PHOTO: LUCIA XIAO | Landlords

Ever since the first lockdown, when I ran my first webinar, I have been asking people not to hold back and continue to invest in property and if they weren’t ready, to get ready asap. I was confident then, as I am now, that prices will continue to rise. So sure, that while economists, property associations and the like were predicting crashes and advising people to wait for ‘bargains’, I was expanding my businesses both in property mentoring and mortgage finance and employing new staff every week.

It’s unfortunate and sad to see so many people who’ve come to me, absolutely regretting their decision to wait for the crash that didn’t come.

Why am I so sure there’s no impending crash?

Here are three reasons why I believe Auckland house prices will continue to fly:

Quantitative Easing

RBNZ have continued to hold the OCR at 0.25% but in August it boosted its quantitative easing program.

What does this mean?

Quantitative easing is RBNZ’s money printing program, it’s limit of $60 billion was raised to $100 billion with the intent to stimulate the economy and encourage spending primarily through pushing down interest rates.

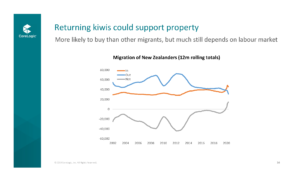

Immigration

Net migration is still strong when comparing to the same time last year, young skilled kiwis are unable to go overseas for working holidays and many Kiwis are returning home after New Zealand’s success with keeping COVID-19 under control, compared to other countries. This means supply is still low and not keeping with demand.

READ MORE VIA LUCIA XIAO