires, surpassing all other countries, and there is a significant reason behind this trend. Recent data from the Australian Treasury, real estate experts, property portal Juwai IQI, and PropTrack all indicate a surge in overseas demand for Australian housing.

SPONSORED: Looking for a real estate database from $99 plus gst? | SALE

NAB’s latest Residential Property Survey reveals a substantial increase in the proportion of Australian homes sold to foreign buyers since the reopening of Australia’s borders in late 2021. PropTrack’s data on overseas searches on realestate.com.au shows record-high foreign buyer interest in Australian housing, with China leading the way.

Millionaires flooding into Australia to buy property amid weak migration, laundering laws.

The Australian Treasury reported a 40% increase in approvals for foreign purchases of Australian homes in the last quarter compared to the previous year. Buyers from mainland China, Hong Kong, Taiwan, and Vietnam are prominently contributing to this rise.

Juwai IQI has ranked Australia as the top choice for Chinese buyers, with a notable 158% surge in Chinese buyer inquiries during the third quarter. This aligns with a broader trend of increased international buying activity, facilitated by improved flight connectivity.

Various experts, including Juwai spokesperson David Platter and local agents, highlight the significant impact of Chinese buyers on the Australian real estate market. The observations indicate a notable increase in foreign buyer inquiries and sales, with expectations of further growth in the coming year.

Properties in Toorak, Vic, are being snapped up buy foreign buyers.

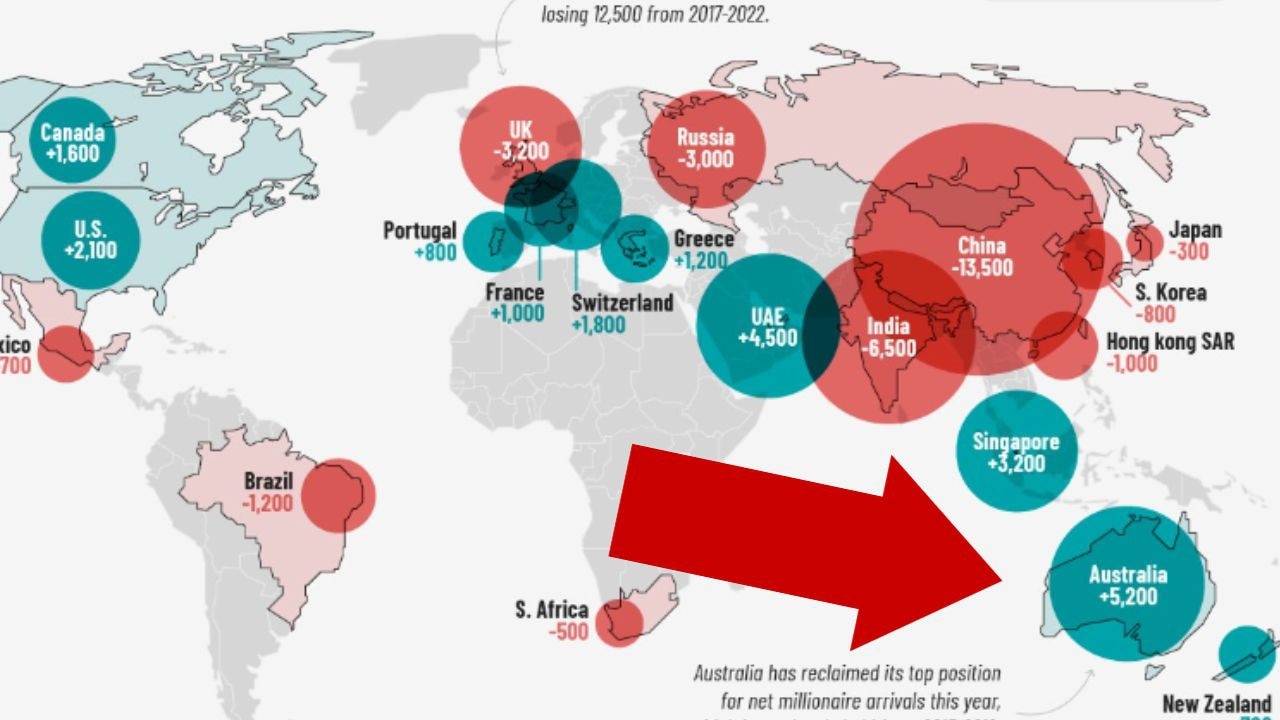

The migration patterns of millionaires worldwide, as forecasted by The Visual Capitalist, predict that Australia will experience the highest influx of millionaire migrants this year, with a substantial number making their way to the country.

Several factors have converged to make Australian housing attractive to foreign buyers. Firstly, the decision in 2009 to allow temporary migrants, particularly international students, to purchase established housing has boosted demand. Secondly, Australia’s comparatively weak anti-money laundering (AML) laws, specifically the delayed implementation of ‘Tranche 2’ global AML rules, have made Australian housing a preferred avenue for money laundering.

The ‘golden ticket’ visa, introduced in 2012, has further facilitated money laundering, with a significant number of Chinese citizens benefitting from this scheme. Calls from anti-corruption campaigners and Australia’s Productivity Commission to abolish these visas have been ongoing.

Despite warnings from global regulators like the Financial Action Taskforce (FATF) and Austrac about money laundering through Australian real estate, the implementation of AML regulations has faced strong resistance from industries subject to the regulation.

The article emphasizes the need for the Albanese government to break the cycle of stonewalling and implement Tranche 2 AML rules. Additionally, recommendations include discontinuing the ‘golden ticket’ visa program and prohibiting temporary migrants from purchasing established Australian homes to prevent the continued influx of foreign funds into the country’s real estate market. Failure to address these issues may perpetuate the trend of Australians being priced out of their housing market, with Australian real estate serving as a global magnet for laundered money.

SOURCE: NEWS.COM.AU